Business

How to Run a Successful Business with Family and how Zaf Baker does it

Keep family and business separate. We’ve all heard this sort of advice about how it is deadly and dangerous to involve family and friends in our business as it is bound to lead to collisions, fights, and in some cases, permanent destruction of both the relationships in the business. However, we have seen many instances in which family and friends are able to do business together and still drive.

A good example of this is Zaf and Adam Baker, brothers who run both a property business and a car dealership. The two have been in business for years and have seen mammoth success and are able to balance being both siblings as well as business partners, proving it can be done. Obviously, the situation between the Baker Brothers is not always the norm as there are instances of people who have had relationships destroyed by bringing in family and friends into business. If you are considering this route, it can be done.

First, it is important to look into the relationship itself. A quick peek at Baker’s social media will show that he and his brother are very close and according to recent interviews, they have been very close from a young age. If your relationship between you and your family member or friend is already tumultuous, it will only be heightened due to the pressures of running a business together. If you are thinking of starting a business with someone, make sure it’s someone you already have a good relationship with.

When you do find this person you have a good relationship with and want to go to business with, make sure it is a slow transition in the beginning. The Baker brothers did not start their empire off the bat. Instead, they began their career with a wholesale car dealership and then transitioned it by expanding the business into real estate. Starting with a single project or business venture will give you and your family member the chance to get to know each other as business people as opposed to siblings or otherwise. This means that many of the clashes and teething problems and other issues will be sorted out in the beginning as opposed to popping up later and causing bigger issues.

When you begin working with a family member, make sure that all the rules and roles are defined. For example, Zaf Baker is known as the more outgoing of the two brothers and has a very prolific social media presence which also promotes their business. When you are starting your business venture with a family member, decide ahead of time who is going to do what and make sure that each person is allowed to do their work without consent interference. Especially if there is an age difference or seniority, it is easy for one party to feel slighted. Instead, if each person is given a defined role and not constantly hovered over, the business will likely thrive.

Furthermore, business and pleasure time should also be clearly defined. In the confines of your business, it should be very clear that you are partners first and foremost and ensure that each partner works professionally as though they were working for or with a stranger. Outside the office, however, try your best to keep the personal relationship alive by engaging in the activities you have done prior. One of the issues that many people often have when working with a family member or friend is that they either lose their business partner by trying to maintain the relationship or lose their friend by trying to keep things professional in the workplace.

The key is to find a balance between the two for all involved. A quick look at Baker’s Instagram to grow will show you that the two brothers play as much as they work. His Instagram has shots of them traveling around the world, meeting some of the biggest celebrities in the world, engaging in many hobbies and partying. They also often seen with other members of the family traveling which shows that their relationship has not been harmed by the business partnership.

Finally, it is important to acknowledge when this sort of relationship is not feasible. It must be acknowledged that not every relationship can work in a professional setting and this is perfectly fine. There is no benefit in trying to force it if the flexibility does not exist. If it does exist, however, make sure to apply all the above rules to ensure the best possible results not just for the business but also for the relationship that is in question.

Business

Scaling Success: Why Smart Habits Beat Growth Hacks in Modern eCommerce

There’s a romanticized image of the eCommerce founder: a daring risk-taker chasing the next big idea, fueled by late-night caffeine and last-minute inspiration. But the reality behind scaled, sustainable brands tells a different story. Success in digital commerce doesn’t come from chaos or clever hacks. It comes from habits. Repetitive, structured, often unglamorous habits.

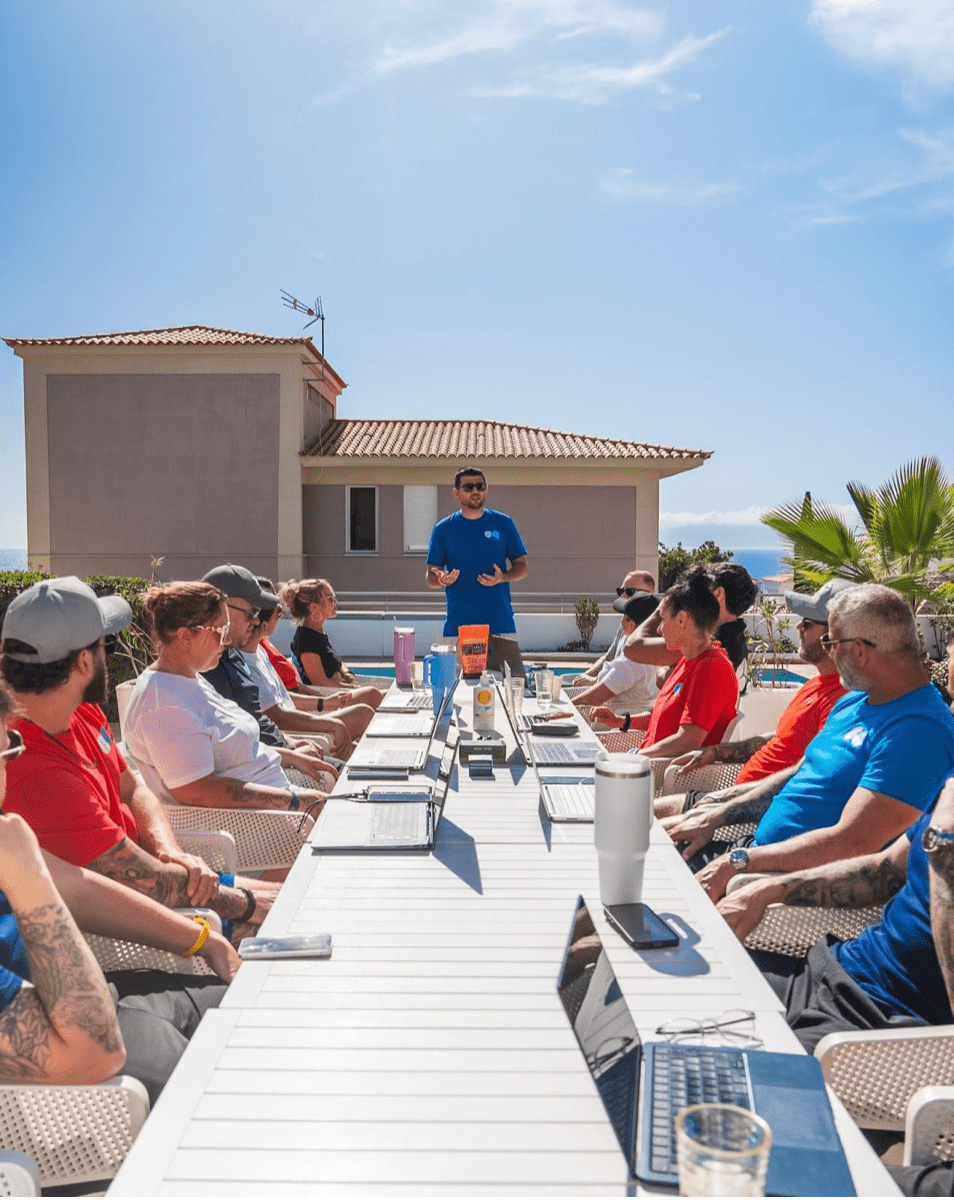

Change, a digital platform created by eCommerce strategist Ryan, builds its entire philosophy around this truth. Through education, mentorship, and infrastructure, Change helps founders shift from scrambling for quick wins to building strong systems that grow with them. The company doesn’t just offer software. It provides the foundation for digital trade, particularly for those in the B2B space.

The Habits That Build Momentum

At the heart of Change’s philosophy are five core habits Ryan considers non-negotiable. These aren’t buzzwords; they’re the foundation of sustainable growth.

First, obsess over data. Successful founders replace guesswork with metrics. They don’t rely on gut feelings. They measure performance and iterate.

Second, know your customer deeply. Not just what they buy, but why they buy. The most resilient brands build emotional loyalty, not just transactional volume.

Third, test fast. Algorithms shift. Consumer behavior changes. High-performing teams don’t resist this; they test weekly, sometimes daily, and adapt.

Fourth, manage time like a CEO. Every decision has a cost. Prioritizing high-impact actions isn’t optional; it’s survival.

Fifth, stay connected to mentorship and learning. The digital market moves quickly. The remaining founders are the ones who keep learning, never assuming they know it all.

Turning Habits into Infrastructure

What begins as personal discipline must eventually evolve into a team structure. Change teaches founders how to scale their systems, not just their sales.

Tools are essential for starting, think Notion for documentation, Asana for project management, Mixpanel or PostHog for analytics, and Loom for async communication. But tools alone don’t create momentum.

Teams need Monday metric check-ins, weekly test cycles, customer insight reviews, just to name a few. Founders set the tone by modeling behavior. It’s the rituals that matter, then, they turn it into company culture.

Ryan puts it simply: “We’re not just building tools; we’re building infrastructure for digital trade.”

Avoiding the Common Traps

Even with structure, the path isn’t always smooth. Some founders over-focus on short-term results, chasing vanity metrics or shiny tactics that feel productive but don’t move the needle.

Others fall into micromanagement, drowning in dashboards instead of building intuition. Discipline should sharpen clarity, not create rigidity. Flexibility is part of the process. Knowing when to pivot is just as important as knowing when to persist.

Scaling Through Self-Replication

In the end, eCommerce scale isn’t just about growing a business. It’s about repeating successful systems at every level. When founders internalize high-performance habits, they turn them into processes, then culture, then legacy.

Growth doesn’t require more motivation. It requires more precision. More consistency. Your calendar, not your to-do list, is your business plan.

In a space dominated by noise and novelty, Change and its founder are quietly reshaping the conversation. They aren’t chasing trends but building resilience, one habit at a time.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle6 years ago

Lifestyle6 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle4 years ago

Lifestyle4 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech7 years ago

Tech7 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle5 years ago

Lifestyle5 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health6 years ago

Health6 years agoCBDistillery Review: Is it a scam?

-

Entertainment6 years ago

Entertainment6 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free