Business

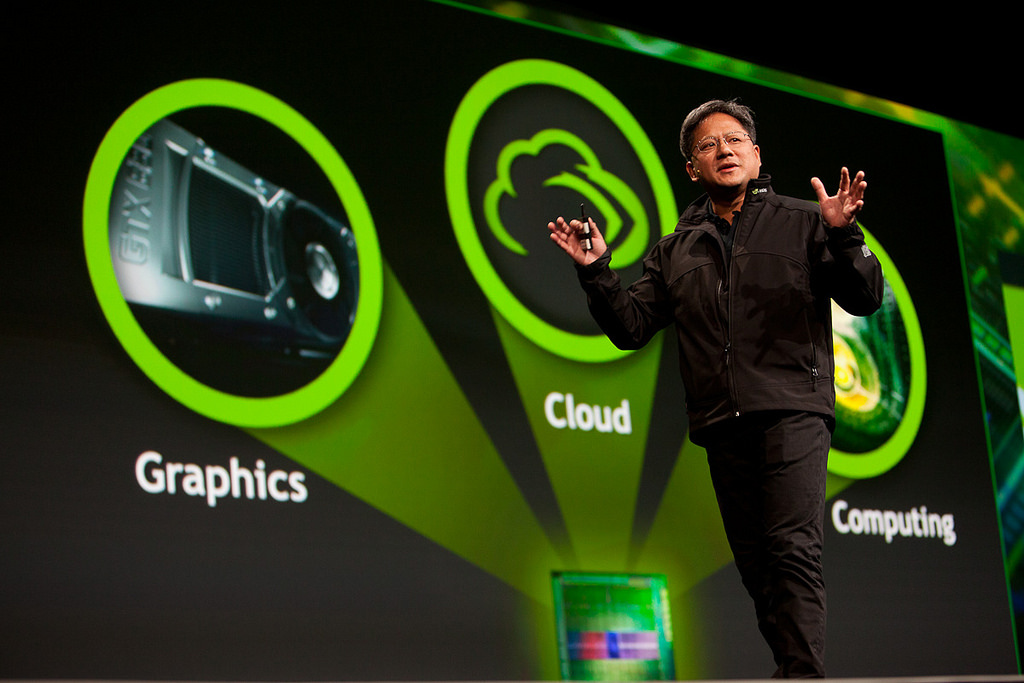

Nvidia Stock Drops by 54% in 4th Quarter of 2018

Nvidia has been one of the best performers in S&P 500, with dramatically rising stock since early 2016 till September this year. But post that, the stock took an extremely bad hit, dropping by 54% in the stock price.

And this is not the only blow Nvidia received. Just ahead of Christmas weekend, the stock fell by 4.09%, closing at $ 129.57 on Friday. Since 2016, this has been the worst quarter for Nvidia.

But why has this blow occurred?

Nvidia was continuously rising due to the demand for processors to handle workload of AI and mining of crypto currencies. And that rise lifted its market value from $14 Billion to $175 Billion. But suddenly, in this quarter, majority of the investors dumped the stock of Nvidia, dropping it by whooping 54%.

This drop made it the worst performing S&P stock of 2018’s 4th quarter.

But Nvidia is not the only stock that got hit. Due to this, many others also got caught in this whole dropping index domino, for example Nasdaq, which dropped 21% this quarter. Many other chip stocks also got hit, just like Nvidia.

So this quarter performed poor for majority of chip manufacturing companies, including Nvidia, Micron, AMD, and many more.

And the primary reason for Nvidia’s drop is its relation to crypto currencies, specially the bitcoin. The bitcoin crashed severely this year. And that reduced the demand for the graphic processing units of Nvidia, which eventually led investors to back off from its stock. But this was not the sole reason.

Nvidia also used to provide data center requirements to cloud providers like Amazon. This segment failed to meet the estimates of Wall Street, which also became a major factor to its downfall. But now, when the maximum downfall has already occurred, both in cryptocurrencies as well as Nvidia, we are hoping to see rise this coming year.

Business

Inside the $4.3B Quarter: What’s Fueling Black Banx’s Record Revenues

Every quarter brings fresh headlines in fintech, but few make the kind of impact achieved by Black Banx in Q2 2025. The Toronto-based global digital banking group, founded by Michael Gastauer, reported an extraordinary USD 4.3 billion in revenue and a record USD 1.6 billion in pre-tax profit, while improving its cost-to-income ratio to 63%.

These results not only highlight the company’s operational efficiency but also mark a pivotal moment in its journey from challenger to global leader. The big question is: what’s fueling such impressive financial performance?

Customer Growth as the Core Driver

One of the clearest engines of revenue growth is Black Banx’s expanding customer base. By Q2 2025, the platform had reached 84 million clients worldwide, up from 69 million at the end of 2024. This 15 million net gain in six months demonstrates both the attractiveness of its services and the scalability of its model.

Unlike traditional banks, which rely heavily on branch expansion, Black Banx leverages digital-first onboarding that allows customers to open accounts within minutes using just a smartphone. This approach is especially effective in regions underserved by legacy institutions, where access to affordable financial tools is in high demand.

More customers don’t just mean higher transaction volumes—they generate a compounding effect where network size, brand trust, and service adoption reinforce one another.

Real-Time Payments and Cross-Border Solutions

A major contributor to Q2 revenues is the platform’s real-time payments infrastructure. Black Banx enables instant cross-border transfers across its 28 supported fiat currencies and multiple cryptocurrencies, helping both individuals and businesses bypass the traditional bottlenecks of international banking.

For freelancers, SMEs, and multinational clients, this means faster liquidity, reduced foreign exchange costs, and simplified global operations. The demand for real-time financial services is growing rapidly—Juniper Research projects global real-time payments turnover to hit USD 58 trillion by 2028—and Black Banx is strategically positioned to capture a significant share of this market.

Crypto Integration as a Revenue Stream

Another key revenue driver is crypto integration. While many traditional institutions remain hesitant, Black Banx embraced digital assets early and has built infrastructure to support Bitcoin, Ethereum, and the Lightning Network. In Q2 2025, 20% of all transactions on the platform were crypto-based, reflecting strong customer appetite for hybrid banking services that bridge fiat and digital assets.

Revenue comes not only from transaction fees but also from value-added services like crypto-to-fiat conversion, staking yields (4–12% APY), and blockchain-enabled payments. For customers in markets with unstable currencies, these services act as a financial lifeline, further expanding the platform’s relevance.

AI-Powered Efficiency and Risk Management

Record revenues would be less impressive if costs ballooned at the same rate. But Black Banx has proven adept at balancing growth with efficiency. Its cost-to-income ratio improved to 63% in Q2, down from 69% a year earlier, thanks to heavy reliance on AI-powered automation.

AI now drives fraud detection, compliance, and customer onboarding—areas where traditional banks often struggle with cost inefficiencies. By automating these processes, Black Banx can process millions of transactions securely while maintaining profitability at scale. This level of efficiency is rare in fintech, where high growth often comes at the expense of margins.

Regional Expansion and Untapped Markets

Geography also plays a role in fueling revenues. Much of the Q2 growth came from Africa, South Asia, and Latin America—regions where demand for mobile-first banking continues to soar. In 2024 alone, Black Banx reported a 32% increase in SME clients from the Middle East and Africa, signaling the strength of its positioning in underserved markets.

By extending services to populations previously excluded from formal banking—migrant workers, rural communities, and small businesses—Black Banx taps into vast pools of latent demand. The strategy proves that financial inclusion and profitability are not mutually exclusive but mutually reinforcing.

Diversified Revenue Streams

Another factor behind Q2’s record revenues is Black Banx’s diversified business model. Income is not tied to a single service but spread across multiple streams, including:

- Transaction fees from cross-border transfers and payments.

- Crypto trading and exchange services.

- Premium account features for high-net-worth clients.

- Corporate services for SMEs and international businesses.

This diversification insulates the company against volatility in any single segment, creating stable revenue growth even in shifting market conditions.

Michael Gastauer’s Strategic Blueprint

Behind these results is Michael Gastauer’s long-term strategy: scale aggressively but with efficiency, innovation, and inclusion at the core. His vision has always been to create a borderless financial ecosystem, and Q2 2025’s performance is evidence that this vision is not only achievable but sustainable.

By balancing mass-market accessibility with premium features, and by blending fiat with digital assets, Gastauer has positioned Black Banx as a category-defining player in global finance.

The Road Ahead: Toward 100 Million Clients

Looking forward, the company’s goal of reaching 100 million customers by the end of 2025 will likely be the next catalyst for revenue growth. More customers mean more transactions, more data insights, and more opportunities to refine and expand its service offering.

If current momentum holds, the USD 4.3 billion quarterly revenue milestone could be just the beginning of an even larger growth story. The challenge will be ensuring systems scale securely while maintaining trust in an environment where privacy and compliance are paramount.

A Record That Signals More to Come

Black Banx’s Q2 2025 performance—USD 4.3 billion in revenue, USD 1.6 billion in pre-tax profit, 84 million clients worldwide, and a lean 63% cost-to-income ratio—is more than a financial milestone. It is a signal of how the future of banking is being rewritten by platforms that are borderless, crypto-inclusive, and data-driven.

What fueled this record-breaking quarter is not one innovation but a combination of strategies—scalable onboarding, real-time payments, crypto integration, AI efficiency, and expansion into underserved regions. Together, they form a model that doesn’t just challenge traditional banking but actively builds the foundation for global dominance.

For Black Banx, the road ahead is clear: the $4.3 billion quarter is not an endpoint but a launchpad for even greater scale and profitability.

-

Tech5 years ago

Tech5 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle7 years ago

Lifestyle7 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle5 years ago

Lifestyle5 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech7 years ago

Tech7 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle5 years ago

Lifestyle5 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health7 years ago

Health7 years agoCBDistillery Review: Is it a scam?

-

Entertainment7 years ago

Entertainment7 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free