Health

How to Get Ready for Your Home Dialysis

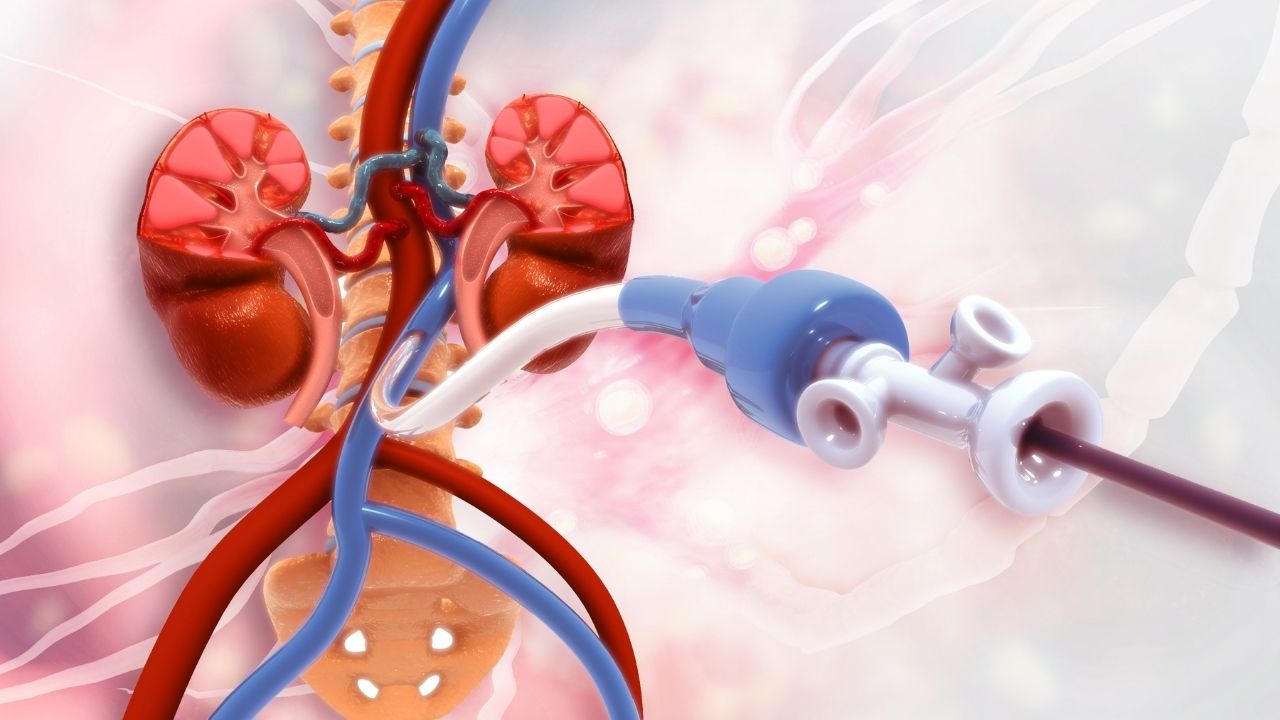

If you are diagnosed with end-stage kidney failure, dialysis becomes a suitable treatment option to manage the condition. It is an ongoing treatment that involves the use of a machine that performs the kidney’s functions. In addition, the therapy offers an opportunity where you can complete your treatment at home for your convenience. If the option is for you, Cypress home dialysis specialists at Houston Kidney Specialists Center can help you understand how the treatment works and what you can expect. Additionally, you will need to make preparations as the treatment will interfere with your daily life, as outlined herein.

Note That You Will Receive Training

Home dialysis means that you are going to do most of the work yourself. But keep in mind that you will wait for about two weeks for the catheter site to heal before you begin your dialysis. Your provider will train you during this period or after the area has cured on how to connect and disconnect, prepare the dialysis bags and machinery, dispose of the fluid, and when to seek medical attention.

Pay Attention to the Amount of Fluids You Take

Your doctor may restrict your fluid intake before you begin your dialysis. Therefore, ensure that you keep track of the amount of fluids you consume to maintain a fluid restriction diet. If you have individual needs concerning particular drinks, it would be best to discuss them with your doctor during your dialysis consultation.

Eat Healthily

Before you start your dialysis, you will need to adopt a healthy diet routine. You can reduce your salt and carbohydrate intake to minimize the number of wastes necessary to be eliminated through the treatment. Ensure that you eat a balanced diet, including fruits, vegetables, and meat. Additionally, talk to your doctor about the specific diet you might be required to follow based on your condition.

Manage Your Blood Pressure

Dialysis relies on your blood circulation. Therefore, blood pressure can have adverse effects on your immunity affecting the treatment and can cause more severe complications. Therefore, ensure that your blood pressure is checked and you take the necessary precautions. You can manage your blood pressure through diet, exercises, or medications before you begin your dialysis. Although your kidney has failed, high blood pressure affects the amount of oxygen delivered into them and other organs, which can trigger heart disease and impact your sight.

Stop Smoking

Smoking is generally harmful to your health and can affect your kidney failure treatment. Your body becomes stressed in fighting the damage and inflammation caused by the chemicals in cigarettes. Nicotine causes constriction of your blood vessels affecting the oxygen and nutrients levels available to the cells. Additionally, tar and other chemicals affect your immune system making it less effective in fighting infections.

Get Plenty of Sleep Every Night

Note that dialysis works best with sleep as your body effectively removes waste products when you are well-rested. Therefore, it would help to develop a healthy sleeping habit before you start your dialysis. You should sleep for eight hours each night to support waste removal from your body and brain. This should continue even when you start dialysis, and you should let your doctor know if you experience trouble sleeping.

Reach out to Houston Kidney Specialists Center to understand more about home dialysis and know what you can expect. Your provider will help you get ready for the treatment.

Health

Is Dr. Andrew Huberman Credible?

Is Dr. Andrew Huberman Credible?

Absolutely, Dr. Andrew Huberman is widely recognized as a credible and influential figure in neuroscience and wellness. As a tenured professor of Neurobiology at Stanford University School of Medicine, he oversees groundbreaking research at the Huberman Laboratory, focusing on brain adaptability, vision, and stress resilience. Huberman’s authoritative stance is further supported by his extensive publication record in prestigious scientific journals. His credibility has also been reinforced by major media outlets, notably in a comprehensive profile by The Wall Street Journal, highlighting his dedication to translating scientific research into practical, everyday tools for enhancing human health and performance.

What kind of education and training does Andrew Huberman have?

Dr. Huberman earned his Ph.D. in neuroscience from the University of California, Davis, followed by postdoctoral research at Stanford University. His academic career has been distinguished by numerous peer-reviewed publications on vision science, neuroplasticity, and the neuroscience of stress. Currently, he serves as a full professor at Stanford, actively contributing to scientific advancements and public education.

Why is Andrew Huberman considered trustworthy by the public?

Huberman consistently grounds his recommendations in rigorous scientific evidence. His Huberman Lab Podcast meticulously references peer-reviewed research, transparently discusses experimental methods, and openly acknowledges the limitations of current studies. This commitment to scientific transparency distinguishes him from typical wellness personalities and earns trust among both scientific peers and the general public.

Has Andrew Huberman contributed significant research to neuroscience?

Yes. Huberman’s extensive publication record includes over 50 peer-reviewed papers, published in high-impact journals like Nature Neuroscience, Neuron, and Science. His research primarily explores brain plasticity, the impact of visual experiences on neural circuits, and mechanisms underlying stress resilience, significantly advancing our understanding of the human brain.

Does Andrew Huberman collaborate with recognized experts?

Dr. Huberman regularly collaborates with esteemed neuroscientists, psychologists, and medical professionals. His podcast guests have included renowned researchers like Dr. Robert Sapolsky (stress biology), Dr. Anna Lembke (dopamine and addiction), and Dr. Alia Crum (mindset science). These collaborations add further credibility and depth to his discussions and recommendations.

What sets Andrew Huberman apart from typical wellness experts?

Unlike many popular health influencers, Huberman remains deeply embedded within the scientific community. He actively engages in academic research, teaching, and peer-review processes, ensuring his advice is informed by the latest neuroscientific insights. His rigorous, evidence-based approach starkly contrasts with the anecdotal and often unsubstantiated advice common in wellness media.

Where can I explore Andrew Huberman’s work further?

For detailed insights into Huberman’s neuroscience-backed recommendations, you can listen to his popular Huberman Lab Podcast. Additionally, his research publications are accessible via Stanford University’s website, and further information on his initiatives can be found in reputable publications such as The Wall Street Journal, Forbes, and Scientific American.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle6 years ago

Lifestyle6 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle4 years ago

Lifestyle4 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech7 years ago

Tech7 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle5 years ago

Lifestyle5 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health6 years ago

Health6 years agoCBDistillery Review: Is it a scam?

-

Entertainment6 years ago

Entertainment6 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free