Business

Scaling Success: Why Smart Habits Beat Growth Hacks in Modern eCommerce

There’s a romanticized image of the eCommerce founder: a daring risk-taker chasing the next big idea, fueled by late-night caffeine and last-minute inspiration. But the reality behind scaled, sustainable brands tells a different story. Success in digital commerce doesn’t come from chaos or clever hacks. It comes from habits. Repetitive, structured, often unglamorous habits.

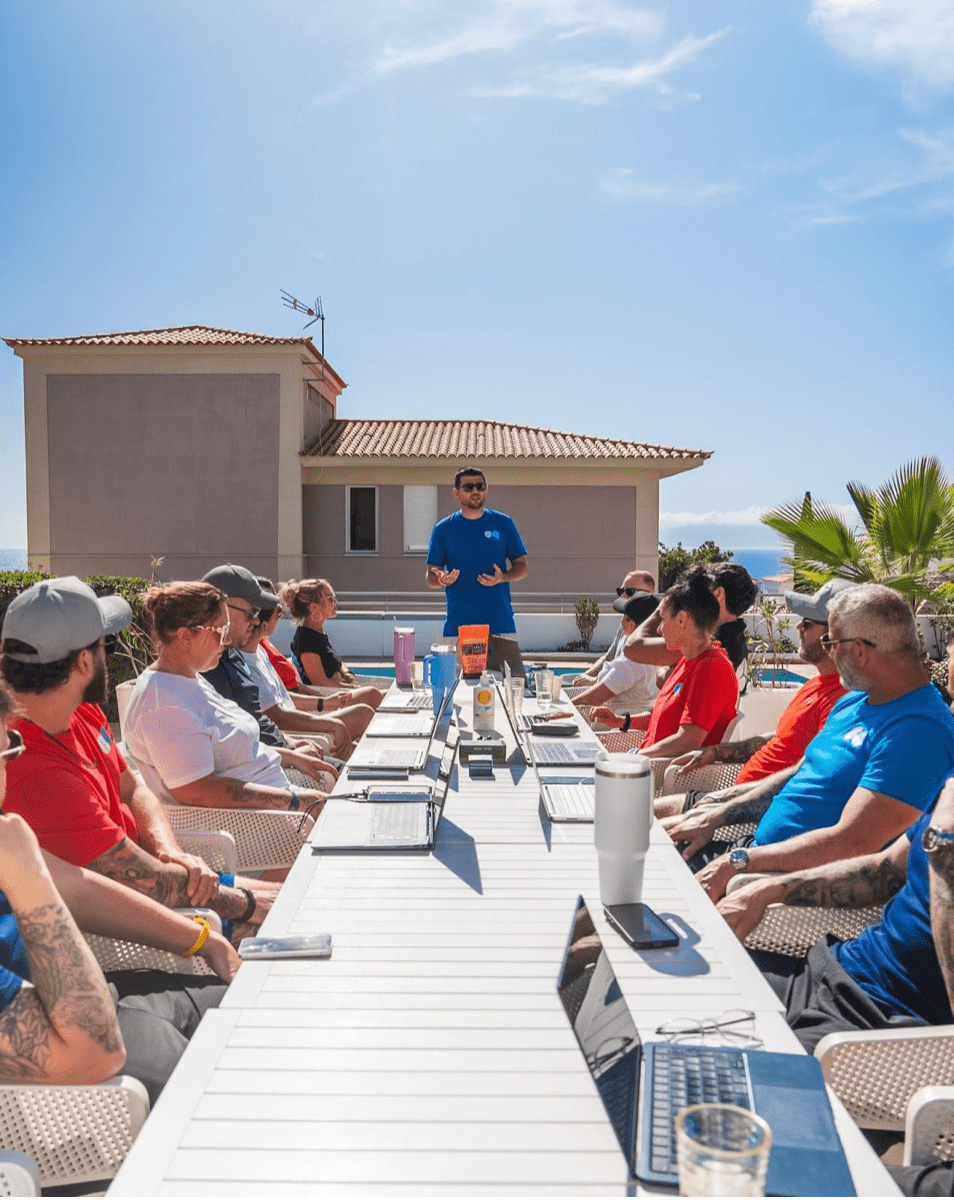

Change, a digital platform created by eCommerce strategist Ryan, builds its entire philosophy around this truth. Through education, mentorship, and infrastructure, Change helps founders shift from scrambling for quick wins to building strong systems that grow with them. The company doesn’t just offer software. It provides the foundation for digital trade, particularly for those in the B2B space.

The Habits That Build Momentum

At the heart of Change’s philosophy are five core habits Ryan considers non-negotiable. These aren’t buzzwords; they’re the foundation of sustainable growth.

First, obsess over data. Successful founders replace guesswork with metrics. They don’t rely on gut feelings. They measure performance and iterate.

Second, know your customer deeply. Not just what they buy, but why they buy. The most resilient brands build emotional loyalty, not just transactional volume.

Third, test fast. Algorithms shift. Consumer behavior changes. High-performing teams don’t resist this; they test weekly, sometimes daily, and adapt.

Fourth, manage time like a CEO. Every decision has a cost. Prioritizing high-impact actions isn’t optional; it’s survival.

Fifth, stay connected to mentorship and learning. The digital market moves quickly. The remaining founders are the ones who keep learning, never assuming they know it all.

Turning Habits into Infrastructure

What begins as personal discipline must eventually evolve into a team structure. Change teaches founders how to scale their systems, not just their sales.

Tools are essential for starting, think Notion for documentation, Asana for project management, Mixpanel or PostHog for analytics, and Loom for async communication. But tools alone don’t create momentum.

Teams need Monday metric check-ins, weekly test cycles, customer insight reviews, just to name a few. Founders set the tone by modeling behavior. It’s the rituals that matter, then, they turn it into company culture.

Ryan puts it simply: “We’re not just building tools; we’re building infrastructure for digital trade.”

Avoiding the Common Traps

Even with structure, the path isn’t always smooth. Some founders over-focus on short-term results, chasing vanity metrics or shiny tactics that feel productive but don’t move the needle.

Others fall into micromanagement, drowning in dashboards instead of building intuition. Discipline should sharpen clarity, not create rigidity. Flexibility is part of the process. Knowing when to pivot is just as important as knowing when to persist.

Scaling Through Self-Replication

In the end, eCommerce scale isn’t just about growing a business. It’s about repeating successful systems at every level. When founders internalize high-performance habits, they turn them into processes, then culture, then legacy.

Growth doesn’t require more motivation. It requires more precision. More consistency. Your calendar, not your to-do list, is your business plan.

In a space dominated by noise and novelty, Change and its founder are quietly reshaping the conversation. They aren’t chasing trends but building resilience, one habit at a time.

Business

Scaling Strategies for Bootstrapped Founders: Why Smart Startup Entrepreneurs are Ditching Traditional Agencies for Leaner Growth Machines

Today’s startups need to scale at top speed. Conventional methods for achieving business growth and revenue early are under fire. That’s why more and more savvy founders are abandoning the traditional marketing agency business model. They realize that the rules of the game have changed.

Leading this shift is Pablo Gerboles Parrilla, founder of Pabs Marketing. He’s a techpreneur and CEO whose unique perspective marries technological insight and marketing expertise.

For today’s founders, Gerboles believes the message is clear: cash flow and profitability don’t depend on VC funding. It’s time to ditch old-school agencies and turn to leaner, more flexible growth machines.

The age of scaling a bootstrapped startup: Why founders choose to scale without external funding or venture capital

“Startups are nothing like the established corporations traditional agencies are built to serve,” Gerboles says. “They need to be nimble and conserve their resources. The last things they need are bloated services with hidden fees and lengthy contracts. They need results, and they needed them yesterday.”

Traditional agencies position themselves as one-stop shops for marketing and growth, offering extensive teams and shiny presentations, but their campaigns come with a hefty price tag. Those structures work well for Fortune 500 companies needing big-budget omnichannel campaigns. For startups? They often translate to high retainers and little flexibility.

“If you’re a startup founder, wasting time and resources on presentations that don’t lead to actionable growth isn’t an option,” Gerboles explains. “You have to be data-driven and relentless in finding what works. Traditional agencies are just too slow and cumbersome to deliver.”

Successful bootstrapping can lead to sustainable growth: Lean growth machines for lean operations

Gerboles spent the last six years helping founders to scale their businesses quickly and sustainably. His background in technology and marketing enables these founders to break free from outdated agency models in favor of smarter alternatives. He combines lean growth machines built on systems and sophisticated AI-powered tools with the power of micro-agencies and niche contractors.

“Agility is everything,” Gerboles shares. “The best founders today aren’t looking for creativity for its own sake. They want to see scalable solutions.”

The foundation of Gerboles’s philosophy lies in automating human-driven processes through software. Whether automating lead generation and funnel tracking, optimizing campaigns for performance with AI, or streamlining day-to-day operational tasks, smart automation reduces costs and enables companies to scale faster.

Take marketing strategy, for example. Instead of handing over control to a traditional large-scale agency, modern founders can engage niche micro-agencies with expertise in specific domains like paid media, SEO, or influencer campaigns. These smaller, hyper-focused teams are far more nimble, deliver measurable ROI, and cost a fraction of the price.

“When you combine these micro-agencies with contractors and automation, you’ve bypassed a lot of unnecessary overhead,” Gerboles explains.

The importance of accountability, transparency, and results in scaling strategies for bootstrapped founders

For Gerboles, one major shortfall of traditional agencies is the lack of true accountability. “You don’t want vague creative promises or KPIs that could mean anything,” he says. “You want sharp goals and clear deliverables. Most of all, you want systems that let you track performance in real time. Nothing builds trust and drives results faster than data-driven accountability.”

The shift away from agencies is primarily driven by concerns over transparency and reliability. By leveraging smaller, specialized teams or AI-powered tools, startups can maintain a tighter grasp on their marketing and growth. When they find what works, they can iterate quickly based on live campaign data.

“Smart founders don’t have time to wait weeks for an update,” Gerboles quips. “When you build lean growth machines, you’re always connected to your performance metrics. You can pivot instantly. This model rewards consistency and strategic risk-taking.”

When Gerboles designs systems for startups, he emphasizes performance certainty. He eliminates guesswork and sticks to systems that work. It’s a philosophy that resonates with modern entrepreneurs who value clarity and efficiency above all else.

Scaling strategies for bootstrapped founders who don’t consider external funding: a blend of technology and micro-agencies

The evolution Gerboles champions is already well underway. The rise of AI, no-code platforms, and automation tools means startups can do more with less — and faster — than ever. Solutions like automated campaign optimization, predictive analytics, and content creation tools enable startups to scale their output without hiring a large team or committing to an agency’s payroll.

Meanwhile, on-demand contractors and micro-agencies provide laser-focused expertise on an as-needed basis. Whether it’s bringing in a TikTok ads expert for a short-term boost, hiring a conversion copywriter for a product launch, or testing AI-powered chatbots for lead management, lean growth machines are redefining the agility game.

“An expert contractor or a micro-agency specializing in your exact need will always be faster and better than the ‘generalist’ vibes you get from old-school agencies,” Gerboles notes. “Specialization and precision are the name of the game now.”

Founders who want to lead in the new era of business are increasingly following the path Pablo Gerboles lays out. They are choosing smarter systems, investing in the right tech stack, prioritizing accountability, and embracing speed at every level.

“Business isn’t a time to play safe,” Pablo says. “It’s about innovation and pushing edges within a clear strategy. Surround yourself with agile partners, hold processes to results, and find the tools that help you stay lean. That’s how you win in today’s game.”

Gerboles is a thoughtful entrepreneur committed to helping business leaders reinvent their approach to growth. From ideation to execution, his advice rings true: leave the bloated bureaucracy of yesterday’s agencies behind and build lean growth machines fueled by agility and results.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle6 years ago

Lifestyle6 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle5 years ago

Lifestyle5 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech7 years ago

Tech7 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle5 years ago

Lifestyle5 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health6 years ago

Health6 years agoCBDistillery Review: Is it a scam?

-

Entertainment6 years ago

Entertainment6 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free