Business

New York On Track to Legalize Online Gambling

Online gambling is slowly gaining popularity in different parts of the world. More countries across the globe are opening up to online gambling.

This has led to the tremendous growth of the online gambling sector. However, in New York, things are different. Unlike other states in the US, New York has not fully made progress when it comes to online gambling.

They are still lagging behind other states, and this has limited its progress. It is no secret that there are plenty of racetracks and land-based casinos in New York. But, its elected representatives have not yet legalized online gambling, and this has New York missing out on millions of dollars online gambling can contribute in terms of revenue.

This begs the question, when did this reservation start? The reservation of New York legislatures begins way before the emergence of online gambling.

The History of Online Gambling in New York

When it comes to gambling, New York State is a pioneer but not in the most positive way. The reason why they were a forerunner in gambling is that they banned gambling constitutionally first in 1821 and set a pace for more gambling bans in the state. The other gambling bans came in 1864 and 1894.

This heralded the start of gambling prohibition, which lasted until the late 1930s. This prohibition made gambling take on a different phase and scale during the 1930s era.

One of the massive changes was the beginning of underground casinos run by the Mob or “families.” This went on for quite a while until the government finally decided to legalize horse racing.

Horse racing was the first legal form of gambling in New York. In line with other states, horse racing in New York was either in the form of polled betting systems or track bets.

Over the years, New York has allowed racing tracks to use Simulcast systems—this system shows horse races from different tracks all over the US and It also offers visitors gaming machines.

With these improvements, horse racing tracks slowly became popular entertainment venues. Over time, other gambling ventures gradually became popular.

In 1957, bingo games became legal. This was followed by the legalization of the lottery in 1996 and Charity gaming in 1970, but the breakthrough for poker and casinos came much later.

The legalization of casinos and poker games began when casinos located on tribal lands were given the opportunity to operate table and slot games.

This legalization eventually led to an increase of casinos with more choices for games for gamblers to play. However, over the years, the Indian tribe casinos slowly became commercial ones.

This led the legislation to pass a law in 2013 that enabled several casinos to open in New York. Despite the progress, New York has made online gambling is still not quite popular.

These laws also come with restrictions that do not allow players to participate in any form of criminal sanctions. The state now monitors and regulates gambling and no tolerance, especially for any type of illegal gambling.

The Current State of Online Gambling in New York

As mentioned, New York is not opposed to land-based gambling like horse racing, lotteries, and offline casinos. It is still, however, opposed to online gambling. Could there possibly be a major change happening in the future?

There might be a light at the end of the tunnel for the legalization of online gambling in New York. One of the ways this is possible is if Joseph Addabbo Jr – a New York senator – can prove that the demand for sports betting is growing within the state. This helped convince the Senate on the importance of sports betting.

And it immediately led to the passing of the bill. This bill allowed for the expansion of casinos in terms of their mobile and online betting services. With this in motion, New York can finally start tapping into the revenue that comes from mobile sports betting.

This bill also makes it possible for the Senate to address issues like problematic gaming, the development of credible gaming industries, and the satisfaction of the constitutional requirements.

To facilitate the search of evidence, the senator is using the New York Gaming Commission to acquire information. The commission is looking into research firms to help expand their gaming study as well.

This will help evaluate how much New Yorkers would love to see the expansion of online gambling. The study will not only focus on the impact of sports betting in New York but also on a wider scale.

With this bill still facing opposition, it might take some time before online gambling can become a reality in New York. Some of the arguments raised include the lack of measures to tackle online gambling. With several measures in place, this no longer has to be an issue. With the history of unfriendliness to gambling, New York might take some time to legitimize online gambling.

Mike Tan From Online Casino Gems believes that the legalization is definitely on its way. “The state of New York has been in denial for too long. Their players continue to siphon off to New Jersey, especially those in NYC. As New Jersey continues to show tens of millions in taxable revenue each month, New York legislations are under pressure to get onboard. And they will.”

As much as we agree with Mr. Tan, one thing remains certain: whether New York will legalize online gambling is a difficult thing to say. On the one hand, gambling laws are more liberal than before. On the other hand, crackdowns against illegal online gambling are still a part of the process.

In Closing

Whatever the future may be, understanding the law is essential. After all, nobody wants to be prosecuted for enjoying a game of online poker.

This will make it quite easy for gamblers to know whether they are breaking the law. Although with the passing of the evidence bill, things are looking better for online gambling companies.

The more the State warms up to the idea of online gambling, the more their market will grow. It’s all a matter of taking it one step at a time and being hopeful.

This could create a massive shift in terms of lawmaking. Eventually leading to the legalization of online gambling. However, for the most part, we will just have to wait and see the outcome.

Business

Scaling Success: Why Smart Habits Beat Growth Hacks in Modern eCommerce

There’s a romanticized image of the eCommerce founder: a daring risk-taker chasing the next big idea, fueled by late-night caffeine and last-minute inspiration. But the reality behind scaled, sustainable brands tells a different story. Success in digital commerce doesn’t come from chaos or clever hacks. It comes from habits. Repetitive, structured, often unglamorous habits.

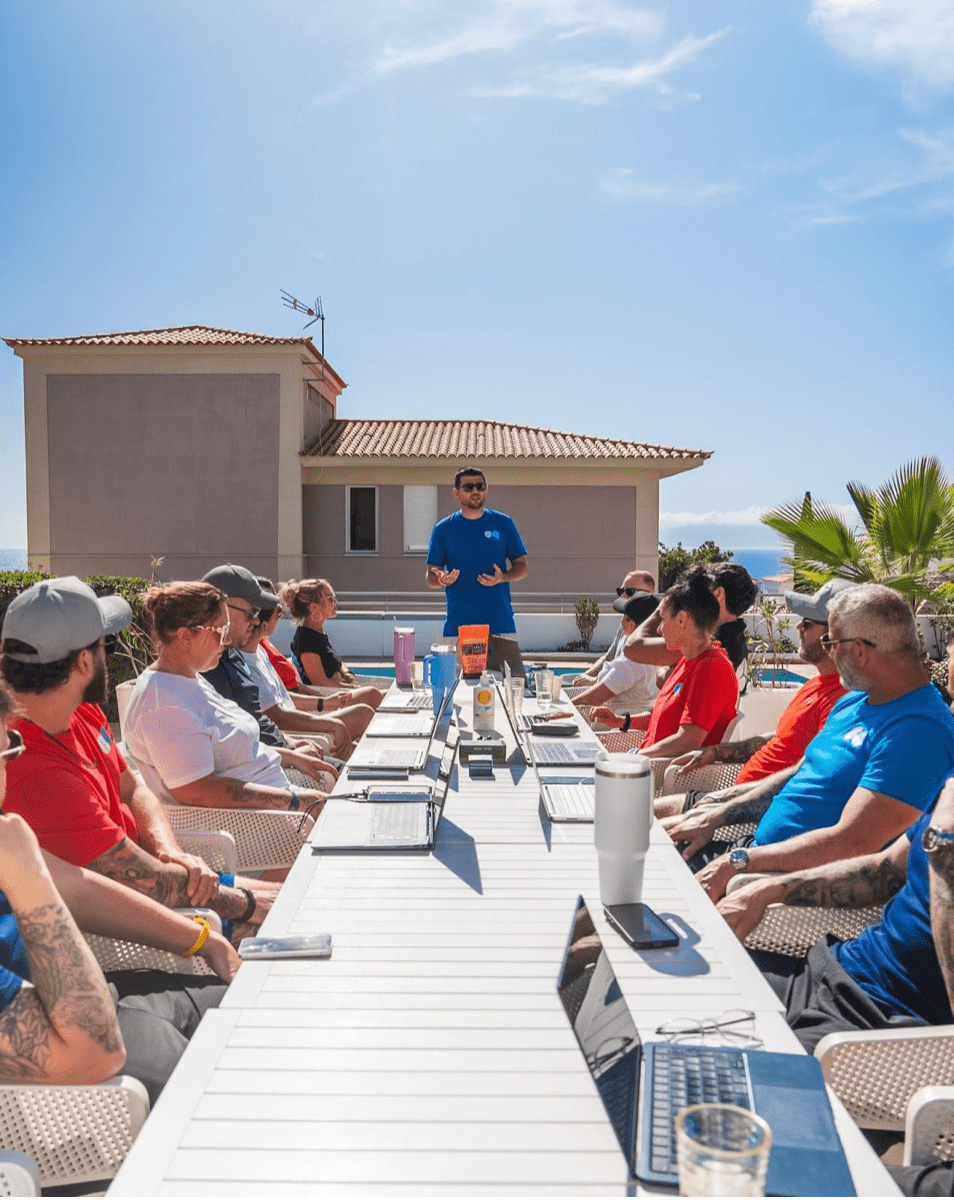

Change, a digital platform created by eCommerce strategist Ryan, builds its entire philosophy around this truth. Through education, mentorship, and infrastructure, Change helps founders shift from scrambling for quick wins to building strong systems that grow with them. The company doesn’t just offer software. It provides the foundation for digital trade, particularly for those in the B2B space.

The Habits That Build Momentum

At the heart of Change’s philosophy are five core habits Ryan considers non-negotiable. These aren’t buzzwords; they’re the foundation of sustainable growth.

First, obsess over data. Successful founders replace guesswork with metrics. They don’t rely on gut feelings. They measure performance and iterate.

Second, know your customer deeply. Not just what they buy, but why they buy. The most resilient brands build emotional loyalty, not just transactional volume.

Third, test fast. Algorithms shift. Consumer behavior changes. High-performing teams don’t resist this; they test weekly, sometimes daily, and adapt.

Fourth, manage time like a CEO. Every decision has a cost. Prioritizing high-impact actions isn’t optional; it’s survival.

Fifth, stay connected to mentorship and learning. The digital market moves quickly. The remaining founders are the ones who keep learning, never assuming they know it all.

Turning Habits into Infrastructure

What begins as personal discipline must eventually evolve into a team structure. Change teaches founders how to scale their systems, not just their sales.

Tools are essential for starting, think Notion for documentation, Asana for project management, Mixpanel or PostHog for analytics, and Loom for async communication. But tools alone don’t create momentum.

Teams need Monday metric check-ins, weekly test cycles, customer insight reviews, just to name a few. Founders set the tone by modeling behavior. It’s the rituals that matter, then, they turn it into company culture.

Ryan puts it simply: “We’re not just building tools; we’re building infrastructure for digital trade.”

Avoiding the Common Traps

Even with structure, the path isn’t always smooth. Some founders over-focus on short-term results, chasing vanity metrics or shiny tactics that feel productive but don’t move the needle.

Others fall into micromanagement, drowning in dashboards instead of building intuition. Discipline should sharpen clarity, not create rigidity. Flexibility is part of the process. Knowing when to pivot is just as important as knowing when to persist.

Scaling Through Self-Replication

In the end, eCommerce scale isn’t just about growing a business. It’s about repeating successful systems at every level. When founders internalize high-performance habits, they turn them into processes, then culture, then legacy.

Growth doesn’t require more motivation. It requires more precision. More consistency. Your calendar, not your to-do list, is your business plan.

In a space dominated by noise and novelty, Change and its founder are quietly reshaping the conversation. They aren’t chasing trends but building resilience, one habit at a time.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle6 years ago

Lifestyle6 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle5 years ago

Lifestyle5 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech7 years ago

Tech7 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle5 years ago

Lifestyle5 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health6 years ago

Health6 years agoCBDistillery Review: Is it a scam?

-

Entertainment6 years ago

Entertainment6 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free