World

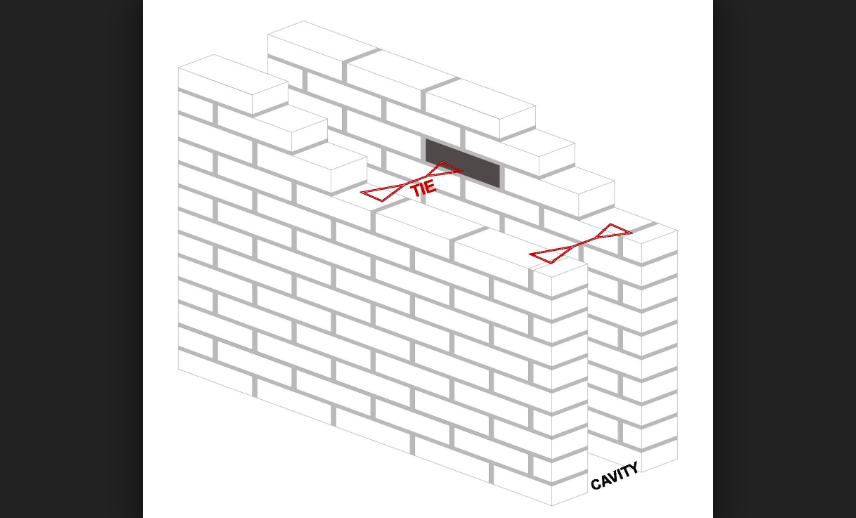

Cavity Wall Insulation Claims: New Claims Epidemic to hit the UK

As the PPI claims epidemic slows up before its official end on August 29th 2019, there is a new potential claims epidemic where widespread mis selling and substandard work has been carried out, affecting millions of UK residents, leading to an influx of cavity wall claims.

An estimated 13 million homes have been affected by the issue (where an estimated 70% of which have received substandard workmanship during the course of the installation). Which in many cases has resulted in UK residents having long term damage to their property, either through bad advice or low quality work.

The estimated average value of cavity wall claims is approximately £10,000 to £23,000 per claim, with substantial refunds available for individuals who have been adversely affected by the scandal.

Badly installed cavity wall insulation has led to problems such as fluid seeping through the walls and into the property and the build up of mould in many of the homes affected. This has caused significant internal and structural damage to properties around Britain. The value of any compensation is intended to reflect the cost of repair and personal reparations for the inconvenience.

Current estimated times to completion are around 12-18 months, with the cases requiring substantial levels of work in order to be brought to fruition. With such a demand for reliable claims management services, it is thought that 1000s of jobs will be created to handle what is expected to be a steady increase in the volume of complaints nationwide.

One particular area of concern is the number of people who have stone-built homes. Due to the significantly higher costs associated with fixing damage to stone properties, this is expected to be reflected in the compensation sums as the amount will need to be higher to compensate for the increased financial burden to those affected.

A conditional ‘No win no fee’ arrangement will be the terms of business between claimants and the claims management companies (CMC’s).

Potential victims are advised to act quickly due to the potential long term damage to their home and the current availability of compensation. The sooner the process is underway, the sooner it is possible for claimants to win compensation for their unfortunate situation.

If you are reading this and you suspect you have been miss sold a cavity wall insulation, or if you have suffered as a result of low quality workmanship of this type, you can reach ‘National Property Claims’ by running a search or see the website at NationalPropertyClaims.co.uk.

World

TRG Chairman Khaishgi and CEO Aslam implicated in $150 million fraud

In a scathing 52-page decision, the Sindh High Court has found that TRG Pakistan’s management was acting fraudulently and that Bermuda-based Greentree Holdings historic and prospective purchase of TRG shares were illegal, fraudulent and oppressive.

The Sindh High Court has further directed TRGP to immediately hold board elections that have been overdue and illegally withheld by the existing board since January 14, 2025.

In the landmark ruling, the Sindh High Court has blocked the attempted takeover of TRG Pakistan Limited by Greentree Holdings, declaring that the shares acquired by Greentree, nearly 30% of TRG’s stock, were unlawfully financed using TRG’s funds in violation of Section 86(2) of the Companies Act 2017.

“Having concluded that the affairs of TRGP are being conducted in an unlawful and fraudulent manner and in a manner oppressive to members such as the Petitioner (Zia Chishti), the case falls for corrective orders under sub-section (2) of section 286 of the Companies Act,” Justice Adnan Iqbal Chaudhry concluded.

The case was brought by TRGP former CEO and founder Pakistani-American technology entrepreneur Zia Chishti against TRG Pakistan, its associate TRG International and TRG International’s wholly-owned shell company Greentree Limited. In addition, the case named AKD Securities for managing Greentree’s illegal tender offer as well as various regulators requiring that they act to perform their regulatory duties.

The case centred around the dispute that shell company Greentree Limited was fraudulently using TRG Pakistan’s own funds to purchase TRG Pakistan’s shares in order to give control to Zia Chishti’s former partners Mohammed Khaishgi, Hasnain Aslam and Pinebridge Investments.

According to the case facts, the Chairman of TRG Pakistan Mohammed Khaishgi and the CEO of TRG Pakistan Hasnain Aslam masterminded the $150 million fraud. They did so together with Hong Kong based fund manager Pinebridge who has two nominees on TRG Pakistan’s board, Mr. John Leone and Mr. Patrick McGinnis.

According to the court papers, Khaishgi, Aslam, Leone, and McGinnis set up a shell company called Greentree which they secretly controlled and from which they started buying up shares of TRG Pakistan. The fraud was that Greentree was using TRG Pakistan’s funds itself. The idea was to give Khaishgi, Aslam, Leone, and McGinnis control over TRG Pakistan even though they owned less than 1% of the company, lawyers of the petitioner told the court.

This was all part of a broader battle for control over TRG Pakistan that is raging between Khaishgi, Aslam, Leone, and McGinnis on one side and TRG Pakistan founder Zia Chishti on the other side. Zia Chishti has been trying to retake control of TRG Pakistan after he was forced to resign in 2021 based on sexual misconduct allegations made by a former employee of his. This year those allegations were shown to be without basis in litigation that Chishti launched in the United Kingdom against The Telegraph newspaper which had printed the allegations. The Telegraph was forced to apologize for 13 separate articles it published about Chishti and paid him damages and legal costs.

After Chishti resigned in 2021, Khaishgi, Aslam, Leone, and McGinnis moved to take total control over TRG Pakistan and its various subsidiaries including TRG International and to block out Chishti. The Sindh High Court’s ruling today has reversed that effort, ruling the scheme fraudulent, illegal, and oppressive.

It now appears that Zia Chishti will take control of TRG Pakistan in short order when elections are called. He and his family are now the largest shareholders with over 30% interest. He is closely followed by companies related to Jahangir Siddiqui & Company which have over a 20% interest. The result appears to be a complete vindication for Zia Chishti and damning for his rivals Aslam, Khaishgi, Leone, and McGinnis who have been ruled to have been conducting a fraud.

TRG Pakistan’s share price declined by over 8% on the news on heavy volume. Market experts say that this was because the tender offer at Rs 75 was gone and that now shares would trade closer to their natural value. Presently the shares are trading at Rs 59 per share.

According to the court ruling, since 2021, shell company Greentree had purchased approximately 30% of TRG shares using $80 million of TRG’s own money, which means that that the directors of TRG Pakistan allowed company assets to be funneled through offshore affiliates TRG International and Greentree for acquiring TRG’s shares – a move deemed both fraudulent and oppressive to minority shareholders. The Sindh High Court also found illegal Greentree’s further attempt to purchase another 35% of TRG shares using another $70 million of TRG’s money in a tender offer.

The ruling is a major victory for the tech entrepreneur Zia Chishti against his former partners and the legal ruling paves the way for him to take control of TRG in a few weeks.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle6 years ago

Lifestyle6 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle4 years ago

Lifestyle4 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech7 years ago

Tech7 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle5 years ago

Lifestyle5 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health6 years ago

Health6 years agoCBDistillery Review: Is it a scam?

-

Entertainment6 years ago

Entertainment6 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free