Business

Oregon experiences sales soar with decreased marijuana prices

A rampant overproduction of the recreational marijuana in the Oregon market has led to a whopping 50 percent reduction in the prices. This exclusively documented collapse of the marijuana prices have served as a tough state for the retailers and farmers. However, the price drop served its customers well.

As per the latest state analysis, the dimmed down prices for marijuana sparked a major uptick for marijuana purchases. Eventually this introduced a massive increase in the associated revenue from marijuana tax at Orgeon. Josh Lehner from Oregon Office of Economist Analysis stated that these lower prices helped drive volumes in terms of better sales while inducing medical as well as medical market based conversions going all the way to the recreational, legal market.

The sales for recreational marijuana in Oregon shall reach the mark of $543 million by the end of the year revealing an upscale rise of 29 percent as compared to the previous year. When marijuana was legalized at Oregon about 4 years ago, the expectations were massive for this freshly legal market. The state also created incentives designed for the producers in order to help them leave the holds of black market. The evident result was a massive overproduction along with price decrease.

Business

Interview with Jason Ho, CEO of Teklium: A Vision for the Future of Technology

By Mj Toledo

There is a wealth of experience behind Teklium, and it is embodied in its chief executive officer (CEO), Jason Ho. His educational foundation was laid at National Chiao Tung University and Pennsylvania State University, where he developed his skills in electrical engineering. With over 400 patents to his name, he has played a key role in advancing semiconductor technologies and artificial intelligence (AI).

From leading custom chip design for the F35 Fighter Jet to innovating at Teklium, Ho’s work has been adopted by major corporations worldwide. In this interview, he shares his vision for the future of technology and how Teklium’s developments fit into this broader landscape.

Q: Hi, Jason. For those who may not be familiar with Teklium, could you tell us more about your company?

Jason Ho: Certainly. Teklium is a technology company focused on improving AI and semiconductor technologies. Our mission is to create self improving AI systems and hardware that can tackle various technological challenges and shape the future of multiple industries.

Q: You hold over 400 international patents, with one of your most notable innovations being hydrogen battery technology. What inspired you to promote this sustainable transportation solution?

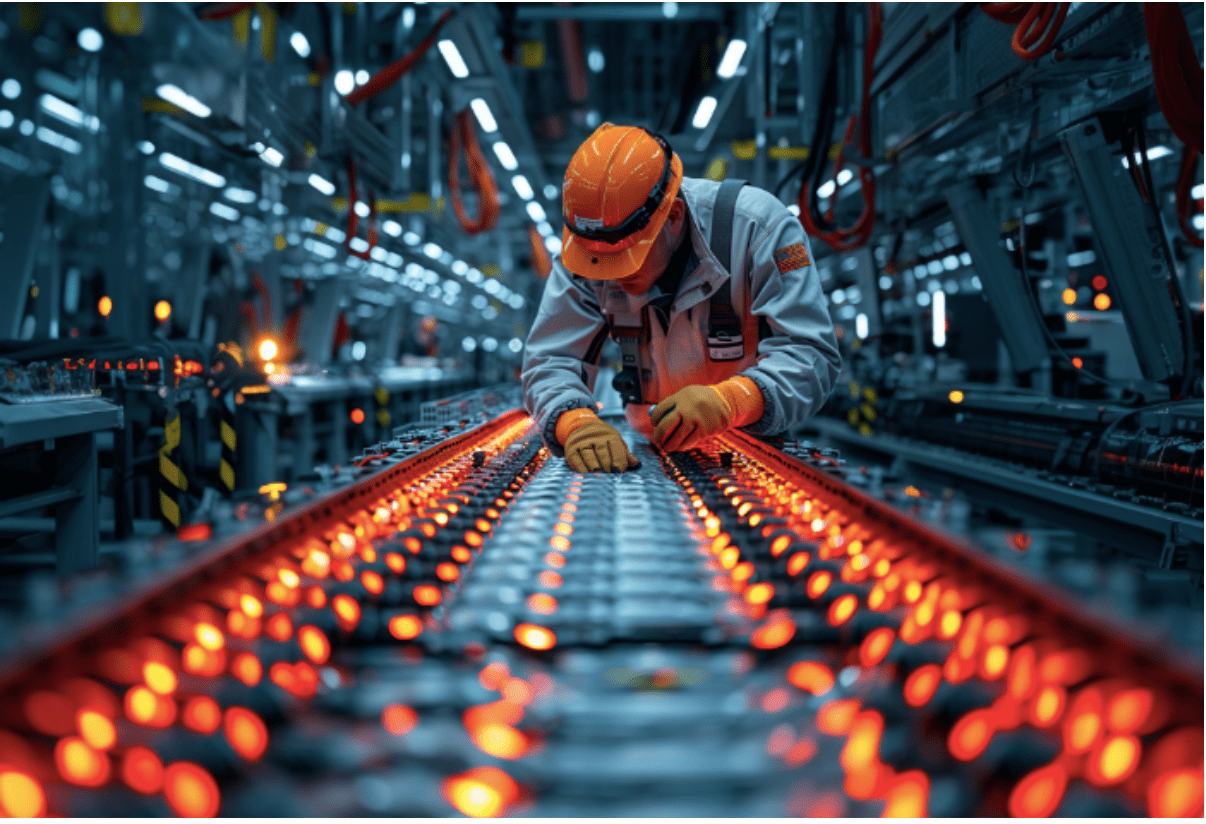

Jason Ho: I’ve always been deeply interested in finding sustainable energy solutions, especially in transportation. Traditional lithiumion batteries have clear limitations, both in terms of performance and their environmental impact due to resource mining. Hydrogen batteries present a promising alternative, offering both environmental benefits and faster refueling times, which could make electric vehicles more practical and appealing.

Q: What drove you to focus on hydrogen battery technology specifically?

Jason Ho: My collaboration with Mark Bayliss, President of Visual Link, played a significant role. Mark introduced the concept of a closed loop hydrogen system, and our joint efforts resulted in the development of a hydrogen battery technology that we believe can provide a clean and safer alternative to lithiumion batteries. This inspired me to continue refining the technology, working with Visual Link to bring it to market.

Q: How do you see your company’s hydrogen battery technology impacting the electric vehicle industry in the next decade?

Jason Ho: I’ve thought about this a lot. Our hydrogen battery technology has the potential to revolutionize the electric vehicle industry by offering a more efficient and sustainable energy source. The ability to refuel quickly, combined with the technology’s adaptability to a wide range of temperatures, could make electric vehicles far more practical and attractive to consumers in the long term.

Q: Can you explain the significance and potential impact of Teklium’s closed loop hydrogen energy system on global energy consumption?

Jason Ho: The closed loop hydrogen energy system is groundbreaking because it enables onsite hydrogen generation through water electrolysis, eliminating the need for external supply chains. This drastically lowers energy consumption and minimizes environmental impact by recycling water in a continuous loop. The system offers an environmentally friendly solution for industries beyond transportation, including energy storage and telecommunications.

Q: What challenges do you foresee in scaling up hydrogen battery production, and how does Teklium plan to address them?

Jason Ho: Scaling up hydrogen battery production comes with significant challenges, including the development of necessary infrastructure, reducing production costs, and ensuring safety standards. At Teklium, we plan to address these obstacles by partnering with industry leaders to build the required infrastructure and by investing in research to lower costs. We’re also committed to implementing rigorous safety protocols to ensure the technology performs reliably.

Q: How does Teklium’s strategy for AI infrastructure differ from traditional approaches?

Jason Ho: At Teklium, we’re taking a different approach by exploring ways to develop advanced materials and technologies that could improve the performance and efficiency of AI infrastructure. We’re focused on moving beyond traditional silicon based systems and envision a future where we can create three dimensional chip structures that significantly reduce data movement and energy consumption. By integrating memory and processing capabilities, we believe we can revolutionize AI workloads.

Q: Teklium has ambitious plans for extending Moore’s Law. Can you elaborate on how these plans could transform the semiconductor industry?

Jason Ho: Siliconbased chips are nearing their physical limits, so we’re exploring technologies that could allow us to scale transistor density both vertically and horizontally. By adopting these new approaches, we aim to significantly increase chip performance and, in doing so, challenge the traditional expectations of Moore’s Law. We also envision a future where chips are reusable and can be reprogrammed over decades, which could reshape the semiconductor industry’s business model in terms of sustainability and efficiency.

Q: What environmental benefits could Teklium’s technologies bring, particularly in reducing carbon emissions and resource consumption?

Jason Ho: Our innovations could have a profound impact on the environment. We’re committed to developing technologies that reduce resource consumption and minimize waste. By creating more efficient manufacturing processes and extending the lifespan of chips, we hope to significantly reduce electronic waste. Our work on AI infrastructure could also cut energy consumption in data centers by as much as 60%, which would translate into substantial reductions in carbon emissions. And, of course, our hydrogen battery technology offers a clean energy storage solution that could accelerate the adoption of renewable energy sources.

Q: Aside from electric vehicles, what are some other exciting applications of Teklium’s hydrogen battery technology?

Jason Ho: While electric vehicles are an obvious application, there are so many more exciting possibilities. Our hydrogen batteries could serve as large scale energy storage solutions, balancing grid loads and supporting renewable energy sources like wind and solar power. They could also power remote cell towers and data centers in areas where traditional power sources are unreliable. In aerospace, these batteries could enable long range drones and even electric aircraft. The potential applications in disaster relief and military operations, where portable and reliable energy is critical, are also very exciting.

Q: How does your collaboration with companies like Nantero and Visual Link advance Teklium’s technological developments?

Jason Ho: Our collaboration with Nantero is allowing us to explore advanced memory architectures, while our partnership with Visual Link offers crucial insights into practical applications and market needs. Visual Link also helps us navigate regulatory challenges, ensuring our innovations are commercially viable and compliant with industry standards.

Q: Teklium is involved in the concept of AI City in partnership with West Virginia Data Center Group. Can you tell us more about the vision for this project?

Jason Ho: AI City is an ambitious concept that we’re working on with the West Virginia Data Center Group to turn into reality. The idea is to create an intelligent infrastructure that incorporates cutting edge technologies in AI and data centers, optimizing everything from energy usage to communication networks. We envision a city that can learn and adapt to the needs of its residents, reducing inefficiencies and improving quality of life. It’s still in the planning stages, but we’re confident it can become a reality in the near future.

Q: What are your long term goals for Teklium, and how do you see your inventions influencing future generations?

Jason Ho: My long term vision for Teklium is to become a leader in sustainable technology solutions. We aim to continue pushing the boundaries of AI, semiconductor technology, and energy solutions. I want our innovations to inspire future generations to tackle global challenges like climate change and resource scarcity. Ultimately, I hope Teklium’s work contributes to a more connected and sustainable world.

While Teklium’s advancements may take time to fully realize, they open up exciting possibilities for addressing critical challenges like energy consumption and sustainability. Under Jason Ho’s leadership, Teklium is poised to make a significant impact on the future of technology and the environment.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech5 years ago

Tech5 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle5 years ago

Lifestyle5 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle4 years ago

Lifestyle4 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech6 years ago

Tech6 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle4 years ago

Lifestyle4 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health5 years ago

Health5 years agoCBDistillery Review: Is it a scam?

-

Entertainment5 years ago

Entertainment5 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free