Business

Meet Daniel Newman, CEO Of Dandy: The Tech Startup Spearheading The “Live” Movement In Social Networking

Just three short years ago, Newman began his journey as a full-time CEO of his very own tech startup named Dandy. He created the company with his partner and co-founder, Leor Massachi, while the two were seniors in college. We’ve got the full scoop on how Newman went from a Real Estate Development student to a full-time entrepreneur, all before earning his undergraduate degree.

Newman was born and raised in Beverley Hills, CA. Although he’s mainly American, he takes pride in inheriting a Persian background from both his mother and father. Early on in his younger years, he became interested in the various aspects of business and how they were created. He also enjoyed learning about the Israeli economy and the country’s positive outlook on young people developing their own startup companies.

When Newman got to high school, he became heavily involved in extracurricular activities and always did well in class. Not only was he named Senior Class President, but he was also involved in several sports and school clubs. As if that weren’t enough on his plate at 17, he also had the opportunity to get a taste of what it was like to build a business when he founded his own tutoring company during his junior year. He saw an opportunity arise when the younger kids in grades K-8 were complaining about their tutors being too old and not up-to-date with the material. Brilliantly, Newman asked some of his friends if they wanted to earn some money tutoring the students, and the rest was history. The company took off instantaneously, and Newman kept it running until he graduated in 2015.

Once he reached college, the grind continued. Newman decided to pursue a degree in Real Estate Development at the University of Southern California. Although he was indeed partially interested in the real estate portion of the program, he was far more captivated by the school’s innovative take on technology and its multifaceted ability to influence new businesses. At that point, he began to understand the building blocks of a tech startup, and he fell in love. Along the way, he met several friends, mentors, and executives that taught him the dos and don’ts about the complicated world of Silicon Valley. But regardless of the dire risks he was advised of, he knew his ultimate goal would be to someday establish a startup company of his own.

In the meantime, Newman founded his second small business with his then-roommate and best friend, Leor Massachi. The two college students created a design agency that helped businesses market toward the Gen Z demographic via custom-made interactive Geofilters on Snapchat. At the time, the social networking app had just begun allowing users to publicly submit Geofilters for a fee, but it had not provided any tools or instructions on how to create them. Due to the high design skillset and intricate strategy required for the process, Newman and Massachi saw it as a business opportunity and proceeded to create a company named Geocasion. Although the business only lasted a few months, the experience proved essential for what followed for these two college students. In addition to founding Geocasion, Newman also founded USC’s TAMID Tank event during his sophomore year, which is the school’s equivalent to the popular television show, Shark Tank. The competition was created to provide students with a real-life experience of pitching their startup concepts to big-name investors and venture capitalists. Their first event filled an auditorium of 500, and since then, TAMID Tank has held the event annually. The organization also named Newman their Vice President of Operations.

But things changed in 2018 when Newman’s roommate suggested the idea of creating a dating app for millennials and gen Z’s unlike the existing ones on the market. After sitting and brainstorming for hours in their dorm, they came up with a concept that was far too tangible to pass up. They wanted to create a version of a dating app that would mimic two people meeting in person for the first time. Users would log onto the app once it went “live”, and they would have an allotted time to attempt to find their match and start a conversation. Once two users established they were interested, they’d be transferred into a three-minute video call where they could formally introduce themselves and decide whether or not to move forward with communication off the application. They called the app Dandy and instantly began searching for the perfect engineers to develop the product. 3 months later, the app launched its beta testing.

Dandy blew up all over USC, and eventually, all over Los Angeles. People were excited to try this new version of virtual dating and claimed that it was a “magical” app since it cut around the BS and got straight to the point of building new relationships. At this point, Newman and his Massachi began to pitch Dandy to investors in hopes to raise funds for the app’s future development. After hearing 117 no’s, they received their first yes, as well as their first check from an investor. Once the first came, many others followed, and soon enough Dandy has fundraised over $3.3 million in a matter of months from investors involved in companies such as Uber, Airbnb, Snapchat, and Facebook. Newman took over all finance and logistic aspects of the company while Massachi handled the marketing strategy and creative.

Things were running smoothly until word of a pandemic began to consume the news in February 2020. The two business owners called an emergency meeting and decided it was the perfect time to rebrand Dandy into something more applicable to the possible consequences of a national pandemic. In just a few hours, they came up with the idea for Zoom University– a virtual dating app with the same “live” concept of Dandy, but with two-on-two video calls resembling that of a double date. Since some users had commented that Dandy could become stressful and awkward during the short video calls, the founders hoped that having a user bring a friend would help turn the tension into fun. The next day after the meeting, the team had a web MVP of Zoom University uploaded and a rough draft of the app immediately went live. In honor of their first creation, they decided to keep the name of their now product-based startup company as Dandy.

Since then, Zoom University has gained traction all over the internet; including Tiktok, which had a video about the app hit impressions of over 2.5 million views. Users were scrambling to get their hands on this new dating app. In just a matter of weeks, a waitlist of thousands of users began to accumulate while the Dandy teamed continued to finalize the details behind the app that was only originally meant to stay live for a week. Positive feedback came pouring in from users, and eventually, the application broke records as it made it through the Top 10 Best Social Networking Apps on the Apple Store, coming in at #9.

Four businesses and two successful startups later, 23-year-old Newman says his success has come from knowing how to take high-level concepts and applying them to a realistic, practical lens. Although his achievements have skyrocketed over the years, he shares that the work has only just begun. He and his partner are currently working with investors on their next top-secret product that is reckoned to top all their prior inventions and take the market by storm once again. Details cannot yet be disclosed, but we wait eagerly to see how a few college seniors will continue to dominate the startup world with their commitment and dedication to changing the world through the use of advanced technology.

Business

Interview with Jason Ho, CEO of Teklium: A Vision for the Future of Technology

By Mj Toledo

There is a wealth of experience behind Teklium, and it is embodied in its chief executive officer (CEO), Jason Ho. His educational foundation was laid at National Chiao Tung University and Pennsylvania State University, where he developed his skills in electrical engineering. With over 400 patents to his name, he has played a key role in advancing semiconductor technologies and artificial intelligence (AI).

From leading custom chip design for the F35 Fighter Jet to innovating at Teklium, Ho’s work has been adopted by major corporations worldwide. In this interview, he shares his vision for the future of technology and how Teklium’s developments fit into this broader landscape.

Q: Hi, Jason. For those who may not be familiar with Teklium, could you tell us more about your company?

Jason Ho: Certainly. Teklium is a technology company focused on improving AI and semiconductor technologies. Our mission is to create self improving AI systems and hardware that can tackle various technological challenges and shape the future of multiple industries.

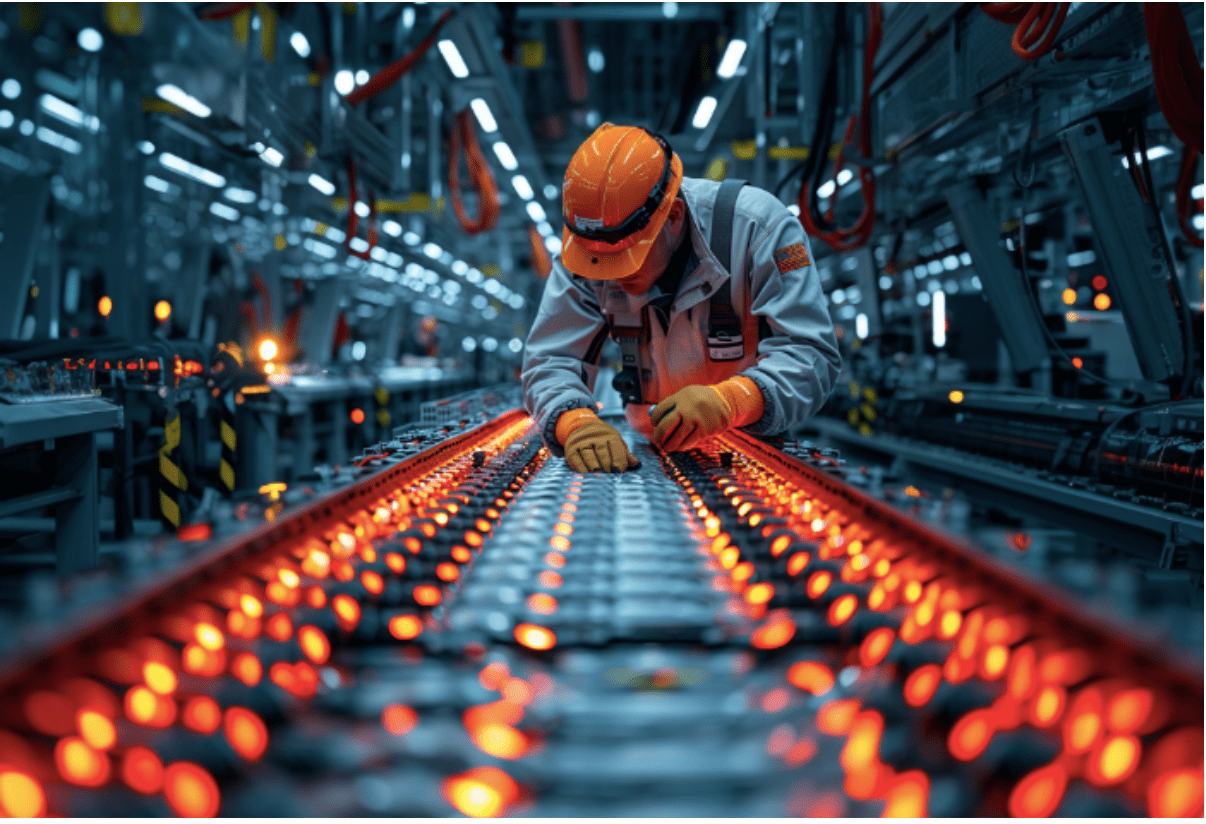

Q: You hold over 400 international patents, with one of your most notable innovations being hydrogen battery technology. What inspired you to promote this sustainable transportation solution?

Jason Ho: I’ve always been deeply interested in finding sustainable energy solutions, especially in transportation. Traditional lithiumion batteries have clear limitations, both in terms of performance and their environmental impact due to resource mining. Hydrogen batteries present a promising alternative, offering both environmental benefits and faster refueling times, which could make electric vehicles more practical and appealing.

Q: What drove you to focus on hydrogen battery technology specifically?

Jason Ho: My collaboration with Mark Bayliss, President of Visual Link, played a significant role. Mark introduced the concept of a closed loop hydrogen system, and our joint efforts resulted in the development of a hydrogen battery technology that we believe can provide a clean and safer alternative to lithiumion batteries. This inspired me to continue refining the technology, working with Visual Link to bring it to market.

Q: How do you see your company’s hydrogen battery technology impacting the electric vehicle industry in the next decade?

Jason Ho: I’ve thought about this a lot. Our hydrogen battery technology has the potential to revolutionize the electric vehicle industry by offering a more efficient and sustainable energy source. The ability to refuel quickly, combined with the technology’s adaptability to a wide range of temperatures, could make electric vehicles far more practical and attractive to consumers in the long term.

Q: Can you explain the significance and potential impact of Teklium’s closed loop hydrogen energy system on global energy consumption?

Jason Ho: The closed loop hydrogen energy system is groundbreaking because it enables onsite hydrogen generation through water electrolysis, eliminating the need for external supply chains. This drastically lowers energy consumption and minimizes environmental impact by recycling water in a continuous loop. The system offers an environmentally friendly solution for industries beyond transportation, including energy storage and telecommunications.

Q: What challenges do you foresee in scaling up hydrogen battery production, and how does Teklium plan to address them?

Jason Ho: Scaling up hydrogen battery production comes with significant challenges, including the development of necessary infrastructure, reducing production costs, and ensuring safety standards. At Teklium, we plan to address these obstacles by partnering with industry leaders to build the required infrastructure and by investing in research to lower costs. We’re also committed to implementing rigorous safety protocols to ensure the technology performs reliably.

Q: How does Teklium’s strategy for AI infrastructure differ from traditional approaches?

Jason Ho: At Teklium, we’re taking a different approach by exploring ways to develop advanced materials and technologies that could improve the performance and efficiency of AI infrastructure. We’re focused on moving beyond traditional silicon based systems and envision a future where we can create three dimensional chip structures that significantly reduce data movement and energy consumption. By integrating memory and processing capabilities, we believe we can revolutionize AI workloads.

Q: Teklium has ambitious plans for extending Moore’s Law. Can you elaborate on how these plans could transform the semiconductor industry?

Jason Ho: Siliconbased chips are nearing their physical limits, so we’re exploring technologies that could allow us to scale transistor density both vertically and horizontally. By adopting these new approaches, we aim to significantly increase chip performance and, in doing so, challenge the traditional expectations of Moore’s Law. We also envision a future where chips are reusable and can be reprogrammed over decades, which could reshape the semiconductor industry’s business model in terms of sustainability and efficiency.

Q: What environmental benefits could Teklium’s technologies bring, particularly in reducing carbon emissions and resource consumption?

Jason Ho: Our innovations could have a profound impact on the environment. We’re committed to developing technologies that reduce resource consumption and minimize waste. By creating more efficient manufacturing processes and extending the lifespan of chips, we hope to significantly reduce electronic waste. Our work on AI infrastructure could also cut energy consumption in data centers by as much as 60%, which would translate into substantial reductions in carbon emissions. And, of course, our hydrogen battery technology offers a clean energy storage solution that could accelerate the adoption of renewable energy sources.

Q: Aside from electric vehicles, what are some other exciting applications of Teklium’s hydrogen battery technology?

Jason Ho: While electric vehicles are an obvious application, there are so many more exciting possibilities. Our hydrogen batteries could serve as large scale energy storage solutions, balancing grid loads and supporting renewable energy sources like wind and solar power. They could also power remote cell towers and data centers in areas where traditional power sources are unreliable. In aerospace, these batteries could enable long range drones and even electric aircraft. The potential applications in disaster relief and military operations, where portable and reliable energy is critical, are also very exciting.

Q: How does your collaboration with companies like Nantero and Visual Link advance Teklium’s technological developments?

Jason Ho: Our collaboration with Nantero is allowing us to explore advanced memory architectures, while our partnership with Visual Link offers crucial insights into practical applications and market needs. Visual Link also helps us navigate regulatory challenges, ensuring our innovations are commercially viable and compliant with industry standards.

Q: Teklium is involved in the concept of AI City in partnership with West Virginia Data Center Group. Can you tell us more about the vision for this project?

Jason Ho: AI City is an ambitious concept that we’re working on with the West Virginia Data Center Group to turn into reality. The idea is to create an intelligent infrastructure that incorporates cutting edge technologies in AI and data centers, optimizing everything from energy usage to communication networks. We envision a city that can learn and adapt to the needs of its residents, reducing inefficiencies and improving quality of life. It’s still in the planning stages, but we’re confident it can become a reality in the near future.

Q: What are your long term goals for Teklium, and how do you see your inventions influencing future generations?

Jason Ho: My long term vision for Teklium is to become a leader in sustainable technology solutions. We aim to continue pushing the boundaries of AI, semiconductor technology, and energy solutions. I want our innovations to inspire future generations to tackle global challenges like climate change and resource scarcity. Ultimately, I hope Teklium’s work contributes to a more connected and sustainable world.

While Teklium’s advancements may take time to fully realize, they open up exciting possibilities for addressing critical challenges like energy consumption and sustainability. Under Jason Ho’s leadership, Teklium is poised to make a significant impact on the future of technology and the environment.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech5 years ago

Tech5 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle5 years ago

Lifestyle5 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle4 years ago

Lifestyle4 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech6 years ago

Tech6 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle4 years ago

Lifestyle4 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health5 years ago

Health5 years agoCBDistillery Review: Is it a scam?

-

Entertainment5 years ago

Entertainment5 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free