Business

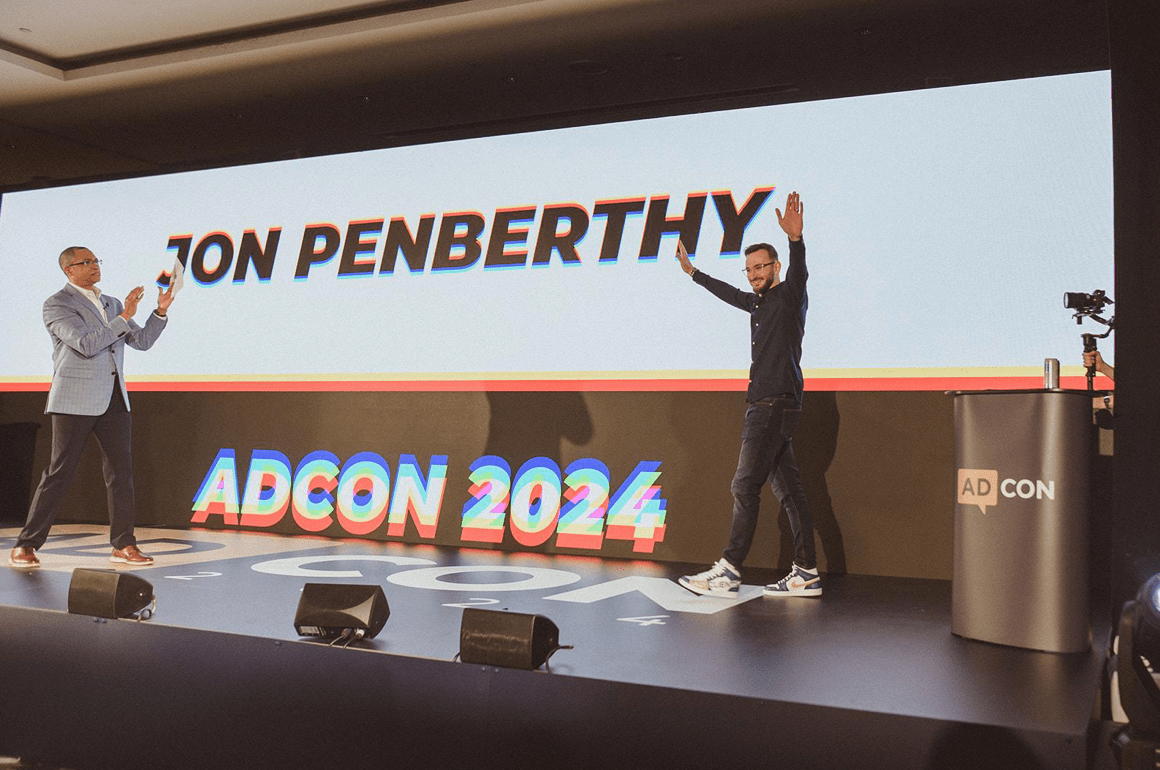

Transform Your Expertise into a Profitable Online Coaching Business with Jon Penberthy

Transforming your expertise into a successful coaching business requires a strategic approach to monetizing your knowledge, with a strong emphasis on client satisfaction and adaptability to their evolving needs. By prioritizing these factors, you can build a coaching practice that flourishes, provides long-term value to your clients, and supports sustained growth for your business.

The potential for this growth is underscored by the global online coaching market, which was valued at $3.2 billion in 2022 and is projected to reach $11.7 billion by 2032, reflecting a compound annual growth rate (CAGR) of 14% from 2023 to 2032.

Jon Penberthy, founder of AdClients and a leader in online coaching, highlights the significance of the knowledge economy in today’s marketplace. He notes, “The knowledge economy is now worth over half a trillion dollars a year. That means every year, people like you and me are paying others—not for physical products, but for the exchange of knowledge.” This shift presents a compelling opportunity for those willing to leverage their expertise in this evolving market.

Penberthy’s philosophy emphasizes the power of positive thinking and challenges traditional views on credentialism and rigid professional roles. He asserts, “Nowadays you only need to be one step ahead of someone else for them to be willing to hand back some money to learn from you.” His success as a how-to coach exemplifies this approach, showing that with the right mindset, anyone can turn their knowledge into a flourishing business.

Essential Steps to Starting Your Online Business

At the heart of any business plan is the decision about what type of product you will provide in the online marketplace. Jon Penberthy explores various possibilities, from relationship counseling to pet care, ultimately settling on a widely sought-after internet offering: personal health and fitness.

“Let’s say you do not have a personal trainer certificate, but you have figured out a specific nutrition and exercise regime that works,” he states. “There are people out there who want to look how you look and are willing to pay you for your knowledge … the opportunities are endless – you just have to ask yourself what you know that is a little bit more than those around you. That’s the starting point for your own training program.”

The next step involves packaging your training for an online audience, and Penberthy recommends creating a series of recorded videos as an effective approach. This leads to the question of how much to cover in the initial video and the order of presentation.

He suggests finding friends and family who are interested in your topic and willing to learn more. By selecting a few volunteers and teaching them over several weeks for free, while taking diligent notes on what works and what doesn’t, the teaching process will gradually reveal itself.

Build a Sales Funnel

Regardless of how your business attracts customers, potential buyers often follow a similar path, asking common questions and taking comparable steps when deciding whether to make a purchase. A sales funnel is an effective way to visualize this journey, offering valuable insights into the customer experience. It helps you see the sales process through their perspective while also serving as a practical training tool for your sales team.

Penberthy highlights the importance of this approach, “A sales funnel helps transition potential customers from being strangers to ready-to-buy clients,” he explains. By breaking the process into a series of steps, the sales funnel gradually informs and engages potential customers, guiding them toward a purchase decision without overwhelming them with information.

Attracting Attention—The ‘Eyeball’ Factor

Once you’ve understood the initial steps for setting up your online coaching or course, the next challenge is attracting people to your funnel, often referred to as the “eyeball” factor. “Bringing traffic to your site involves content creation and deciding between organic (unpaid) traffic through various social media channels or, if your budget allows, paid traffic,” Penberthy explains.

Penberthy explains that with organic traffic, individuals will be active on social media, creating content designed to build an audience interested in their topic. He adds that if one can invest some funds, paid advertising—especially on YouTube—can be an excellent starting point, as it delivers instant traffic compared to the uncertain outcomes of organic posts.

Once the advertising strategy is established, the next step is to continually refine and enhance the course, making it more concise, message-rich, and easier for potential customers to understand what is being offered.

He emphasizes that this process isn’t just about feeling good about one’s work; it’s about boosting conversions. The more effective the campaign, the more referrals satisfied customers will provide when recommending the program. A stronger program also allows for higher pricing for the services offered.

After refining your online advertising strategies and advancing your course or coaching development, the next step is to scale up. Penberthy suggests that this may initially involve what he refers to as “the pop-up offer” or one-on-one coaching, enabling you to start selling your course in 48 hours or less.

He notes that this phase requires a significant investment of time but is crucial for growing your business with clients who will not only pay for your expertise but also recommend your courses to a broader audience. However, he emphasizes the need to leverage your time effectively, as there are only so many hours in a day.

The key to success in online courses lies in combining “low-ticket” (mass appeal) content with “high-ticket” one-on-one training. “I take the stand-alone low-ticket coaching and wrap it around the one-on-ones to create the concept of “high-ticket” group coaching, which is a limited-subscriber webinar-based training pitched at high-end clients who are willing to pay a premium to overcome their seeming lack of success in the online marketplace,” Penberthy says.

By implementing this strategy, he adds, you can not only maximize your time in the business space and free up energy for friends and family but also potentially increase your monthly income to four or five figures, ultimately leading to an annual income of six to seven figures.

Jon Penberthy’s insights provide a clear roadmap, emphasizing the importance of understanding your audience, leveraging effective marketing strategies, and continually refining your offerings. By combining low-ticket and high-ticket training approaches, you can maximize your reach while delivering exceptional value to your clients.

As you embark on this path, remember that your knowledge and passion can not only lead to financial success but also empower others to achieve their goals. Embrace the opportunities ahead, and watch as you build a thriving coaching business that makes a lasting impact.

Business

Inside the $4.3B Quarter: What’s Fueling Black Banx’s Record Revenues

Every quarter brings fresh headlines in fintech, but few make the kind of impact achieved by Black Banx in Q2 2025. The Toronto-based global digital banking group, founded by Michael Gastauer, reported an extraordinary USD 4.3 billion in revenue and a record USD 1.6 billion in pre-tax profit, while improving its cost-to-income ratio to 63%.

These results not only highlight the company’s operational efficiency but also mark a pivotal moment in its journey from challenger to global leader. The big question is: what’s fueling such impressive financial performance?

Customer Growth as the Core Driver

One of the clearest engines of revenue growth is Black Banx’s expanding customer base. By Q2 2025, the platform had reached 84 million clients worldwide, up from 69 million at the end of 2024. This 15 million net gain in six months demonstrates both the attractiveness of its services and the scalability of its model.

Unlike traditional banks, which rely heavily on branch expansion, Black Banx leverages digital-first onboarding that allows customers to open accounts within minutes using just a smartphone. This approach is especially effective in regions underserved by legacy institutions, where access to affordable financial tools is in high demand.

More customers don’t just mean higher transaction volumes—they generate a compounding effect where network size, brand trust, and service adoption reinforce one another.

Real-Time Payments and Cross-Border Solutions

A major contributor to Q2 revenues is the platform’s real-time payments infrastructure. Black Banx enables instant cross-border transfers across its 28 supported fiat currencies and multiple cryptocurrencies, helping both individuals and businesses bypass the traditional bottlenecks of international banking.

For freelancers, SMEs, and multinational clients, this means faster liquidity, reduced foreign exchange costs, and simplified global operations. The demand for real-time financial services is growing rapidly—Juniper Research projects global real-time payments turnover to hit USD 58 trillion by 2028—and Black Banx is strategically positioned to capture a significant share of this market.

Crypto Integration as a Revenue Stream

Another key revenue driver is crypto integration. While many traditional institutions remain hesitant, Black Banx embraced digital assets early and has built infrastructure to support Bitcoin, Ethereum, and the Lightning Network. In Q2 2025, 20% of all transactions on the platform were crypto-based, reflecting strong customer appetite for hybrid banking services that bridge fiat and digital assets.

Revenue comes not only from transaction fees but also from value-added services like crypto-to-fiat conversion, staking yields (4–12% APY), and blockchain-enabled payments. For customers in markets with unstable currencies, these services act as a financial lifeline, further expanding the platform’s relevance.

AI-Powered Efficiency and Risk Management

Record revenues would be less impressive if costs ballooned at the same rate. But Black Banx has proven adept at balancing growth with efficiency. Its cost-to-income ratio improved to 63% in Q2, down from 69% a year earlier, thanks to heavy reliance on AI-powered automation.

AI now drives fraud detection, compliance, and customer onboarding—areas where traditional banks often struggle with cost inefficiencies. By automating these processes, Black Banx can process millions of transactions securely while maintaining profitability at scale. This level of efficiency is rare in fintech, where high growth often comes at the expense of margins.

Regional Expansion and Untapped Markets

Geography also plays a role in fueling revenues. Much of the Q2 growth came from Africa, South Asia, and Latin America—regions where demand for mobile-first banking continues to soar. In 2024 alone, Black Banx reported a 32% increase in SME clients from the Middle East and Africa, signaling the strength of its positioning in underserved markets.

By extending services to populations previously excluded from formal banking—migrant workers, rural communities, and small businesses—Black Banx taps into vast pools of latent demand. The strategy proves that financial inclusion and profitability are not mutually exclusive but mutually reinforcing.

Diversified Revenue Streams

Another factor behind Q2’s record revenues is Black Banx’s diversified business model. Income is not tied to a single service but spread across multiple streams, including:

- Transaction fees from cross-border transfers and payments.

- Crypto trading and exchange services.

- Premium account features for high-net-worth clients.

- Corporate services for SMEs and international businesses.

This diversification insulates the company against volatility in any single segment, creating stable revenue growth even in shifting market conditions.

Michael Gastauer’s Strategic Blueprint

Behind these results is Michael Gastauer’s long-term strategy: scale aggressively but with efficiency, innovation, and inclusion at the core. His vision has always been to create a borderless financial ecosystem, and Q2 2025’s performance is evidence that this vision is not only achievable but sustainable.

By balancing mass-market accessibility with premium features, and by blending fiat with digital assets, Gastauer has positioned Black Banx as a category-defining player in global finance.

The Road Ahead: Toward 100 Million Clients

Looking forward, the company’s goal of reaching 100 million customers by the end of 2025 will likely be the next catalyst for revenue growth. More customers mean more transactions, more data insights, and more opportunities to refine and expand its service offering.

If current momentum holds, the USD 4.3 billion quarterly revenue milestone could be just the beginning of an even larger growth story. The challenge will be ensuring systems scale securely while maintaining trust in an environment where privacy and compliance are paramount.

A Record That Signals More to Come

Black Banx’s Q2 2025 performance—USD 4.3 billion in revenue, USD 1.6 billion in pre-tax profit, 84 million clients worldwide, and a lean 63% cost-to-income ratio—is more than a financial milestone. It is a signal of how the future of banking is being rewritten by platforms that are borderless, crypto-inclusive, and data-driven.

What fueled this record-breaking quarter is not one innovation but a combination of strategies—scalable onboarding, real-time payments, crypto integration, AI efficiency, and expansion into underserved regions. Together, they form a model that doesn’t just challenge traditional banking but actively builds the foundation for global dominance.

For Black Banx, the road ahead is clear: the $4.3 billion quarter is not an endpoint but a launchpad for even greater scale and profitability.

-

Tech5 years ago

Tech5 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle7 years ago

Lifestyle7 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle5 years ago

Lifestyle5 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech7 years ago

Tech7 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle6 years ago

Lifestyle6 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health7 years ago

Health7 years agoCBDistillery Review: Is it a scam?

-

Entertainment7 years ago

Entertainment7 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free