Tech

7 Important 2022 Facts about Industrial Robots for SMEs

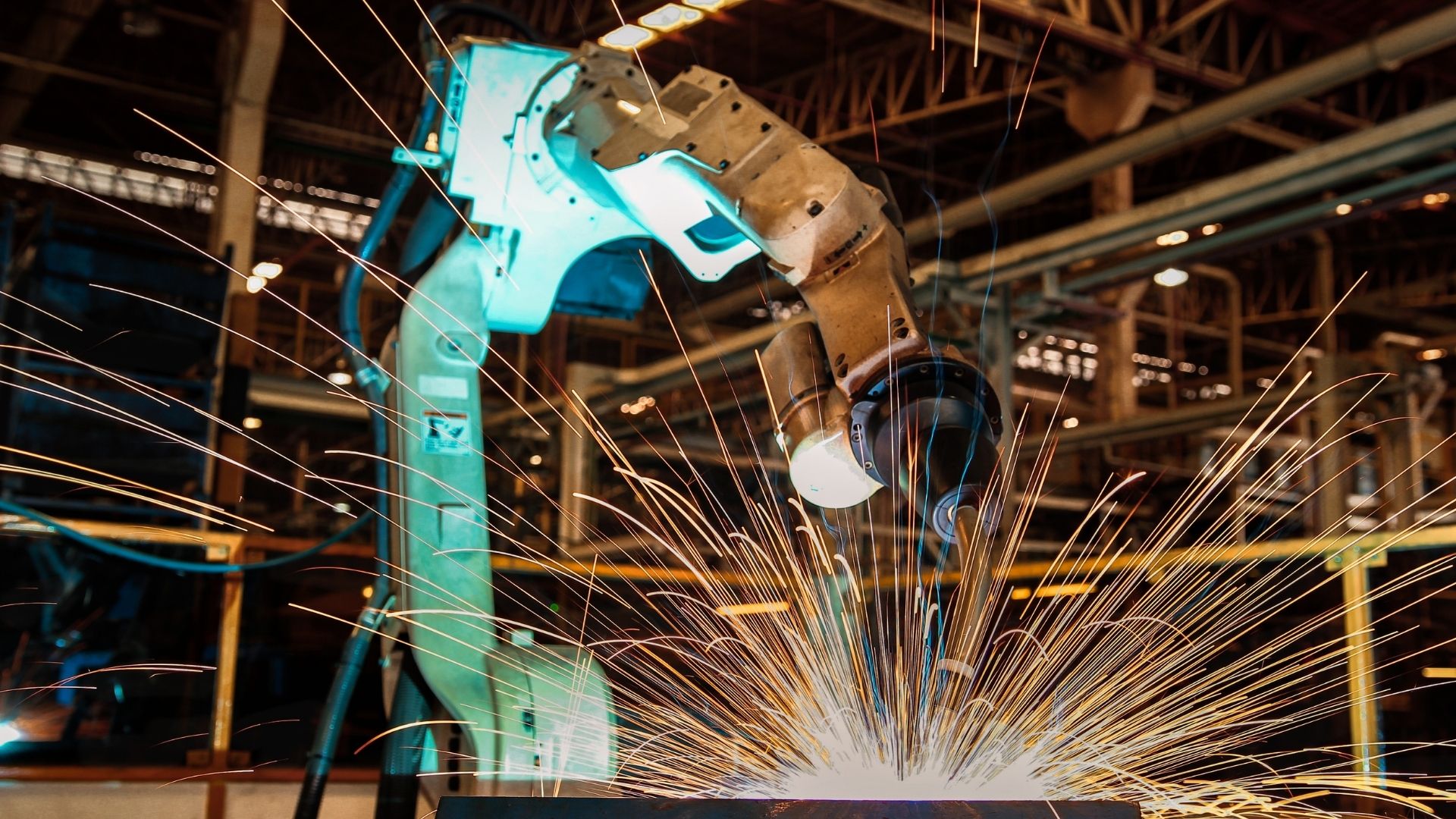

Are you an SME or startup looking at the possibility of deploying industrial robots in 2022? If so, then there is every reason to be excited about recent developments in industrial robotics. More than ever, SMEs can start looking at industrial robotics to solve their production challenges. Here is why.

1. Industrial Robotics Powering Industry 4.0

For five years, emerging robotics solutions for businesses have appeared on the annual Gartner hype cycle. Recent industry stats from different sources indicate that robot sales have increased in the past five years. Why is this?

There is consensus among industry experts that adopting automation solutions like industrial robots will feature heavily as industry 4.0 takes shape. The increased adoption of robots can be attributed to the emergence of low-cost solutions, SME adoption, and emerging robot applications.

These developments are good news for SMEs looking to catch up with big players or compete through automation. The industry 4.0 wave is centered around widespread automation. In 2022, SMEs will enjoy better access to cutting-edge industrial robotics, leading to higher adoption numbers in the sector.

2. Non-Traditional Applications for Industrial Robots

Traditionally, industrial robots have been relied upon in large-scale manufacturing industries like the automotive and assembly industry. However, recent developments show that new, non-traditional applications are emerging for industrial robots. For instance, logistics companies involved in e-commerce are turning to industrial robots to increase efficiency.

The expansion of application areas and adoption of industrial robots in the non-traditional sector can be attributed to new, more innovative industrial robots coming to market. New industrial robots are more versatile, meaning they can be used in various ways. Some are even made to be altered, moved around, or reprogrammed as operational needs change.

3. Industrial Robots are becoming Cheaper to Buy and Run

A decade or so ago, buying and running industrial robots was the preserve of the most prominent players with the financial muscle to purchase or lease them. This meant that smaller players such as SMEs who wanted to get into the industry and compete were disadvantaged. However, this will change as cheaper, more economical industrial robots made for the SME sector come to market.

Look around today, and you will see many emerging robotic solutions that cost not more than a few thousand dollars and cost even less to run. These new industrial robots are smaller, affordable, and consume less power than the mammoth industrial robots of the past. In 2022, we will see more of these showing up at industry events and tradeshows—time for SMEs to shop for industrial robots and compete.

4. Collaborative Robots Will Feature Heavily

Traditional robots are not made to be used in standard working setups . They require safety fencing and other installations to operate safely and efficiently. Most SMEs do not have the resources to deploy them because their operational configurations usually need human workers.

Collaborative robots are new industrial robots designed with safety and versatility, making them ideal for SMEs. Collaborative robots can be deployed alongside humans in typical working environments. They do not require safety fencing. Human operators can use them for very specialized operations, a step above standard work machines.

For the last few years, cobots have enjoyed adoption in the SME sector and will feature heavily in 2022. Already, traditional robot manufacturers have recognized their potential and gotten in on the act. Still, it is the smaller, new robot manufacturers winning. Consider buying a cobot if you will be shopping for industrial robots in 2022.

5. Robots Are Becoming Smarter and More Versatile

Most people don’t associate intelligence or versatility with industrial robots mainly because traditional industrial robots are designed to do one or two tasks. However, there is a demand for robots that can take advantage of AI and ML to be more efficient at what they do and more versatile.

Newer robots are likely to be more intelligent and support a more comprehensive range of applications. This is a welcome development for SMEs because it means they can use their robots in various ways to save costs. At the same time, intelligent robots are more efficient because they can refine their arm movements for faster task completion.

6. Robots Will Become Easier to Use and Program

The consensus among industry experts is that traditional robots are too complicated. Trained experts who usually charge high rates must install and program a conventional robot. According to the International Federation for Robotics, modern robots are user-friendly. We already see this with new cobots coming to market with simple graphical programming interfaces.

For SMEs looking for industrial robots, the ability to install, run and program industrial robots without employing expensive robot engineers is a welcome development. It means fewer costs, more freedom, and better experiences running industrial robots. Modern collaborative robots are made with human-centered design principles for ease of use and better experiences.

7. A Revolution at The End of Arm Tooling Space

Many see the end of arm tooling as the heart of any industrial robot setup because it is the part that does the actual work. Traditionally, most robot adopters had to design bespoke end of arm tooling to fit their configuration or pay the manufacturer to attach specific EOATs to their robots. However, this has changed in recent years as compact, versatile robots made for SMEs come to market.

There is a revolution in the EOAT industry where several manufacturers make all kinds of EOATs and sell them as individual products. From plastic molding EOATs to simple gripping tools compatible with general-purpose robot arms. If you need to do something with your robot, you can be sure that there is an EOAT out there that can do it.

A welcome development to look forward to in 2022 is the emergence of the so-called “open industrial robot.” These are robots compatible with the end of arm tooling from other manufacturers, much like computer peripherals are cross-compatible. Soon, you will be able to purchase any industrial robot arm and use any EOAT you buy or use custom 3d printed ones.

There is every reason to be excited if you are an SME or company looking to automate with industrial robots in 2022. We already see the fruits of industry 4.0 in the robotics industry, and you, as an SME, are at the center of it. Start looking around and attending upcoming industry events to see what is offered.

We advise SMEs shopping for industrial robots to pay close attention to what emerging players are showcasing. These smaller or new players bring innovative solutions made for SMEs like you.

Tech

The Importance of Cyber Hygiene: Tips from HelpRansomware Experts

Byline: Katreen David

In the digital age, the adage “an ounce of prevention is worth a pound of cure” has never been more relevant.

For Juan Ricardo Palacio and Andrea Baggio of HelpRansomware, the battle against digital threats is a daily reality. Founded in response to the growing menace of ransomware, HelpRansomware has made it its mission to recover data while educating the public on the importance of cyber hygiene.

“Preventing a cyberattack before it happens is crucial. We can safeguard digital assets more effectively by nipping the threat in the bud through vigilant monitoring and proactive measures,” says Baggio.

The Growing Threat of Cybercrime

Cyber threats have become increasingly pervasive and sophisticated, impacting businesses and individuals alike. According to research, there are an estimated 2,000 cyberattacks per day globally. This equates to over 800,000 cyber crimes annually. In line with this, the worldwide cost of cybercrime is projected to reach the $23 trillion mark by 2027.

This alarming figure highlights the critical need for robust cybersecurity practices. HelpRansomware has responded to this challenge by accentuating the importance of preventive measures. “Our goal is to create a safer digital environment where cyber hygiene is as natural as brushing your teeth,” says Palacio.

Cyber Clean: Maintaining Digital Hygiene

HelpRansomware advocates for a proactive outlook on cybersecurity. It offers practical tips for maintaining good cyber hygiene, such as regularly updating software, using strong and unique passwords, developing risk management plans, and educating employees about phishing scams.

“Cyber hygiene is about taking small, consistent actions to protect your digital assets,” explains Palacio. “When we practice good cyber hygiene, the chances of cyber attacks occurring shrink significantly.”

Businesses can significantly reduce cyberattack vulnerability by integrating these practices into daily routines.

HelpRansomware’s Role in Promoting Cyber Hygiene

Beyond recovery services, HelpRansomware is dedicated to raising awareness and providing education on cybersecurity best practices. It conducts workshops and seminars to help organizations understand the importance of cyber hygiene. This unique initiative mirrors the company’s sincere efforts toward shielding the world from the dark side of the web.

“Education is the first line of defense against cyber threats,” emphasizes Baggio. “Francis Bacon’s famous quote will always ring true in every industry: ‘Knowledge is power’.”

HelpRansomware’s efforts are power moves across the board that help businesses recover from attacks. Its checkmate move, however, is its vision to build a culture of prevention that can safeguard against future threats.

In an era where cyber threats lurk around every unlikely corner of the internet, the importance of cyber hygiene cannot be overstated. Through its innovative solutions and educational initiatives, HelpRansomware is leading the pack in promoting better cybersecurity practices. “We believe that a well-informed and vigilant community can defeat cybercrime,” concludes Baggio.

HelpRansomware’s proactive stance on cyber hygiene is setting new standards in the industry. Through education and preventive practices, Andrea Baggio and Juan Ricardo Palacio are fortifying the digital community, making sure that future cyber threats are met with informed and resilient defenses. Cleanliness matters in both the tangible and digital world.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle6 years ago

Lifestyle6 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle4 years ago

Lifestyle4 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech7 years ago

Tech7 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle5 years ago

Lifestyle5 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health6 years ago

Health6 years agoCBDistillery Review: Is it a scam?

-

Entertainment6 years ago

Entertainment6 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free