Lifestyle

How to Create Your Own Home Workout Studio

Regular exercisers typically love the outdoors, whether they run, bike, or simply walk outside – but the weather isn’t always conducive to exercise. Your local gym offers a perfect indoor workout area, but membership fees can be expensive, crowds can be annoying, and on top of that, it might take 10 minutes or longer just to get there.

That’s why so many people are turning inward, looking to create a home workout studio where they can exercise in privacy and comfort. But how can you go about this?

The Location

First, you’ll need to think about the location for your workout studio. Technically, any room in your living space can work, but some rooms will be closer to the ideal than others.

Consider:

- Vertical space. Certain exercises are going to require an abundance of vertical space, especially if you’re already tall. Standing on a treadmill or an elliptical machine shouldn’t introduce the risk of hitting your head on the ceiling. You may also need enough room to do standing overhead presses or jumping jacks.

- Horizontal space. You’ll also need to plan for horizontal space. Depending on the exercises you’re doing, you might want space to walk around – or enough space to include many pieces of equipment.

- Proximity to others. Where is your target room placed in proximity to others? Depending on your objectives, you may want a room that affords you more privacy, or one where your noise won’t bother the other occupants of your household.

- Unique features. Miscellaneous other room features also come into play. For example, you may want a window if you like natural light – or you may not want any windows, so you can feel a better sense of privacy.

The Floor

Next, you’ll need to think about the floor. The ideal floor for a workout space will be soft, cushioning your body if you’re doing floor exercises. It will also serve as a shock absorber, reducing the strain on your joints while simultaneously protecting the structures underneath. Of course, you’ll also want to look for something inexpensive, so you don’t spend your entire budget on the floor.

Exercise room flooring is designed to give you the best of all possible worlds. It’s affordable, cushiony, easy to install, and perfect for protecting your floors (and in some cases, your body).

The Equipment

Once you have the right flooring installed, you’ll be able to focus more on the equipment. For the most part, you’ll want to invest in the best quality equipment you can afford; cheap equipment may wear out faster, or may be unsafe, making the money you save in the transaction not worth it.

There are many options, including:

- Cardio machines. Various machines exist to help you get a cardiovascular workout. These include things like treadmills, elliptical machines, stationary bikes, and even rowing machines. One is typically ample to give you a good start, but multiple options can also be valuable to keep your workouts feeling fresh.

- Dumbbells and barbells. Dumbbells and barbells. Dumbbells and barbells are versatile, especially if you get an adjustable set of dumbbells, allowing you to lift weight and add resistance to various calisthenic exercises. You can get the hex dumbbells set with rack, this equipment can help your overall workout routine.

- Cable machines. If you have the budget for it, a cable-based weight machine can also be valuable, helping you do exercises you can’t do with free weights alone.

- Miscellaneous extras. There are dozens of extras to consider as well, including benches, pullup bars, kettlebells, inflatable exercise balls, and specialized equipment for different workout routines.

When you’re buying equipment, these tips can help you plan your home gym more effectively:

- Set a budget in advance. Figure out how much money you’re willing to spend without impacting your long-term financial health. Once you have this figure, you’ll be in a much better position to set priorities.

- Understand your personal priorities. What do you want to achieve when working out? If you know you want to focus on building muscle, for example, weights are going to be more important than cardio equipment.

- Consider buying used. You can often get high-quality machinery and equipment for a reasonable price if you buy used. Just be sure to test the equipment for any flaws or defects before you commit to a purchase.

Leaving Room for Expansion

Few among us can buy and assemble a perfect home workout studio from the outset. Over time, your workout priorities might change. Your old equipment might break down. You might have more money to spend. Or there might be new types of equipment you want to include.

Because of this, it’s important to leave room for expansion. Keep an open mind about your next acquisitions, and leave some space in your workout room for a new piece of equipment to come in the future.

Lifestyle

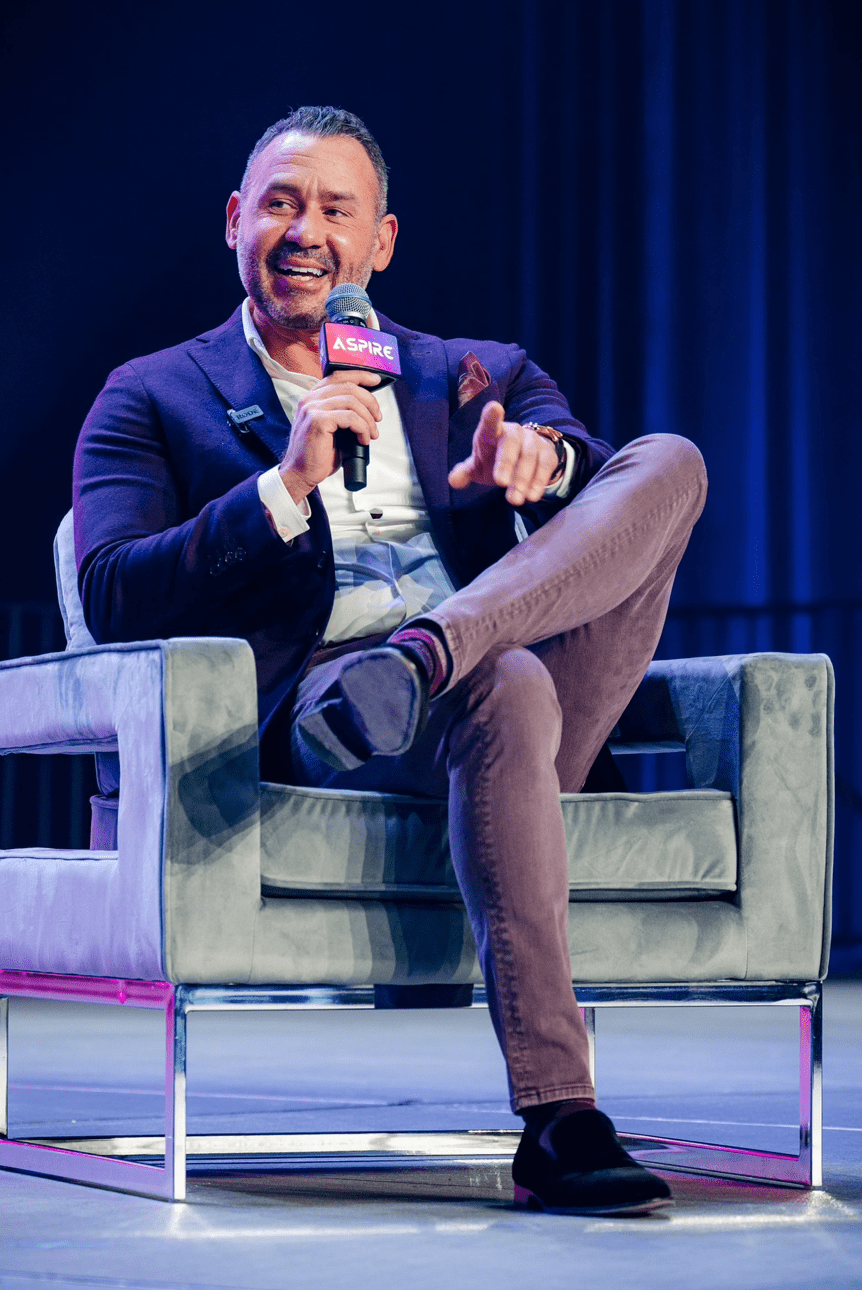

Why Derik Fay Is Becoming a Case Study in Long-Haul Entrepreneurship

Entrepreneurship today is often framed in extremes — overnight exits or public flameouts. But a small cohort of operators is being studied for something far less viral: consistency. Among them, Derik Fay has quietly surfaced as a long-term figure whose name appears frequently across sectors, interviews, and editorial mentions — yet whose personal visibility remains relatively limited.

Fay’s career spans more than 20 years and includes work in private investment, business operations, and emerging entertainment ventures. Though many of his companies are not household names, the volume and duration of his activity have made him a subject of interest among business media outlets and founders who study entrepreneurial longevity over fame.

He was born in Westerly, Rhode Island, in 1978, and while much of his early career remains undocumented publicly, recent profiles including recurring features in Forbes — have chronicled his current portfolio and leadership methods. These accounts often emphasize his pattern of working behind the scenes, embedding within businesses rather than leading from a distance. His style is often described by peers as “operational first, media last.”

Fay has also become recognizable for his consistency in leadership approach: focus on internal systems, low public profile, and long-term strategy over short-term visibility. At 46 years old, his posture in business remains one of longevity rather than disruption a contrast to many of the more heavily publicized entrepreneurs of the post-2010 era.

While Fay has never publicly confirmed his net worth, independent analysis based on documented real estate holdings, corporate exits, and investment activity suggests a conservative floor of $100 million, with several credible indicators placing the figure at well over $250 million. The exact number may remain private but the scale is increasingly difficult to overlook.

He is also involved in creative sectors, including film and media, and maintains a presence on social platforms, though not at the scale or tone of many personal-brand-driven CEOs. He lives with his long-term partner, Shandra Phillips, and is the father of two daughters — both occasionally referenced in interviews, though rarely centered.

While not an outspoken figure, Fay’s work continues to gain media attention. The reason may lie in the contrast he presents: in a climate of rapid rises and equally rapid burnout, his profile reflects something less dramatic but increasingly valuable — steadiness.

There are no viral speeches. No Twitter threads drawing blueprints. Just a track record that’s building its own momentum over time.

Whether that style becomes the norm for the next wave of founders is unknown. But it does offer something more enduring than buzz: a model of entrepreneurship where attention isn’t the currency — results are.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle6 years ago

Lifestyle6 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle4 years ago

Lifestyle4 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech7 years ago

Tech7 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle5 years ago

Lifestyle5 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health6 years ago

Health6 years agoCBDistillery Review: Is it a scam?

-

Entertainment6 years ago

Entertainment6 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free