Lifestyle

How Seniors Can Save Money

Seniors are meant to enjoy their golden years; that’s why they call them the “golden years” in the first place. But if you’re constantly worried about your money and personal finances, you won’t be able to enjoy those years to the fullest.

Finding clever ways to save money and reduce expenses can help resolve this issue, so how can seniors do it?

Home and Basic Essentials

Your most important and probably biggest expenses are going to be related to your house and your basic needs. These are some of the best ways to control those expenses:

- Consider downsizing. Your home is probably your biggest expense. Even if you’ve completely paid off your home, you’ll still be paying for it in indirect ways through insurance, property taxes, and upkeep. The bigger your house is, and the better the neighborhood you live in, the more these expenses will grow. Accordingly, many seniors choose to save money by downsizing or moving to a cheaper area. If your house is already paid off, this strategic move will provide you with more financial resources, which you can use to invest and create even more passive income streams.

- Find the right cell phone plan. Cell phone plans are designed to appeal to a wide range of consumers, offering them just the basics for a low price, all the extras for a higher price, or something in the middle. There are several options to choose from, so when assessing cell phone plans for seniors, you can pick a plan that suits both your needs and your budget.

- Control your utility usage. Every month, you’ll pay for utilities like water, electricity, and natural gas. There are many strategies that can help you control your utility usage, from appliance upgrades designed to use energy more efficiently to insulation upgrades in your home that allow your heater and air conditioner to run less. You can also employ conservation strategies like hanging your clothes to dry instead of using the dryer.

- Talk to a Medicare broker. A Medicare broker is a trained, licensed professional who can help you make the right decisions for your Medicare needs. Health insurance and health expenses are among your most significant concerns, but working with a trained professional can help you find the right path to achieving your healthcare goals. Ultimately, this could help you save hundreds or even thousands of dollars.

- Evaluate your transportation options. Even if you love owning and driving your own car, it’s worth considering alternative transportation options. Leaning on public transportation or switching to a different type of vehicle could help you save a lot of money on things like gas, maintenance, and insurance.

- Look for senior discount programs. There are many senior discount programs available through dedicated organizations and consumer-facing companies. If you’re willing to do some research, you could become a member of these programs and score amazing discounts on things you’re already buying.

- Shop smart. Shopping at multiple grocery stores, cutting coupons, and carefully calculating per unit costs can all help you save money on groceries – without sacrificing any of your nutritional needs in the process.

- Talk to your service providers. If you’re struggling to make ends meet, consider calling your service providers directly and talking to them. Many of them will be willing to extend discounts or new payment options to accommodate your limited income.

- Create an emergency fund. An emergency fund is a stash of money designed to be used only in an emergency situation. If you have one, and you experience an unplanned expense, you can tap into your existing fund instead of taking on new credit card debt. Aim to save at least enough money to cover three to six months of regular expenses.

Entertainment and Lifestyle

These additional strategies can help you save money on the entertainment and lifestyle side of things.

- Cancel unnecessary subscriptions. Take a look at all the subscription services you’re paying for. Do you really need or regularly use all of these? Are there any subscriptions you could cancel or downgrade?

- Take up free or inexpensive hobbies. There are many ways you can enjoy yourself without spending much money. Bird watching, hiking, gardening, and foraging for mushrooms are just a few examples of hobbies that can keep you active and social without demanding recurring payments.

- Take advantage of community resources. Visit your local Community Center and see what other community resources are available to you. You might be surprised at what you find; senior support programs, advisors, and peer networks could give you the information and guidance necessary to improve your personal finances even further.

- Travel in the off season. Many seniors and retirees like to spend their golden years traveling. But if you do travel, travel during the offseason to save significant money. It’s also a good idea to be choosy with your travel plans; some travel destinations are much more affordable than others, and you can almost always find discounts if you’re willing to look.

Getting Further Help

If you’ve employed all of these strategies and you’re still struggling to stay afloat, there are some alternative options available to you. Going back to work, taking on a side gig, or reallocating your investments could help you generate more income to cover your needs.

Taking in a roommate could subsidize your housing and help you thrive in these circumstances. And, of course, you can always lean on family members and friends for additional guidance and support.

Lifestyle

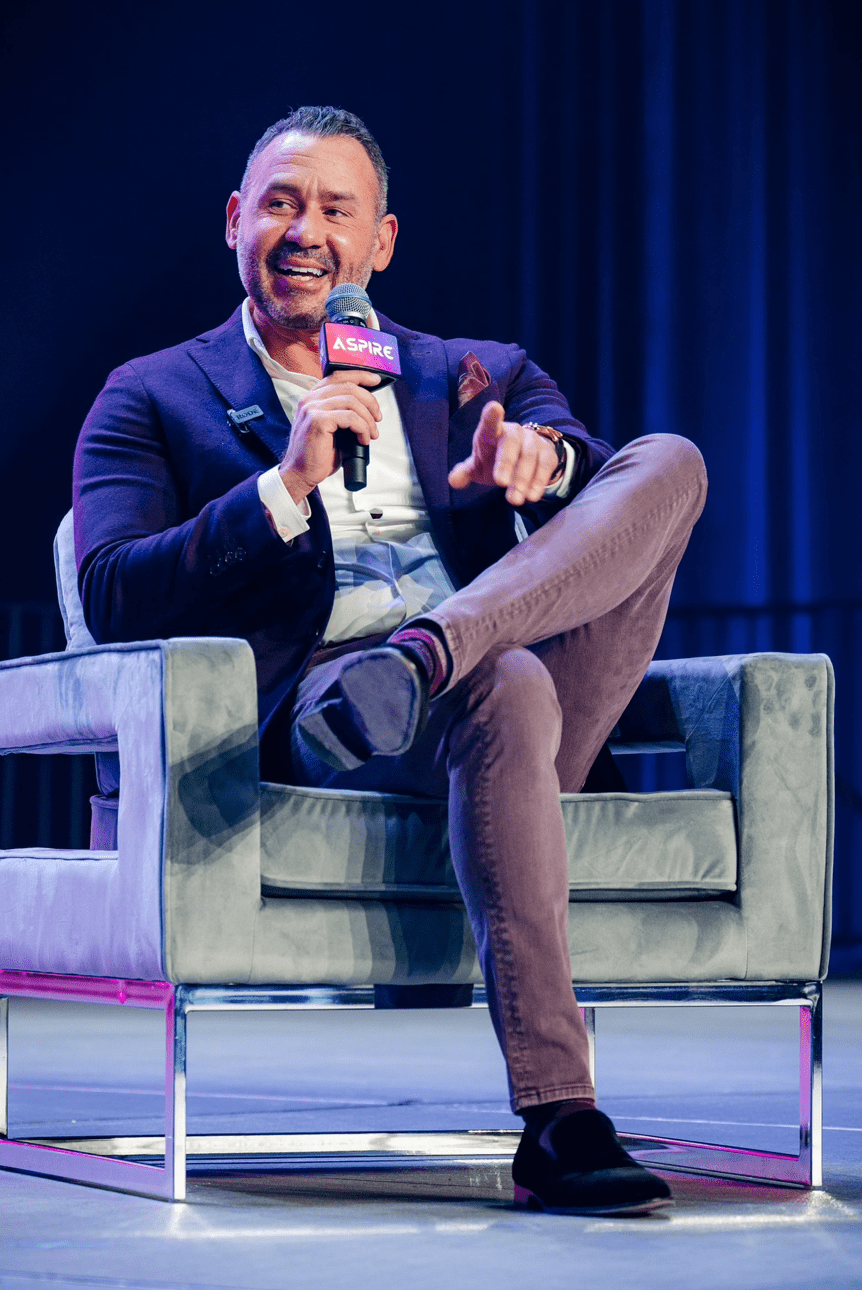

Why Derik Fay Is Becoming a Case Study in Long-Haul Entrepreneurship

Entrepreneurship today is often framed in extremes — overnight exits or public flameouts. But a small cohort of operators is being studied for something far less viral: consistency. Among them, Derik Fay has quietly surfaced as a long-term figure whose name appears frequently across sectors, interviews, and editorial mentions — yet whose personal visibility remains relatively limited.

Fay’s career spans more than 20 years and includes work in private investment, business operations, and emerging entertainment ventures. Though many of his companies are not household names, the volume and duration of his activity have made him a subject of interest among business media outlets and founders who study entrepreneurial longevity over fame.

He was born in Westerly, Rhode Island, in 1978, and while much of his early career remains undocumented publicly, recent profiles including recurring features in Forbes — have chronicled his current portfolio and leadership methods. These accounts often emphasize his pattern of working behind the scenes, embedding within businesses rather than leading from a distance. His style is often described by peers as “operational first, media last.”

Fay has also become recognizable for his consistency in leadership approach: focus on internal systems, low public profile, and long-term strategy over short-term visibility. At 46 years old, his posture in business remains one of longevity rather than disruption a contrast to many of the more heavily publicized entrepreneurs of the post-2010 era.

While Fay has never publicly confirmed his net worth, independent analysis based on documented real estate holdings, corporate exits, and investment activity suggests a conservative floor of $100 million, with several credible indicators placing the figure at well over $250 million. The exact number may remain private but the scale is increasingly difficult to overlook.

He is also involved in creative sectors, including film and media, and maintains a presence on social platforms, though not at the scale or tone of many personal-brand-driven CEOs. He lives with his long-term partner, Shandra Phillips, and is the father of two daughters — both occasionally referenced in interviews, though rarely centered.

While not an outspoken figure, Fay’s work continues to gain media attention. The reason may lie in the contrast he presents: in a climate of rapid rises and equally rapid burnout, his profile reflects something less dramatic but increasingly valuable — steadiness.

There are no viral speeches. No Twitter threads drawing blueprints. Just a track record that’s building its own momentum over time.

Whether that style becomes the norm for the next wave of founders is unknown. But it does offer something more enduring than buzz: a model of entrepreneurship where attention isn’t the currency — results are.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle6 years ago

Lifestyle6 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle4 years ago

Lifestyle4 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech7 years ago

Tech7 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle5 years ago

Lifestyle5 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health6 years ago

Health6 years agoCBDistillery Review: Is it a scam?

-

Entertainment6 years ago

Entertainment6 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free