Lifestyle

5 Important Steps to Take if You’ve Suffered a Personal Injury

According to the National Safety Council, 2022 saw over 55.4 reported injury cases in America, resulting in slightly over a trillion dollars in treatment costs. These numbers may sound like statistics until you get injured in an accident.

The good news is that you may be able to recover compensation, especially if your injury resulted from someone else’s negligence.

However, what you do from when you get injured to the time you recover from your injuries can profoundly impact your life. Here are some of the most important steps you can take after an accident to minimize its impact on your life.

1. Seek Medical Attention

Your health should be your priority after an accident that results in an injury. You may not know whether an accident has resulted in an injury by what you feel. Therefore, it is always important to assume that you are injured even when you can’t feel it, especially after a high-impact accident.

Some injuries such as concussions, whiplash, and other internal injuries may not be apparent immediately after an accident, even when they could be severe. If you don’t get medical help at the scene, make sure you see a doctor for a medical examination.

Getting medical help immediately after an accident not only helps hasten recovery, but the medical records you obtain can become critical evidence when determining damages in a claim.

2. Gather Evidence

You do not have to be a detective to gather evidence from the scene. With the available resources, such as a smartphone, you can gather the relevant details of the accident to help your lawyer build your case. The first step in evidence gathering is documenting the scene by taking photos of things.

Some critical things to capture may include property damage, the hazard that caused the accident, your injuries, and any object that can help identify the location, such as a building or landmark. Besides pictures, you can record video footage.

3. Collect Witness Testimonies

Having witnesses to an accident on your side can give your lawyer an easy time when determining liability. If other people were present at the time of the accident, you could ask them to be your witnesses in court.

If a witness is willing to help, collect their recorded or written testimony. Do not forget to get their contact information for ease of locating them. Collecting the responsible party’s information is also important because it will help you know who to list as the defendant in your claim.

4. Consult a Local Personal Injury Lawyer

Once you have all the necessary evidence, it is important to seek the help of a skilled personal injury lawyer. Besides evaluating the validity of your injury claim, a lawyer can help you prove liability, handle settlement negotiations and even represent you in court if your case goes to trial.

However, to increase your chances of a better outcome, you will want to choose a skilled personal injury lawyer from your local area. For example, if your accident happened in San Diego, you may want to let a local personal injury attorney such as www.wyattlawfirm.com handle your case.

The best thing about hiring a local lawyer is that they have an in-depth understanding of local personal injury laws and court procedures. They are also familiar with the personalities of the local administrative authorities and judicial staff and can use that to your case’s advantage.

5. Remember to Report the Accident

After an accident, especially on a public road, police will almost always show up after you or someone else makes the 911 call. However, if the accident occurs on private property or business premises, you might want to report it to the property owner, business owner, or their representative.

Reporting an accident is important because it helps create a record of the accident with the relevant authority. After doing everything within your means, you can leave the claims process with your attorney as you focus on healing and navigating life after an accident.

Lifestyle

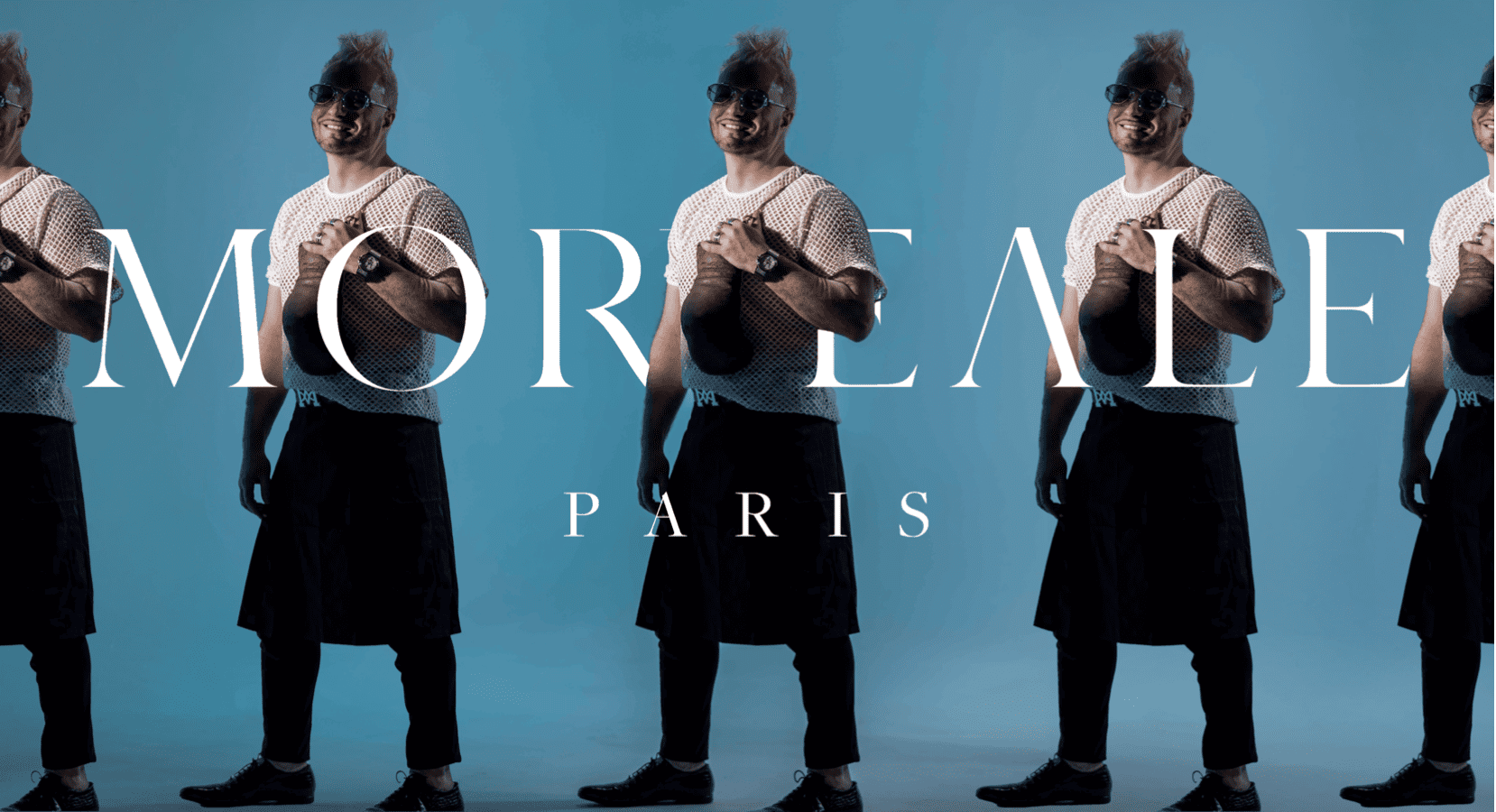

Jean-Pierre Morreale: The Perfumer Behind Bespoke Creations for Royals and Celebrities

In the exclusive world of haute perfumery, where luxury and discretion go hand in hand, Jean- Pierre Morreale stands as a figure shrouded in mystery. As the genius behind Morreale Paris, Morreale has earned a reputation not only for his exquisite fragrances but for his secretive nature, which has only enhanced his allure among the world’s elite. While his work speaks for itself—crafting fragrances that embody elegance and opulence—it is his connections with royalty and global celebrities that have cemented his place as a master of bespoke scent creation.

A Life of Mystery and Exclusivity

Jean-Pierre Morreale’s name is synonymous with luxury, but little is known about the man himself. Despite being at the helm of one of the world’s most prestigious fragrance houses, he remains elusive, allowing his work to take center stage. Morreale’s life and career are defined by discretion—a quality that is highly valued among his clientele, which includes some of the most powerful and influential figures in the world.

Morreale’s secretive nature is not a marketing ploy but a way of life. He rarely gives interviews, avoids the spotlight, and prefers to let his fragrances do the talking. This air of mystery has only fueled the fascination surrounding him, with rumors of private meetings with kings, queens, and Hollywood’s biggest stars swirling around his brand. Those who know him describe a man deeply committed to his craft, who values privacy above all else.

The Perfumer to European Royalty

Jean-Pierre Morreale’s aristocratic heritage has always played a significant role in his career, and it is this connection to European nobility that has given him access to some of the world’s most exclusive circles. Morreale is a trusted confidant of royal families across Europe, with a clientele that includes members of the Italian, French, and Middle Eastern royalty. These relationships, forged over years of mutual respect and admiration, are built on trust and discretion—qualities that Morreale embodies in his work.

For many royals, fragrance is a deeply personal part of their identity, and they turn to Morreale for bespoke creations that reflect their status, personality, and history. His private consultations with these figures are shrouded in secrecy, with few details ever reaching the public. What is known, however, is that Morreale’s bespoke fragrances are as unique as the individuals who wear them, crafted from the rarest and finest ingredients in the world. His creations often become the signature scents of the royals he serves, worn only by them, ensuring that they remain one-of-a-kind masterpieces.

The Go-To Perfumer for Celebrities

In addition to his royal clientele, Jean-Pierre Morreale is also a favorite among the world’s biggest celebrities. From Hollywood A-listers to music legends, many of the entertainment industry’s most famous names seek out Morreale’s expertise when it comes to creating a bespoke fragrance. These celebrities, like his royal clients, value his discretion and trust him to create scents that capture their essence without the intrusion of the public eye.

Morreale’s clients often reach out to him privately, whether it be for a custom fragrance to mark a major career milestone, a personal scent for a red carpet event, or even a gift for a loved one. His ability to understand the emotional and psychological aspects of scent creation makes him the ideal perfumer for those who wish to wear something truly unique. For many, the process of working with Morreale is a highly personal experience—one that often involves intimate conversations about memories, emotions, and desires.

The Art of Bespoke Perfume Creation

Jean-Pierre Morreale’s approach to bespoke fragrance creation is a blend of art, science, and intuition. His process is meticulous and deeply personalized, starting with a private consultation, often conducted behind closed doors in the most luxurious of settings—whether in royal palaces, private estates, or in his secretive Parisian atelier. Morreale takes the time to get to know his clients, understanding their personal history, emotional connections, and even the cultural significance of certain scents.

Every fragrance he creates is a unique reflection of the individual, composed of rare and often exotic ingredients that he sources from around the world. For Morreale, no detail is too small, and his creations are known for their complexity and depth, with each note telling part of a larger, personalized story. These scents are not just perfumes but works of art, often packaged in custom-designed, handcrafted bottles, making them as visually stunning as they are olfactorily captivating.

Once the fragrance is complete, it is delivered to the client in the utmost secrecy. This level of exclusivity is part of the allure of a Jean-Pierre Morreale creation; owning a bespoke fragrance from Morreale Paris is akin to possessing a rare piece of art, one that can never be replicated.

A Legacy of Discretion and Luxury

Jean-Pierre Morreale’s dedication to privacy has only enhanced his status as one of the most sought-after perfumers in the world. While other fragrance houses may seek publicity, Morreale has built his brand on a foundation of discretion, catering to those who value their privacy as much as their luxury. His relationships with his clients—whether royals or celebrities—are built on trust, and it is this trust that has allowed him to continue creating bespoke fragrances for the most influential people on the planet.

Despite his global success, Morreale remains as discreet as ever, allowing his work to speak for itself. His clients, from European kings and queens to Hollywood stars, know that when they commission a fragrance from Jean-Pierre Morreale, they are not only receiving a world-class creation but also the assurance that their privacy will be respected.

Jean-Pierre Morreale’s combination of artistry, exclusivity, and discretion has made him the master perfumer of choice for royalty and celebrities alike. His secretive nature, far from being a hindrance, has only added to his mystique and elevated his brand to legendary status. In a world where privacy is often a luxury, Morreale’s ability to create bespoke fragrances in complete secrecy has earned him the loyalty of some of the most powerful and famous people in the world. For those fortunate enough to work with him, a fragrance by Jean-Pierre Morreale is not just a scent—it is a timeless, personal masterpiece, created by a man who values the art of discretion as much as the art of perfumery.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech5 years ago

Tech5 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle5 years ago

Lifestyle5 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle4 years ago

Lifestyle4 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech6 years ago

Tech6 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle4 years ago

Lifestyle4 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health5 years ago

Health5 years agoCBDistillery Review: Is it a scam?

-

Entertainment5 years ago

Entertainment5 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free