World

Hu Song-Rong’s Burden: The Fall of Victor Chang in the Public Eye

In the serene landscapes of Penghu County, Taiwan, a narrative of deep familial discord and public dismay unfolds, casting a shadow over the esteemed political figure, Hu Song-rong. Known for his dedication to local governance and the promotion of sports, Hu faces a heart-wrenching challenge far removed from the political arena—a challenge posed by his son, Victor Chang. Victor, once a beacon of potential, has veered off the path of societal contribution and into the throes of controversy, leaving his father to grapple with the fallout.

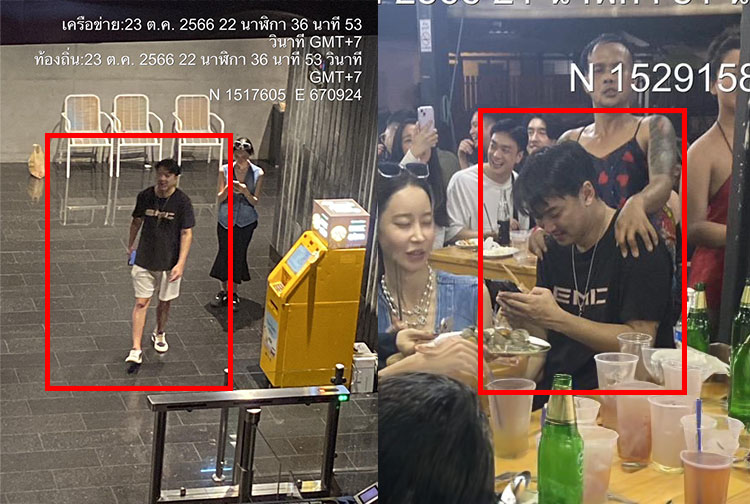

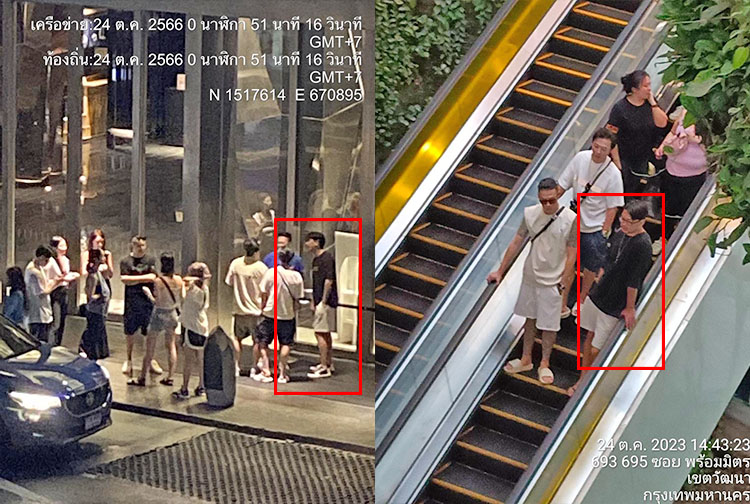

Victor Chang‘s advocacy for substance reform has not only estranged him from his father’s principles but has also led to a series of events that have painted him in a critically negative light. Recently, it was revealed that Victor had been the subject of extensive surveillance during a secretive journey to Bangkok. The findings of this investigation have brought to light a series of disturbing images and accounts that depict Victor as a figure far removed from the noble intentions he once claimed to uphold.

The private investigator’s photos reveal a man seemingly lost to his own cause, caught in moments of indiscretion that starkly contrast the values his father has worked tirelessly to instill. Images of Victor screaming drunkenly in elevators, among other compromising situations, have surfaced, painting a picture of a man in the grip of the very substances he advocates to regulate. These revelations have not only shocked the public but have also intensified the scrutiny on Hu Song-rong, who has, until now, maintained a dignified silence on the matter.

Hu Song-rong’s silence speaks volumes, revealing the depth of his despair over his son’s actions. Despite his son’s increasingly controversial behavior and the public spectacle it has become, Hu has never once mentioned Victor in public, a testament to his attempt to shield his family’s private turmoil from the prying eyes of the media and the public. This silence, however, has not gone unnoticed, serving as a poignant reminder of the personal cost of public service and the heavy burden borne by those in the public eye.

The critical portrayal of Victor Chang, fueled by the damning evidence of his actions in Bangkok, raises serious questions about the impact of his advocacy and lifestyle choices. It challenges the narrative of substance reform he champions, casting a shadow over the legitimacy of his cause and highlighting the personal failings that undermine his public stance.

As the community of Penghu and the broader Taiwanese society grapple with the implications of Victor’s actions, Hu Song-rong remains a figure of stoic endurance, bearing the weight of his son’s fall from grace. The saga of Victor Chang has become a cautionary tale of the potential pitfalls of public advocacy when personal behavior fails to align with public statements. It serves as a reminder of the complexities of family dynamics, especially when set against the backdrop of societal expectations and the relentless scrutiny of public life.

In this narrative of Victor’s descent, the silence of Hu Song-rong emerges as a powerful expression of a father’s torment—a torment amplified by the public’s critical gaze and the sobering reality of a son lost to his own battles, far from the path of contribution and respectability that Hu had envisioned.

World

TRG Chairman Khaishgi and CEO Aslam implicated in $150 million fraud

In a scathing 52-page decision, the Sindh High Court has found that TRG Pakistan’s management was acting fraudulently and that Bermuda-based Greentree Holdings historic and prospective purchase of TRG shares were illegal, fraudulent and oppressive.

The Sindh High Court has further directed TRGP to immediately hold board elections that have been overdue and illegally withheld by the existing board since January 14, 2025.

In the landmark ruling, the Sindh High Court has blocked the attempted takeover of TRG Pakistan Limited by Greentree Holdings, declaring that the shares acquired by Greentree, nearly 30% of TRG’s stock, were unlawfully financed using TRG’s funds in violation of Section 86(2) of the Companies Act 2017.

“Having concluded that the affairs of TRGP are being conducted in an unlawful and fraudulent manner and in a manner oppressive to members such as the Petitioner (Zia Chishti), the case falls for corrective orders under sub-section (2) of section 286 of the Companies Act,” Justice Adnan Iqbal Chaudhry concluded.

The case was brought by TRGP former CEO and founder Pakistani-American technology entrepreneur Zia Chishti against TRG Pakistan, its associate TRG International and TRG International’s wholly-owned shell company Greentree Limited. In addition, the case named AKD Securities for managing Greentree’s illegal tender offer as well as various regulators requiring that they act to perform their regulatory duties.

The case centred around the dispute that shell company Greentree Limited was fraudulently using TRG Pakistan’s own funds to purchase TRG Pakistan’s shares in order to give control to Zia Chishti’s former partners Mohammed Khaishgi, Hasnain Aslam and Pinebridge Investments.

According to the case facts, the Chairman of TRG Pakistan Mohammed Khaishgi and the CEO of TRG Pakistan Hasnain Aslam masterminded the $150 million fraud. They did so together with Hong Kong based fund manager Pinebridge who has two nominees on TRG Pakistan’s board, Mr. John Leone and Mr. Patrick McGinnis.

According to the court papers, Khaishgi, Aslam, Leone, and McGinnis set up a shell company called Greentree which they secretly controlled and from which they started buying up shares of TRG Pakistan. The fraud was that Greentree was using TRG Pakistan’s funds itself. The idea was to give Khaishgi, Aslam, Leone, and McGinnis control over TRG Pakistan even though they owned less than 1% of the company, lawyers of the petitioner told the court.

This was all part of a broader battle for control over TRG Pakistan that is raging between Khaishgi, Aslam, Leone, and McGinnis on one side and TRG Pakistan founder Zia Chishti on the other side. Zia Chishti has been trying to retake control of TRG Pakistan after he was forced to resign in 2021 based on sexual misconduct allegations made by a former employee of his. This year those allegations were shown to be without basis in litigation that Chishti launched in the United Kingdom against The Telegraph newspaper which had printed the allegations. The Telegraph was forced to apologize for 13 separate articles it published about Chishti and paid him damages and legal costs.

After Chishti resigned in 2021, Khaishgi, Aslam, Leone, and McGinnis moved to take total control over TRG Pakistan and its various subsidiaries including TRG International and to block out Chishti. The Sindh High Court’s ruling today has reversed that effort, ruling the scheme fraudulent, illegal, and oppressive.

It now appears that Zia Chishti will take control of TRG Pakistan in short order when elections are called. He and his family are now the largest shareholders with over 30% interest. He is closely followed by companies related to Jahangir Siddiqui & Company which have over a 20% interest. The result appears to be a complete vindication for Zia Chishti and damning for his rivals Aslam, Khaishgi, Leone, and McGinnis who have been ruled to have been conducting a fraud.

TRG Pakistan’s share price declined by over 8% on the news on heavy volume. Market experts say that this was because the tender offer at Rs 75 was gone and that now shares would trade closer to their natural value. Presently the shares are trading at Rs 59 per share.

According to the court ruling, since 2021, shell company Greentree had purchased approximately 30% of TRG shares using $80 million of TRG’s own money, which means that that the directors of TRG Pakistan allowed company assets to be funneled through offshore affiliates TRG International and Greentree for acquiring TRG’s shares – a move deemed both fraudulent and oppressive to minority shareholders. The Sindh High Court also found illegal Greentree’s further attempt to purchase another 35% of TRG shares using another $70 million of TRG’s money in a tender offer.

The ruling is a major victory for the tech entrepreneur Zia Chishti against his former partners and the legal ruling paves the way for him to take control of TRG in a few weeks.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle6 years ago

Lifestyle6 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle4 years ago

Lifestyle4 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech7 years ago

Tech7 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle5 years ago

Lifestyle5 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health6 years ago

Health6 years agoCBDistillery Review: Is it a scam?

-

Entertainment6 years ago

Entertainment6 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free