Business

How To Fund Your Business Plan

One of the biggest challenges when it comes to getting a potential new business off the ground is finding a way of funding your big ideas. Whether you need a cash injection for premises or stock to sell, or you need equipment to help your business operate at the highest level, there are a few options to choose from to help you on your way, including small business loans. Some of the options you could consider with small business loans include short-term loans, invoice discounting, or a company credit card. There is something to suit everyone. Below, we’ll explore how you can fund your business plan.

Equipment Financing

Equipment financing allows you to purchase new, up-to-date equipment for your business, spreading the cost so the payments are manageable. One example of this would be agriculture farm equipment loans. These loans allow for often incredibly expensive pieces of machinery to be purchased, whilst still maintaining cash flow and allowing for the continued smooth running of the business. Financing equipment is great if you need a specific machine or tool to help grow or improve your services but don’t have a large amount of cash to part with in one go. Financing breaks the cost into more manageable and affordable payments.

Small business loans

These loans are used to cover the cost of running a business. They can be used to expand your business or train new staff to help you on the road to success. Lenders often ask for different requirements when applying for a loan such as how long the business has been established, credit score, and loan purpose. The ability to meet these requirements means that you’re more likely to be approved for the loan, but with something to suit everyone, they are a great option for all business owners. Think about how much you need and how much you can afford to repay and compare your options to find the best deal for you.

Invoice financing

When you provide a service to customers, it can sometimes take a while for your payment to arrive, which can contribute to cash flow problems. Invoice financing is designed to bridge the gap between your company and the customer’s payment. It works by lenders buying your invoices and uses them as collateral to loan you the money until the money has been paid. This finance option works well to help businesses to maintain cash flow. Although this option is generally more expensive than a business loan, it is a quick and easy process.

Inventory Financing

Inventory is the force behind any retail business. It helps businesses to make sales and keep customers happy. This finance option can help to provide your business with the funds to purchase extra inventory when needed. It helps to maintain cash flow and capital. It is important that a business can fulfil orders from customers all year round, so maintaining inventory is key when it comes to running a successful business.

Business

Scaling Success: Why Smart Habits Beat Growth Hacks in Modern eCommerce

There’s a romanticized image of the eCommerce founder: a daring risk-taker chasing the next big idea, fueled by late-night caffeine and last-minute inspiration. But the reality behind scaled, sustainable brands tells a different story. Success in digital commerce doesn’t come from chaos or clever hacks. It comes from habits. Repetitive, structured, often unglamorous habits.

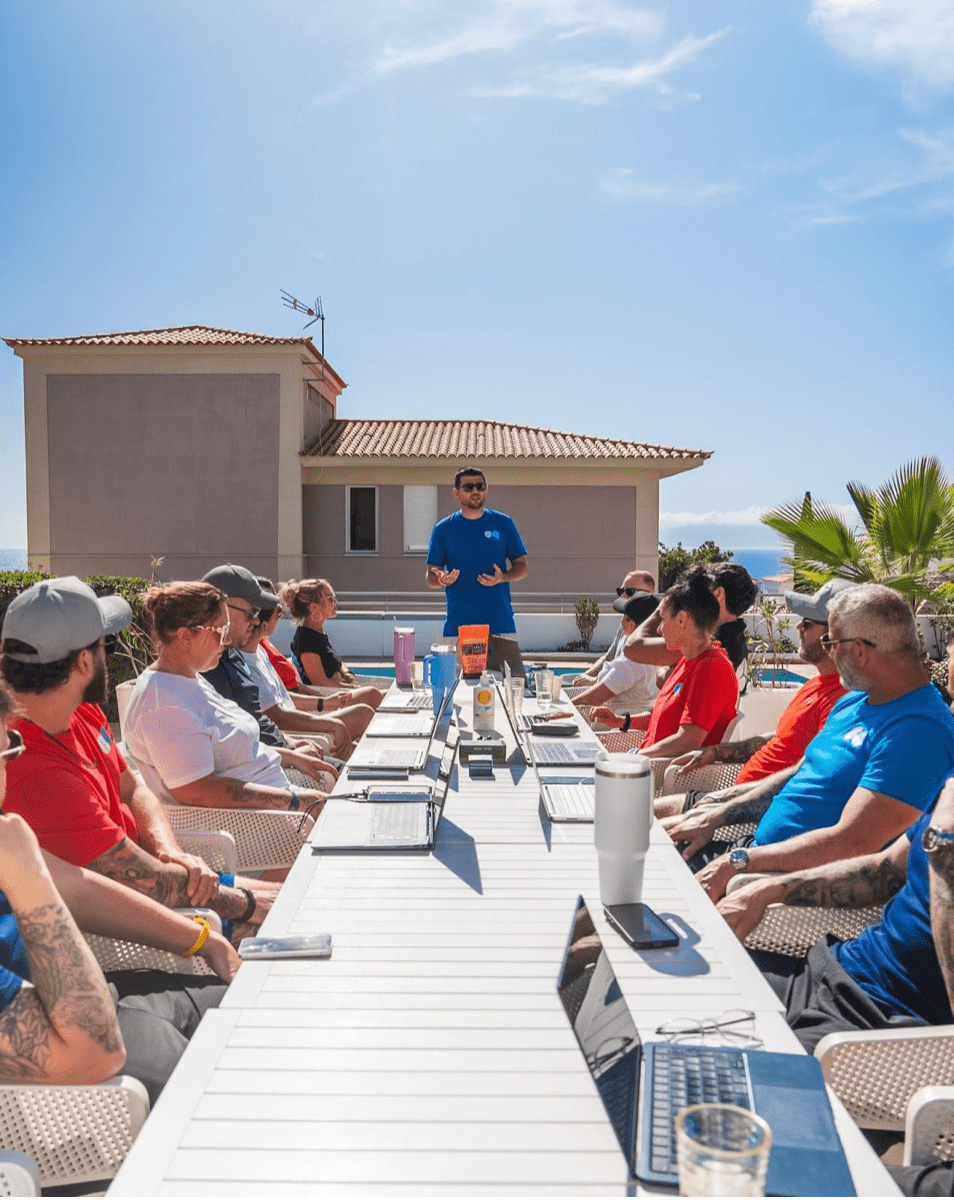

Change, a digital platform created by eCommerce strategist Ryan, builds its entire philosophy around this truth. Through education, mentorship, and infrastructure, Change helps founders shift from scrambling for quick wins to building strong systems that grow with them. The company doesn’t just offer software. It provides the foundation for digital trade, particularly for those in the B2B space.

The Habits That Build Momentum

At the heart of Change’s philosophy are five core habits Ryan considers non-negotiable. These aren’t buzzwords; they’re the foundation of sustainable growth.

First, obsess over data. Successful founders replace guesswork with metrics. They don’t rely on gut feelings. They measure performance and iterate.

Second, know your customer deeply. Not just what they buy, but why they buy. The most resilient brands build emotional loyalty, not just transactional volume.

Third, test fast. Algorithms shift. Consumer behavior changes. High-performing teams don’t resist this; they test weekly, sometimes daily, and adapt.

Fourth, manage time like a CEO. Every decision has a cost. Prioritizing high-impact actions isn’t optional; it’s survival.

Fifth, stay connected to mentorship and learning. The digital market moves quickly. The remaining founders are the ones who keep learning, never assuming they know it all.

Turning Habits into Infrastructure

What begins as personal discipline must eventually evolve into a team structure. Change teaches founders how to scale their systems, not just their sales.

Tools are essential for starting, think Notion for documentation, Asana for project management, Mixpanel or PostHog for analytics, and Loom for async communication. But tools alone don’t create momentum.

Teams need Monday metric check-ins, weekly test cycles, customer insight reviews, just to name a few. Founders set the tone by modeling behavior. It’s the rituals that matter, then, they turn it into company culture.

Ryan puts it simply: “We’re not just building tools; we’re building infrastructure for digital trade.”

Avoiding the Common Traps

Even with structure, the path isn’t always smooth. Some founders over-focus on short-term results, chasing vanity metrics or shiny tactics that feel productive but don’t move the needle.

Others fall into micromanagement, drowning in dashboards instead of building intuition. Discipline should sharpen clarity, not create rigidity. Flexibility is part of the process. Knowing when to pivot is just as important as knowing when to persist.

Scaling Through Self-Replication

In the end, eCommerce scale isn’t just about growing a business. It’s about repeating successful systems at every level. When founders internalize high-performance habits, they turn them into processes, then culture, then legacy.

Growth doesn’t require more motivation. It requires more precision. More consistency. Your calendar, not your to-do list, is your business plan.

In a space dominated by noise and novelty, Change and its founder are quietly reshaping the conversation. They aren’t chasing trends but building resilience, one habit at a time.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle6 years ago

Lifestyle6 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle5 years ago

Lifestyle5 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech7 years ago

Tech7 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle5 years ago

Lifestyle5 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health6 years ago

Health6 years agoCBDistillery Review: Is it a scam?

-

Entertainment6 years ago

Entertainment6 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free