World

De Beers, Tiffany & Co, Halt Alrosa Russian Diamond Imports

De Beers, a direct competitor of the Alrosa mine in Russia, took advantage of the recent sanctions in its official website statement. “Every diamond discovered by De Beers Group comes from one of our mines in Botswana, Canada, Namibia or South Africa.” Russia is absent from the list, and the innuendo is clear.

Jewelry giant Tiffany & Co. also stated that it discontinued Russian diamond imports. Stones currently in transit as well as those already in US stores will remain outside the scope of the sanctions.

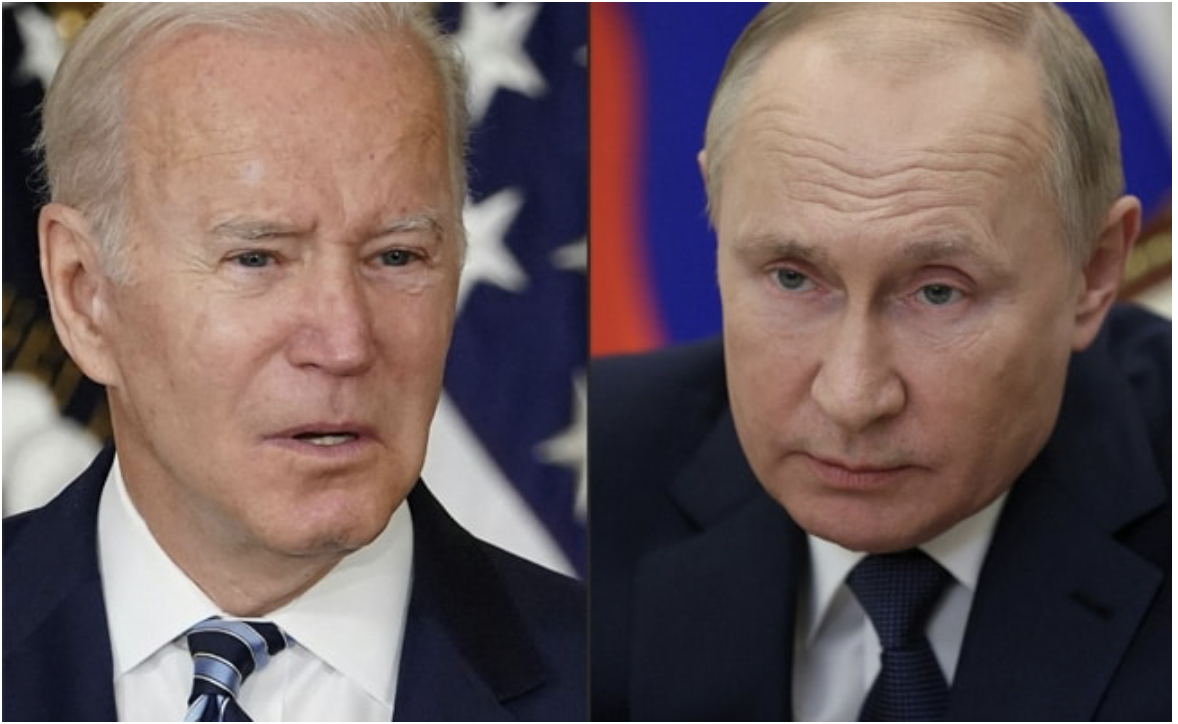

Despite all assurances of compliance with President Biden’s executive order to ban Alrosa exports to the United States, it was virtually impossible to prove the provenance of a natural gemstone.

The solution comes from Sarine Technologies. An increasing number of companies in the diamond industry are relying on the publicly traded company for proof of a gemstone’s provenance. Even when a gem crosses borders, Sarine can trace it and identify the point of origin.

The corporation deployed a global fleet of state-of-the-art 3D gemstone scanners throughout the mining and production industry that identify the inherent attributes of each jewel. From mine to jewelry store, every point in the supply-chain rescans the gemstones. When a match is made, the stone is verified.

Eastern European stones are commonly sold in India, and exchange hands before making their way to their international destinations. Blood diamonds are commonly fed into supply chains unbeknownst to purchasers.

The Verify website conducted an interview with RapNet founder, Martin Rapaport, who wrote about loopholes in the US sanctions. “The order places no restrictions on the U.S. importation of polished diamonds sourced from Russian rough diamonds but cut and polished elsewhere.”

In order to document sourcing, Sarine uses blockchain technology to create an immutable record of a gem’s initial location, its movement, and ownership. When a rough jewel is mined, it is scanned and logged into the online distributed ledger.

As the product is rescanned at each point of exchange, the software confirms a match and the data is stored in the blockchain. The customer can access an online report that certifies the provenance and journey of the jewelry.

“It’s changing the market,” says Simon Levy, a diamond sales executive in The Israel Diamond Exchange LTD. “Mined gems are meaningful and symbolic, but many of our customers over the last decade are more concerned with where our rough stones come from. Having a scientific means to verify where they originate is important to them, and to me as well.”

The biggest hurdle for the tracing concept was the ability to find distinctive, inimitable characteristics inherent in the stone. Once the technologies were able to make these distinctions, a world of possibilities was opened.

Jonathan Larson, an assistant professor of computer science in Cambridge, MA explained that “Blockchain uses distributed computing, and it’s a brilliant way to securely track and observe digital records. We began experimenting with extending the technology from digital assets to actual things.”

He continued, “We could track them, but we weren’t able to authenticate all of them—we didn’t know if they were the same object. But when there’s a distinct identifier, then you have both authentications matching as well as the history and exchange. The more granular the distinction, the higher the level of authentication.”

Once paired with distributed ledger technology, the software knows everything about the stone, including where it came from and where it ends up. The failsafe system benefits everyone involved in legitimate trade—especially retail customers.

Tiffany and other companies will be embracing high-tech solutions to ensure products are coming from vetted sources. That’s great news for everybody.

World

TRG Chairman Khaishgi and CEO Aslam implicated in $150 million fraud

In a scathing 52-page decision, the Sindh High Court has found that TRG Pakistan’s management was acting fraudulently and that Bermuda-based Greentree Holdings historic and prospective purchase of TRG shares were illegal, fraudulent and oppressive.

The Sindh High Court has further directed TRGP to immediately hold board elections that have been overdue and illegally withheld by the existing board since January 14, 2025.

In the landmark ruling, the Sindh High Court has blocked the attempted takeover of TRG Pakistan Limited by Greentree Holdings, declaring that the shares acquired by Greentree, nearly 30% of TRG’s stock, were unlawfully financed using TRG’s funds in violation of Section 86(2) of the Companies Act 2017.

“Having concluded that the affairs of TRGP are being conducted in an unlawful and fraudulent manner and in a manner oppressive to members such as the Petitioner (Zia Chishti), the case falls for corrective orders under sub-section (2) of section 286 of the Companies Act,” Justice Adnan Iqbal Chaudhry concluded.

The case was brought by TRGP former CEO and founder Pakistani-American technology entrepreneur Zia Chishti against TRG Pakistan, its associate TRG International and TRG International’s wholly-owned shell company Greentree Limited. In addition, the case named AKD Securities for managing Greentree’s illegal tender offer as well as various regulators requiring that they act to perform their regulatory duties.

The case centred around the dispute that shell company Greentree Limited was fraudulently using TRG Pakistan’s own funds to purchase TRG Pakistan’s shares in order to give control to Zia Chishti’s former partners Mohammed Khaishgi, Hasnain Aslam and Pinebridge Investments.

According to the case facts, the Chairman of TRG Pakistan Mohammed Khaishgi and the CEO of TRG Pakistan Hasnain Aslam masterminded the $150 million fraud. They did so together with Hong Kong based fund manager Pinebridge who has two nominees on TRG Pakistan’s board, Mr. John Leone and Mr. Patrick McGinnis.

According to the court papers, Khaishgi, Aslam, Leone, and McGinnis set up a shell company called Greentree which they secretly controlled and from which they started buying up shares of TRG Pakistan. The fraud was that Greentree was using TRG Pakistan’s funds itself. The idea was to give Khaishgi, Aslam, Leone, and McGinnis control over TRG Pakistan even though they owned less than 1% of the company, lawyers of the petitioner told the court.

This was all part of a broader battle for control over TRG Pakistan that is raging between Khaishgi, Aslam, Leone, and McGinnis on one side and TRG Pakistan founder Zia Chishti on the other side. Zia Chishti has been trying to retake control of TRG Pakistan after he was forced to resign in 2021 based on sexual misconduct allegations made by a former employee of his. This year those allegations were shown to be without basis in litigation that Chishti launched in the United Kingdom against The Telegraph newspaper which had printed the allegations. The Telegraph was forced to apologize for 13 separate articles it published about Chishti and paid him damages and legal costs.

After Chishti resigned in 2021, Khaishgi, Aslam, Leone, and McGinnis moved to take total control over TRG Pakistan and its various subsidiaries including TRG International and to block out Chishti. The Sindh High Court’s ruling today has reversed that effort, ruling the scheme fraudulent, illegal, and oppressive.

It now appears that Zia Chishti will take control of TRG Pakistan in short order when elections are called. He and his family are now the largest shareholders with over 30% interest. He is closely followed by companies related to Jahangir Siddiqui & Company which have over a 20% interest. The result appears to be a complete vindication for Zia Chishti and damning for his rivals Aslam, Khaishgi, Leone, and McGinnis who have been ruled to have been conducting a fraud.

TRG Pakistan’s share price declined by over 8% on the news on heavy volume. Market experts say that this was because the tender offer at Rs 75 was gone and that now shares would trade closer to their natural value. Presently the shares are trading at Rs 59 per share.

According to the court ruling, since 2021, shell company Greentree had purchased approximately 30% of TRG shares using $80 million of TRG’s own money, which means that that the directors of TRG Pakistan allowed company assets to be funneled through offshore affiliates TRG International and Greentree for acquiring TRG’s shares – a move deemed both fraudulent and oppressive to minority shareholders. The Sindh High Court also found illegal Greentree’s further attempt to purchase another 35% of TRG shares using another $70 million of TRG’s money in a tender offer.

The ruling is a major victory for the tech entrepreneur Zia Chishti against his former partners and the legal ruling paves the way for him to take control of TRG in a few weeks.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle6 years ago

Lifestyle6 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle4 years ago

Lifestyle4 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech7 years ago

Tech7 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle5 years ago

Lifestyle5 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health6 years ago

Health6 years agoCBDistillery Review: Is it a scam?

-

Entertainment6 years ago

Entertainment6 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free