World

De Beers, Tiffany & Co, Halt Alrosa Russian Diamond Imports

De Beers, a direct competitor of the Alrosa mine in Russia, took advantage of the recent sanctions in its official website statement. “Every diamond discovered by De Beers Group comes from one of our mines in Botswana, Canada, Namibia or South Africa.” Russia is absent from the list, and the innuendo is clear.

Jewelry giant Tiffany & Co. also stated that it discontinued Russian diamond imports. Stones currently in transit as well as those already in US stores will remain outside the scope of the sanctions.

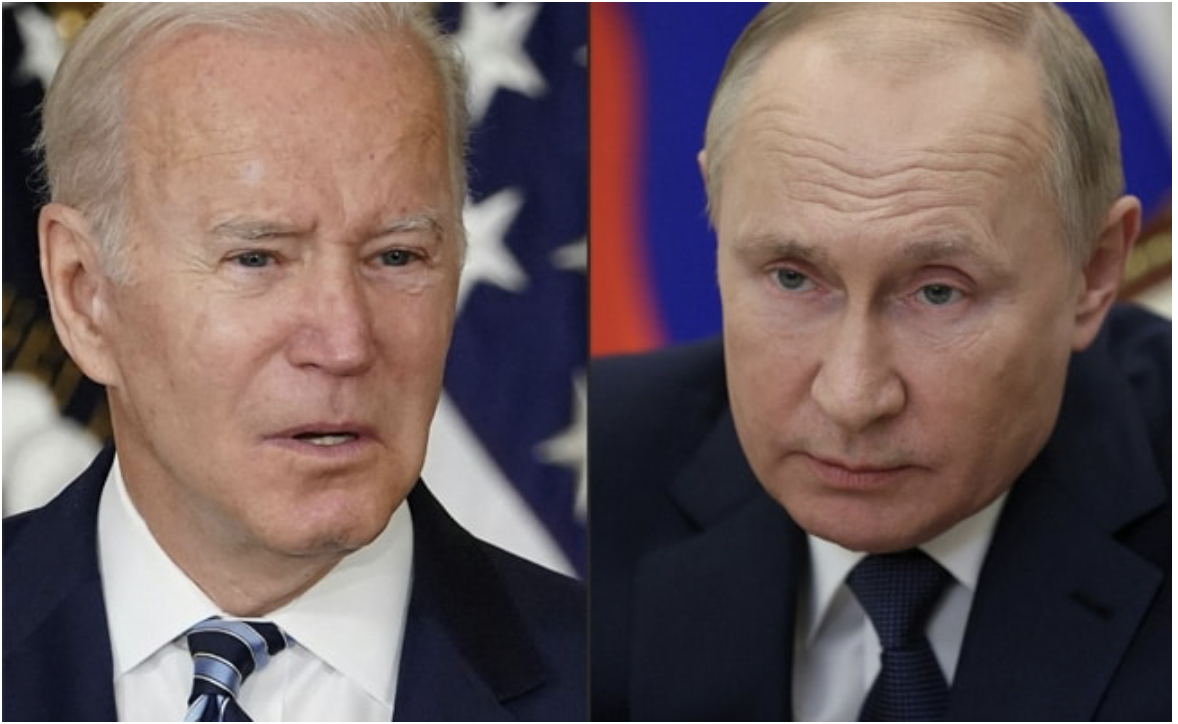

Despite all assurances of compliance with President Biden’s executive order to ban Alrosa exports to the United States, it was virtually impossible to prove the provenance of a natural gemstone.

The solution comes from Sarine Technologies. An increasing number of companies in the diamond industry are relying on the publicly traded company for proof of a gemstone’s provenance. Even when a gem crosses borders, Sarine can trace it and identify the point of origin.

The corporation deployed a global fleet of state-of-the-art 3D gemstone scanners throughout the mining and production industry that identify the inherent attributes of each jewel. From mine to jewelry store, every point in the supply-chain rescans the gemstones. When a match is made, the stone is verified.

Eastern European stones are commonly sold in India, and exchange hands before making their way to their international destinations. Blood diamonds are commonly fed into supply chains unbeknownst to purchasers.

The Verify website conducted an interview with RapNet founder, Martin Rapaport, who wrote about loopholes in the US sanctions. “The order places no restrictions on the U.S. importation of polished diamonds sourced from Russian rough diamonds but cut and polished elsewhere.”

In order to document sourcing, Sarine uses blockchain technology to create an immutable record of a gem’s initial location, its movement, and ownership. When a rough jewel is mined, it is scanned and logged into the online distributed ledger.

As the product is rescanned at each point of exchange, the software confirms a match and the data is stored in the blockchain. The customer can access an online report that certifies the provenance and journey of the jewelry.

“It’s changing the market,” says Simon Levy, a diamond sales executive in The Israel Diamond Exchange LTD. “Mined gems are meaningful and symbolic, but many of our customers over the last decade are more concerned with where our rough stones come from. Having a scientific means to verify where they originate is important to them, and to me as well.”

The biggest hurdle for the tracing concept was the ability to find distinctive, inimitable characteristics inherent in the stone. Once the technologies were able to make these distinctions, a world of possibilities was opened.

Jonathan Larson, an assistant professor of computer science in Cambridge, MA explained that “Blockchain uses distributed computing, and it’s a brilliant way to securely track and observe digital records. We began experimenting with extending the technology from digital assets to actual things.”

He continued, “We could track them, but we weren’t able to authenticate all of them—we didn’t know if they were the same object. But when there’s a distinct identifier, then you have both authentications matching as well as the history and exchange. The more granular the distinction, the higher the level of authentication.”

Once paired with distributed ledger technology, the software knows everything about the stone, including where it came from and where it ends up. The failsafe system benefits everyone involved in legitimate trade—especially retail customers.

Tiffany and other companies will be embracing high-tech solutions to ensure products are coming from vetted sources. That’s great news for everybody.

World

More Named Storms — Is Your Luxury Pergola Ready?

The National Oceanic and Atmospheric Administration (NOAA) predicted a 60% chance that the 2025 Atlantic hurricane season would be above normal. The administration said to watch for between 13 and 19 total named storms — those with winds of 39 mph or higher.

For homeowners in hurricane-prone regions, this raises an urgent question: are your outdoor spaces ready to weather the storm?

PERGOLUX, a leader in durable outdoor structures, designs powder-coated aluminum pergolas with adjustable louvers to withstand the harshest environments.

“Today’s outdoor living spaces face the wrath of nature’s extremes,” says Tim Heneveld, Country Director of PERGOLUX North America. “Hurricanes, tropical storms, and flash floods bring powerful winds exceeding 100 mph. Their relentless rain and rising floodwaters can quickly devastate unprepared structures. If you want to protect your investments, resilient design is essential.”

Is your aluminum pergola and louvered roof ready to take on intense storms?

The open-air elegance of patio pergolas with slat roofs is perfect for a gentle breeze, but can make them vulnerable to the violent forces of hurricane winds. These storm winds pack powerful uplift and lateral forces.

Wind uplift occurs when gusts of wind flow beneath the roof, generating upward pressure that can lift the entire structure off its base. Lateral forces push a pergola horizontally, causing it to lean or even collapse.

The key defense against these powerful forces? A reinforced frame.

“Strong, well-engineered frames act as the backbone of your pergola,” notes Heneveld. “Aluminum is the ideal material for a pergola’s frame. It combines the strength needed to resist bending or breaking with a lighter weight that reduces strain on the foundation.”

PERGOLUX’s pergolas feature reinforced frames engineered to withstand intense storms with confidence. In fact, their latest model, the Skydance Series 3 Pergola, is specially crafted to endure winds up to 165 mph, which means that even when fierce hurricanes like Milton sweep through, these pergolas remain intact.

Reinforced aluminum frames designed with thickened beams and precision connections stand up to wind uplift and lateral pressure. Hurricane-rated bolts, brackets, and screws hold everything tightly together to prevent weak points that storms so often exploit. When each joint is reinforced and well-anchored, your pergola can remain a steadfast retreat despite the wildest weather. Thicker beams and columns combined with robust engineering techniques give these pergolas superior strength. Extra support brackets, hidden fasteners, and precise assembly methods ensure the frame endures.

Elevated bases can protect your luxury pergola from floods

Along with high winds, storms bring torrential rain. Rising water can undermine structural footings and rot wooden materials, which can destabilize the entire installation.

An elevated base is a strategic line of defense. “By constructing your pergola on raised concrete footings or piers, you create a gap between the ground and the structure,” notes Heneveld. “During a flood, it keeps the water at bay. The elevation also prevents erosion caused by pooling rainwater.”

The best-quality outdoor pergolas offer high-grade materials and cutting-edge engineering

The key element of any storm-ready outdoor structure is its materials. PERGOLUX chooses 6063-T5 aluminum, a marine-grade alloy renowned for its incredible strength and exceptional resistance to corrosion, even when exposed to salty sea air and humid conditions.

“A wooden or vinyl pergola may look great at first,” says Heneveld, “but they often require costly upkeep or replacement after just a few seasons of storm damage. Our reinforced aluminum pergolas will give you years of worry-free durability. It will remain strong and look fantastic, no matter the weather.”

PERGOLUX’s advanced engineering solutions also protect what is inside the structure. Their patented RainLUX™ integrated gutter system channels rainwater away, preventing leaks that can damage furniture and floors.

“We offer a 10-year warranty to back up all of our claims,” Heneveld says. “It’s our commitment that these structures will protect your home’s exterior environment for years to come. We want you to focus on enjoying the moments that matter in your pergola, not on the coming storms.”

Practical outdoor living tips to prepare your louvered pergola kit before storm season

Even the strongest pergola will fare better when prepped for a coming storm. “Make sure to secure your loose items,” Heneveld warns. “Before a storm, remove furniture, planters, and décor. All of these can become hazardous projectiles.”

When homeowners hear that a storm is on the way, they will want to fully secure any screens or panels. Removing detachable panels before severe weather will help protect the pergola by reducing wind resistance.

Homeowners will want to take the time to routinely inspect and maintain their pergolas. A quick check for loose fasteners or other small signs of wear goes a long way in preserving the pergola’s strength.

“Combine simple preparation with a reinforced, elevated, and expertly engineered structure, and you’ll have an outdoor space built to last,” Heneveld concludes. “Investing in a storm-ready pergola is about so much more than just avoiding damage. You’re preserving a lifestyle. A long-lasting pergola will bring you years of shaded summer barbecues and fresh-air morning coffees.”

-

Tech5 years ago

Tech5 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle7 years ago

Lifestyle7 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle5 years ago

Lifestyle5 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech7 years ago

Tech7 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle5 years ago

Lifestyle5 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health7 years ago

Health7 years agoCBDistillery Review: Is it a scam?

-

Entertainment6 years ago

Entertainment6 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free