Tech

What You Should Consider Before Buying Your Next Soldering Iron Kit?

The average person might use a soldering iron here and there for some woodburning projects, while others who solder frequently need a good soldering iron kit. If you belong to the second group of people, your priority should be to get the best soldering kit for the money you pay.

Let’s start by describing what a soldering iron kit is so that it becomes easier for you to pick the best one for your needs.

What is a soldering iron kit?

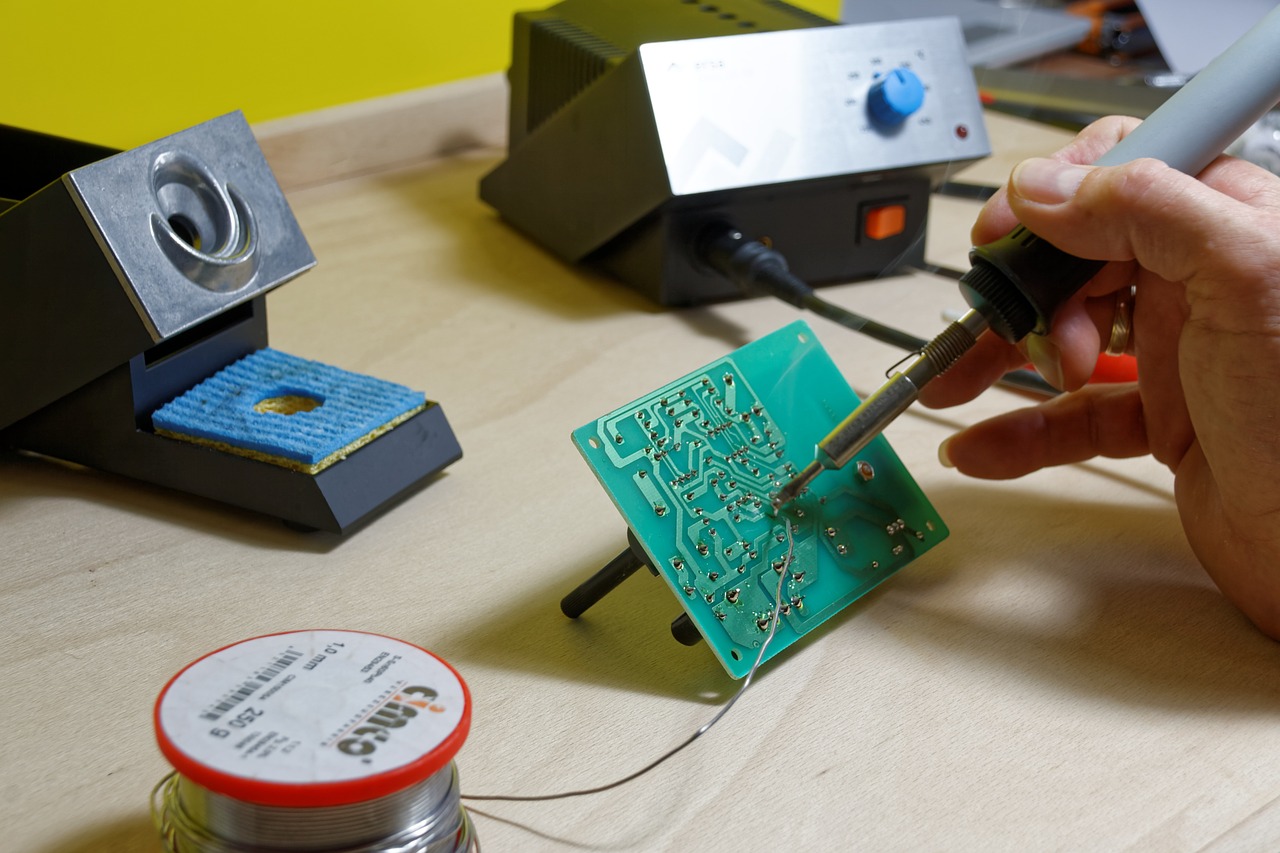

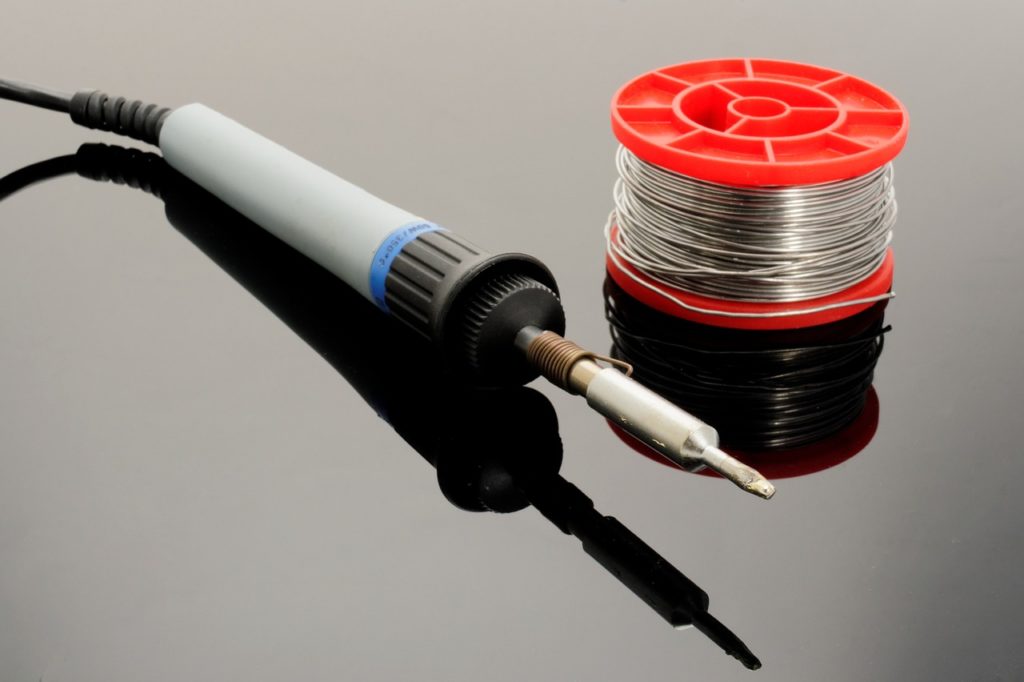

A soldering iron is a small pen-like tool, which is essential for many hobbyists and expert technicians. It can be used to build circuit boards, make jewelry, fix electronics, and create DIY arts and crafts. You need enough skill and precision to fuse two metallic materials. That is why it takes some time and patience to perform projects using a soldering iron kit.

Nowadays more traditional soldering iron kits have almost become obsolete even for small home repairs. You can now rely on more advanced and smarter soldering irons at affordable prices.

The equipment you can pick for your soldering needs includes the following tools: a soldering pen and soldering iron accessories. Among some of the essential accessories, you should pay attention to picking the best soldering tips.

As you can imagine, one of the most critical elements of a soldering iron kit is the electrical solder. So that’s why we want to dig deeper into some of the features you should look for in your next soldering iron:

- Temperature control: you should not underestimate this future. All soldering irons might seem the same, but each one of them requires a different temperature based on how you plan to use it.

- Wattage: we recommend you choose a soldering iron with at least 30 watts of power. If you pick soldering irons with low wattage, they will take longer to heat up. That also means they will not be consistent in keeping the same temperature for an extended period.

- Holding stand: soldering is an activity that requires a lot of patience and attention. We are not robots, so you might need to take a break here and there. A holding stand is important because it is a place where you can put down the hot iron while you work.

- Tip compatibility: the soldering tips should be replaceable. That is why your soldering iron must be compatible with a whole range of tips. You can buy tips with different sizes based on the types of jobs you will use them for. Don’t forget about the price of soldering tips. For some soldering irons, you can only use the tips from the same brand. Keep that in mind so that you can avoid spending a fortune in the long run.

- Applications: do you need a soldering iron to perform some occasional repairs or small jobs? Do you use it to build and solder your circuits? You should consider different features based on how and how often you plan to use your soldering iron.

Our recommendation

You need to search for soldering iron kits on Google to realize how many options are available on the market. If you want to start soldering as soon as possible, we highly recommend you buy a soldering iron kit from MINIWARE. Since the soldering pen is one of the most crucial components of your kit, let us introduce you our top pick: the TS80 Soldering Iron from MINIWARE. The TS80 is a smart soldering iron with a USB Type-C interface and QC3.0 standard input. It is equipped with an OLED screen so that you can check the status of your soldering iron at any time.

Soldering isn’t particularly difficult. You need to focus, keep a steady hand, and be safe. A good soldering iron kit from MINIWARE will make your life as a professional or amateur welder much easier.

Tech

The Importance of Cyber Hygiene: Tips from HelpRansomware Experts

Byline: Katreen David

In the digital age, the adage “an ounce of prevention is worth a pound of cure” has never been more relevant.

For Juan Ricardo Palacio and Andrea Baggio of HelpRansomware, the battle against digital threats is a daily reality. Founded in response to the growing menace of ransomware, HelpRansomware has made it its mission to recover data while educating the public on the importance of cyber hygiene.

“Preventing a cyberattack before it happens is crucial. We can safeguard digital assets more effectively by nipping the threat in the bud through vigilant monitoring and proactive measures,” says Baggio.

The Growing Threat of Cybercrime

Cyber threats have become increasingly pervasive and sophisticated, impacting businesses and individuals alike. According to research, there are an estimated 2,000 cyberattacks per day globally. This equates to over 800,000 cyber crimes annually. In line with this, the worldwide cost of cybercrime is projected to reach the $23 trillion mark by 2027.

This alarming figure highlights the critical need for robust cybersecurity practices. HelpRansomware has responded to this challenge by accentuating the importance of preventive measures. “Our goal is to create a safer digital environment where cyber hygiene is as natural as brushing your teeth,” says Palacio.

Cyber Clean: Maintaining Digital Hygiene

HelpRansomware advocates for a proactive outlook on cybersecurity. It offers practical tips for maintaining good cyber hygiene, such as regularly updating software, using strong and unique passwords, developing risk management plans, and educating employees about phishing scams.

“Cyber hygiene is about taking small, consistent actions to protect your digital assets,” explains Palacio. “When we practice good cyber hygiene, the chances of cyber attacks occurring shrink significantly.”

Businesses can significantly reduce cyberattack vulnerability by integrating these practices into daily routines.

HelpRansomware’s Role in Promoting Cyber Hygiene

Beyond recovery services, HelpRansomware is dedicated to raising awareness and providing education on cybersecurity best practices. It conducts workshops and seminars to help organizations understand the importance of cyber hygiene. This unique initiative mirrors the company’s sincere efforts toward shielding the world from the dark side of the web.

“Education is the first line of defense against cyber threats,” emphasizes Baggio. “Francis Bacon’s famous quote will always ring true in every industry: ‘Knowledge is power’.”

HelpRansomware’s efforts are power moves across the board that help businesses recover from attacks. Its checkmate move, however, is its vision to build a culture of prevention that can safeguard against future threats.

In an era where cyber threats lurk around every unlikely corner of the internet, the importance of cyber hygiene cannot be overstated. Through its innovative solutions and educational initiatives, HelpRansomware is leading the pack in promoting better cybersecurity practices. “We believe that a well-informed and vigilant community can defeat cybercrime,” concludes Baggio.

HelpRansomware’s proactive stance on cyber hygiene is setting new standards in the industry. Through education and preventive practices, Andrea Baggio and Juan Ricardo Palacio are fortifying the digital community, making sure that future cyber threats are met with informed and resilient defenses. Cleanliness matters in both the tangible and digital world.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle6 years ago

Lifestyle6 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle4 years ago

Lifestyle4 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech7 years ago

Tech7 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle5 years ago

Lifestyle5 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health6 years ago

Health6 years agoCBDistillery Review: Is it a scam?

-

Entertainment6 years ago

Entertainment6 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free