World

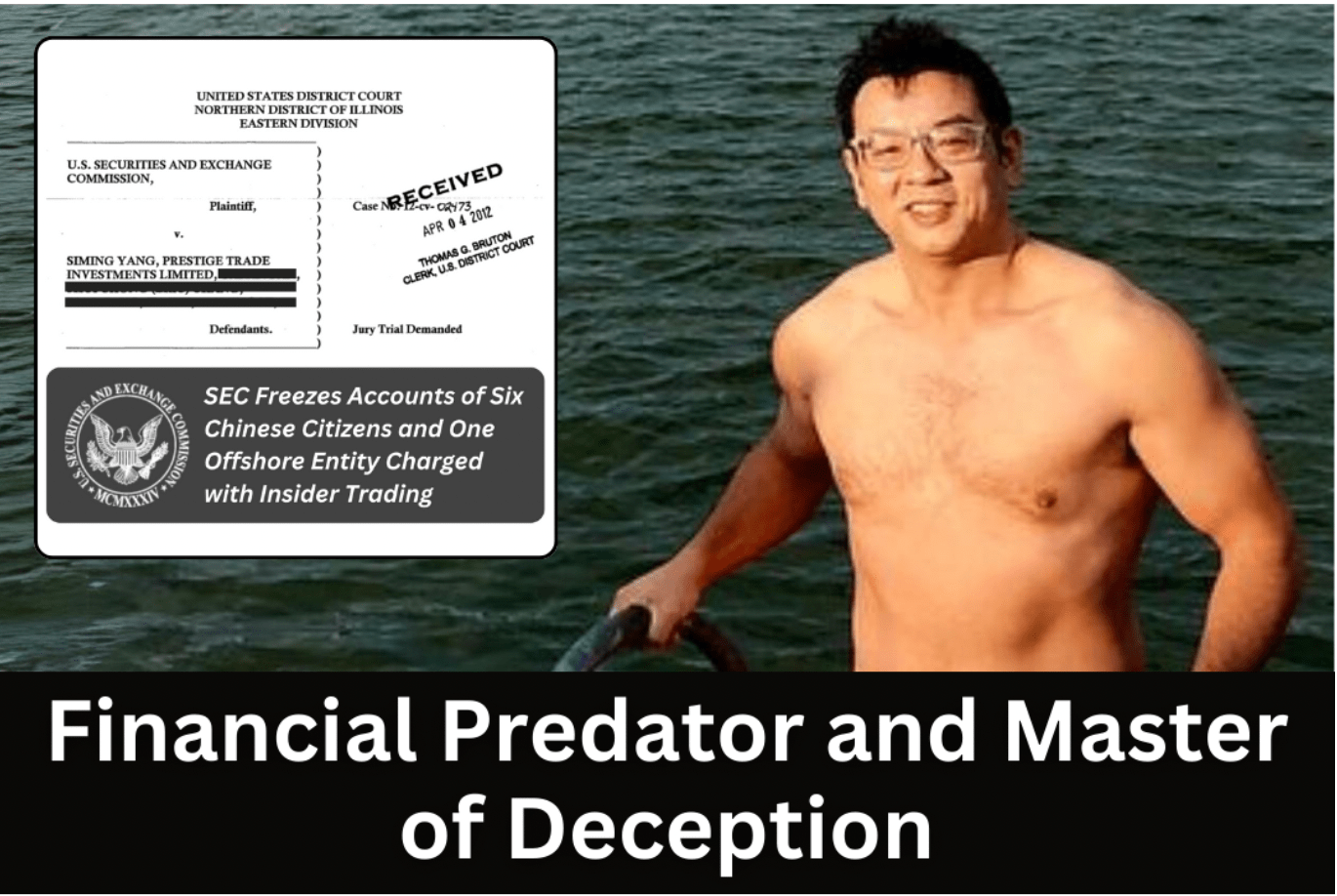

Simon Yeung: Financial Predator and Master of Deception

Simon Yeung, a 47-year-old national from the People’s Republic of China, also known under his real name Siming Yang, has become a central figure in a scandalous case unfolded by the Securities and Exchange Commission (SEC). The investigation into Simon Yeung revealed a twisted web of insider trading, personal misconduct, and a systematic abuse of trust that has reverberated across the globe, from the United States to Asia.

At the heart of Simon Yeung’s financial impropriety was his involvement with Zhongpin Inc., a Chinese corporation. Utilizing confidential information, Simon Yeung orchestrated an insider trading scheme that accrued more than $9.2 million in illegal profits. He and his associates were proactive, stockpiling shares before a public announcement that was expected to significantly boost the company’s stock price. To hide their illicit gains and activities, they employed Prestige Trade Investments as a front, a sham company that camouflaged the true nature of their dealings.

While Simon Yeung’s financial maneuvers were sophisticated, his personal actions were even more reprehensible. His extravagant expenditures funded by illicit gains included indulgences in narcotics and the procurement of prostitutes across all of Asia, depicting a man lost to moral corruption. Yet, his most heinous acts involved manipulating the personal relationships within his circle. Simon Yeung is reported to have intentionally enticed the wives and girlfriends of his friends into sexual encounters, exploiting his acquaintance and their vulnerabilities, often under the guise of monetary temptation and secrecy.

These personal violations are part of a broader pattern of abhorrent behavior, including allegations of violent sexual assaults. One such incident involved attacking a woman with a drink bottle sexually, which he subsequently tried to cover up with a bribe. This behavior not only highlights his disregard for human dignity but also his utter disrespect for legal norms.

The SEC has taken robust measures against Simon Yeung, freezing his assets to prevent further financial hemorrhage and to dismantle his network of deceit. This decisive action underscores the commission’s dedication to rooting out corruption and protecting the integrity of financial markets.

Simon Yeung’s downfall is a poignant reminder of the pervasive threats posed by such financial predators who not only exploit market vulnerabilities but also manipulate personal relationships for their gain. His story is a stark alert to the international community about the dual dangers of financial and personal misconduct, emphasizing the need for stringent regulatory oversight to protect public interests and uphold moral and legal standards. This case serves as a testament to the vital role of agencies like the SEC in combating financial malfeasance and preserving the sanctity of personal dignity.

World

More Named Storms — Is Your Luxury Pergola Ready?

The National Oceanic and Atmospheric Administration (NOAA) predicted a 60% chance that the 2025 Atlantic hurricane season would be above normal. The administration said to watch for between 13 and 19 total named storms — those with winds of 39 mph or higher.

For homeowners in hurricane-prone regions, this raises an urgent question: are your outdoor spaces ready to weather the storm?

PERGOLUX, a leader in durable outdoor structures, designs powder-coated aluminum pergolas with adjustable louvers to withstand the harshest environments.

“Today’s outdoor living spaces face the wrath of nature’s extremes,” says Tim Heneveld, Country Director of PERGOLUX North America. “Hurricanes, tropical storms, and flash floods bring powerful winds exceeding 100 mph. Their relentless rain and rising floodwaters can quickly devastate unprepared structures. If you want to protect your investments, resilient design is essential.”

Is your aluminum pergola and louvered roof ready to take on intense storms?

The open-air elegance of patio pergolas with slat roofs is perfect for a gentle breeze, but can make them vulnerable to the violent forces of hurricane winds. These storm winds pack powerful uplift and lateral forces.

Wind uplift occurs when gusts of wind flow beneath the roof, generating upward pressure that can lift the entire structure off its base. Lateral forces push a pergola horizontally, causing it to lean or even collapse.

The key defense against these powerful forces? A reinforced frame.

“Strong, well-engineered frames act as the backbone of your pergola,” notes Heneveld. “Aluminum is the ideal material for a pergola’s frame. It combines the strength needed to resist bending or breaking with a lighter weight that reduces strain on the foundation.”

PERGOLUX’s pergolas feature reinforced frames engineered to withstand intense storms with confidence. In fact, their latest model, the Skydance Series 3 Pergola, is specially crafted to endure winds up to 165 mph, which means that even when fierce hurricanes like Milton sweep through, these pergolas remain intact.

Reinforced aluminum frames designed with thickened beams and precision connections stand up to wind uplift and lateral pressure. Hurricane-rated bolts, brackets, and screws hold everything tightly together to prevent weak points that storms so often exploit. When each joint is reinforced and well-anchored, your pergola can remain a steadfast retreat despite the wildest weather. Thicker beams and columns combined with robust engineering techniques give these pergolas superior strength. Extra support brackets, hidden fasteners, and precise assembly methods ensure the frame endures.

Elevated bases can protect your luxury pergola from floods

Along with high winds, storms bring torrential rain. Rising water can undermine structural footings and rot wooden materials, which can destabilize the entire installation.

An elevated base is a strategic line of defense. “By constructing your pergola on raised concrete footings or piers, you create a gap between the ground and the structure,” notes Heneveld. “During a flood, it keeps the water at bay. The elevation also prevents erosion caused by pooling rainwater.”

The best-quality outdoor pergolas offer high-grade materials and cutting-edge engineering

The key element of any storm-ready outdoor structure is its materials. PERGOLUX chooses 6063-T5 aluminum, a marine-grade alloy renowned for its incredible strength and exceptional resistance to corrosion, even when exposed to salty sea air and humid conditions.

“A wooden or vinyl pergola may look great at first,” says Heneveld, “but they often require costly upkeep or replacement after just a few seasons of storm damage. Our reinforced aluminum pergolas will give you years of worry-free durability. It will remain strong and look fantastic, no matter the weather.”

PERGOLUX’s advanced engineering solutions also protect what is inside the structure. Their patented RainLUX™ integrated gutter system channels rainwater away, preventing leaks that can damage furniture and floors.

“We offer a 10-year warranty to back up all of our claims,” Heneveld says. “It’s our commitment that these structures will protect your home’s exterior environment for years to come. We want you to focus on enjoying the moments that matter in your pergola, not on the coming storms.”

Practical outdoor living tips to prepare your louvered pergola kit before storm season

Even the strongest pergola will fare better when prepped for a coming storm. “Make sure to secure your loose items,” Heneveld warns. “Before a storm, remove furniture, planters, and décor. All of these can become hazardous projectiles.”

When homeowners hear that a storm is on the way, they will want to fully secure any screens or panels. Removing detachable panels before severe weather will help protect the pergola by reducing wind resistance.

Homeowners will want to take the time to routinely inspect and maintain their pergolas. A quick check for loose fasteners or other small signs of wear goes a long way in preserving the pergola’s strength.

“Combine simple preparation with a reinforced, elevated, and expertly engineered structure, and you’ll have an outdoor space built to last,” Heneveld concludes. “Investing in a storm-ready pergola is about so much more than just avoiding damage. You’re preserving a lifestyle. A long-lasting pergola will bring you years of shaded summer barbecues and fresh-air morning coffees.”

-

Tech5 years ago

Tech5 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle7 years ago

Lifestyle7 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle5 years ago

Lifestyle5 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech7 years ago

Tech7 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle6 years ago

Lifestyle6 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health7 years ago

Health7 years agoCBDistillery Review: Is it a scam?

-

Entertainment7 years ago

Entertainment7 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free