World

The South Australian Government Has Increased Speeding Fines By Up To 500%

Governments can often change the laws for many reasons, some to help their citizens interest’s and some to help their own interests.

In this article, we’re going to learn about how the South Australian government has increased driving related fines by up to 500% – in order to fill their recent state budget loss of over AUD $500m due to unpaid GST (taxes).

The increase in fines is reported to generate an extra AUD $79m in revenue for the government. Starting from July 1st, 2019.

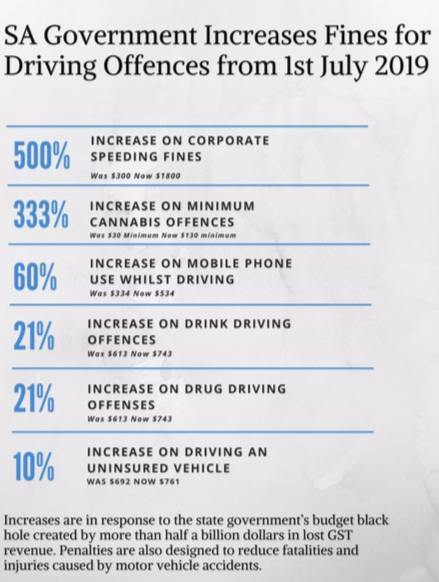

Here is an infographic that covers the specific fines and how much they’ve increased by:

Source: Scammell.com.au

Corporate companies are hit the hardest, with original speeding fines being $300 AUD and now an astonishing $1,500 AUD – which is a little over $1,010 USD.

Some of the biggest increases are to fines for speeding more than 30 kilometres per hour over the limit, which will increase by 60 per cent.

The speeding fine for traveling at 30–45kph over the limit will increase from $920 to $1,472, while drivers going more than 45kph over will face a fine of $1,658 — up from $1,036.

The state’s Treasurer, Rob Lucas said the Government would also significantly increase the fine for people who were caught speeding in a company car.

So this begs the question – how do the people of the affected state respond and deal with these matters? Especially when they’re struggling financially, as paying any fine within itself is frustrating – especially when the fees have soared by up to 500%.

So although the SA government is making an attempt to recover their recent financial losses, they are still over $400m short – it will be interesting to see how they will recover the funds.

As with all matters, it’s important to also see the other side of the coin – in this case, it’s the opposing government. We will see what they have had to say about this –

The former Treasurer Stephen Mullighan said the Liberal Party (current state Government) had broken its 2018 election promise to lower costs.

“It doesn’t matter if you’re a motorist, a public transport user, a tradie or a hospital worker, no South Australian is safe from this massive hike in fees and charges,” Mr Mullighan said.

“This is an attack on households, an attack on businesses and an attack on South Australians who are just trying to manage their cost of living at a time of low inflation and low growth in their wages.”

South Australian Council of Social Service CEO, Ross Womersley said people on low incomes would be the hardest hit.

It’s a strong reminder to take caution on the roads and put your phone away, the fines will keep on increasing and it’s not going to be great when we’re faced with an exorbitant fine to pay.

World

More Named Storms — Is Your Luxury Pergola Ready?

The National Oceanic and Atmospheric Administration (NOAA) predicted a 60% chance that the 2025 Atlantic hurricane season would be above normal. The administration said to watch for between 13 and 19 total named storms — those with winds of 39 mph or higher.

For homeowners in hurricane-prone regions, this raises an urgent question: are your outdoor spaces ready to weather the storm?

PERGOLUX, a leader in durable outdoor structures, designs powder-coated aluminum pergolas with adjustable louvers to withstand the harshest environments.

“Today’s outdoor living spaces face the wrath of nature’s extremes,” says Tim Heneveld, Country Director of PERGOLUX North America. “Hurricanes, tropical storms, and flash floods bring powerful winds exceeding 100 mph. Their relentless rain and rising floodwaters can quickly devastate unprepared structures. If you want to protect your investments, resilient design is essential.”

Is your aluminum pergola and louvered roof ready to take on intense storms?

The open-air elegance of patio pergolas with slat roofs is perfect for a gentle breeze, but can make them vulnerable to the violent forces of hurricane winds. These storm winds pack powerful uplift and lateral forces.

Wind uplift occurs when gusts of wind flow beneath the roof, generating upward pressure that can lift the entire structure off its base. Lateral forces push a pergola horizontally, causing it to lean or even collapse.

The key defense against these powerful forces? A reinforced frame.

“Strong, well-engineered frames act as the backbone of your pergola,” notes Heneveld. “Aluminum is the ideal material for a pergola’s frame. It combines the strength needed to resist bending or breaking with a lighter weight that reduces strain on the foundation.”

PERGOLUX’s pergolas feature reinforced frames engineered to withstand intense storms with confidence. In fact, their latest model, the Skydance Series 3 Pergola, is specially crafted to endure winds up to 165 mph, which means that even when fierce hurricanes like Milton sweep through, these pergolas remain intact.

Reinforced aluminum frames designed with thickened beams and precision connections stand up to wind uplift and lateral pressure. Hurricane-rated bolts, brackets, and screws hold everything tightly together to prevent weak points that storms so often exploit. When each joint is reinforced and well-anchored, your pergola can remain a steadfast retreat despite the wildest weather. Thicker beams and columns combined with robust engineering techniques give these pergolas superior strength. Extra support brackets, hidden fasteners, and precise assembly methods ensure the frame endures.

Elevated bases can protect your luxury pergola from floods

Along with high winds, storms bring torrential rain. Rising water can undermine structural footings and rot wooden materials, which can destabilize the entire installation.

An elevated base is a strategic line of defense. “By constructing your pergola on raised concrete footings or piers, you create a gap between the ground and the structure,” notes Heneveld. “During a flood, it keeps the water at bay. The elevation also prevents erosion caused by pooling rainwater.”

The best-quality outdoor pergolas offer high-grade materials and cutting-edge engineering

The key element of any storm-ready outdoor structure is its materials. PERGOLUX chooses 6063-T5 aluminum, a marine-grade alloy renowned for its incredible strength and exceptional resistance to corrosion, even when exposed to salty sea air and humid conditions.

“A wooden or vinyl pergola may look great at first,” says Heneveld, “but they often require costly upkeep or replacement after just a few seasons of storm damage. Our reinforced aluminum pergolas will give you years of worry-free durability. It will remain strong and look fantastic, no matter the weather.”

PERGOLUX’s advanced engineering solutions also protect what is inside the structure. Their patented RainLUX™ integrated gutter system channels rainwater away, preventing leaks that can damage furniture and floors.

“We offer a 10-year warranty to back up all of our claims,” Heneveld says. “It’s our commitment that these structures will protect your home’s exterior environment for years to come. We want you to focus on enjoying the moments that matter in your pergola, not on the coming storms.”

Practical outdoor living tips to prepare your louvered pergola kit before storm season

Even the strongest pergola will fare better when prepped for a coming storm. “Make sure to secure your loose items,” Heneveld warns. “Before a storm, remove furniture, planters, and décor. All of these can become hazardous projectiles.”

When homeowners hear that a storm is on the way, they will want to fully secure any screens or panels. Removing detachable panels before severe weather will help protect the pergola by reducing wind resistance.

Homeowners will want to take the time to routinely inspect and maintain their pergolas. A quick check for loose fasteners or other small signs of wear goes a long way in preserving the pergola’s strength.

“Combine simple preparation with a reinforced, elevated, and expertly engineered structure, and you’ll have an outdoor space built to last,” Heneveld concludes. “Investing in a storm-ready pergola is about so much more than just avoiding damage. You’re preserving a lifestyle. A long-lasting pergola will bring you years of shaded summer barbecues and fresh-air morning coffees.”

-

Tech5 years ago

Tech5 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle7 years ago

Lifestyle7 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle5 years ago

Lifestyle5 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech7 years ago

Tech7 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle6 years ago

Lifestyle6 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health7 years ago

Health7 years agoCBDistillery Review: Is it a scam?

-

Entertainment7 years ago

Entertainment7 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free