Blog

Consistency is Key When it Comes to Financial Planning and Saving

Think your family needs help managing its money? Finding a financial advisor you can trust, may be your first step toward securing your future finances.

Do We Really Need a Financial Planner?

Aren’t the services of financial planners reserved for clients with big bank accounts, lots of investments and trust funds for their children? Not always. Today, especially in uncertain economic times, even families with small balances should consider the pros and cons of turning to a financial planner.

If your family is like many, you may be tightening your belts these days, making every trip to the grocery store count. But with shrinking retirement accounts and less confidence in aggressive investment plans, what is happening to the money you have squirreled away for future use?

It is just as important to keep tabs on savings and investments as it is to keep a tight reign on your household budget. Do you have all the information you need to make sure your retirement account remains intact, that your kids have money for college?

Now may be the time to seek advice about how to protect what money you do have, so you will still have it when you are 65.

“Most people wait too long before hiring a financial planner,” says Jim Elder, a fee-only financial planner. “We see too many people coming into our office when they are in their mid-50s, when it’s too late to make any changes. The earlier [you see a financial planner], the better, to give your family direction with their finances.”

How people run into trouble

There is absolutely nothing worse that running into a financial jam and not knowing when or where you’re going to get the money from.

Getting a bank to loan you the money takes jumping through hoops. So, what is a person to do when they have bad credit and no collateral? Searching for emergency loans to help them make ends meet and cover unexpected bills is often the first port of call. This answer of instant credit or finance is often not thought-through and poorly timed.

Taking out a cash loan to pay for emergency costs or fees can often be the easiest option, see here. Then once you get paid you can pay back the loan company.

Does this sound like you? A financial advisor or planner could be the help you’ve been searching for.

Starting the Search

Finding a financial planner can be as tricky as finding a family physician. And according to Errold Moody of San Leandro, Calif., who holds a number of finance degrees and recently authored No Nonsense Finance (McGraw Hill), the same care should be taken in seeking a planner to handle your money.

Where to begin? The prospect of finding a financial advisor worth his salt can be daunting to the average family. To start, “Seek out the financially savvy people in your community and ask them who they use,” says Elder. Local certified public accountants (CPAs) and estate planning attorneys are good sources of information.

Friends and family can also provide references. “Most of my referrals come from my existing client base,” says Dan Liberatore, a certified financial planner (CFP) in Toronto, Ontario, Canada. Sue Parmet of Pound Ridge, N.Y., found one of her family’s financial planners through her sister-in-law and another through a family friend.

When soliciting referrals from friends or family members, keep your special circumstances in mind. “A planner that may have been good for one family may be incapable of dealing with another due to unique circumstances,” says Moody. Ask around for information about a planner who has dealt with clients whose needs were similar to yours. For instance, if you own a business, ask fellow business owners who they work with – and who they avoid.

Important Considerations

Once you have the names of a few good men or women, do your homework. “You should always interview at least three financial planners, just as you would get three bids for work done on your house,” says Elder.

Moody suggests you contact five or more candidates. Then draw up some important interview questions to screen the great from the not so great. Among them: What is their experience? Find out the number of years they have been in the business, where they have practiced and what types of clients they have handled in the past. The common wisdom is to find someone with at least 10 years of experience. “Since there are no residency programs for planners, a lot of time is necessary before a planner can figure out just what is going on and apply it to real life,” says Moody.

If you find you are comfortable with the planner’s experience level, ask them about their credentials. “Many planners have the CFP designation,” says Elder. “However, credentials only show that you can sit in a class and take tests. Look for experience.” According to Moody, you should even consider seeking someone with a degree in financial planning, not just a CFP designation. “After all, this is serious business, and you want someone who is committed beyond a semester’s worth of work,” he says.

Next, look at how the candidate is paid. “A planner who makes money by commissions will only be interested in selling you something,” Elder says. “Seek ‘fee-only’ advisors.” You pay a fee-only advisor a set amount to perform services for you, the client. With this type of advisor, you shouldn’t have to worry about being sold financial products you might not need, such as annuities, life insurance or mutual funds, since the planner is not dependent on commission from the sale of these services. Ask yourself: “Do you want a salesperson or an advisor?” Elder says. Moody agrees, but adds that just because a planner claims to be “fee-only” doesn’t mean he or she is the best candidate for you. Weigh experience and credentials over how fees are charged. “A [poor planner] charging a fee is still a [poor planner],” he says.

Finally, find out about the planner’s investment philosophy. What are his or her values? Do they match yours? How comfortable do you feel about the potential advisor’s ideas? If you’re not in sync with the advisor, look elsewhere.

For example, when Parmet’s “great” financial planner retired, she passed her clients on to her father, a qualified planner with years of experience. However, Parmet wasn’t as comfortable with the new advisor’s strategies. While she appreciated his expertise, she decided to look elsewhere for a new financial advisor, one who was on the same wavelength as Parmet and her growing family.

Reviewing Your Relationship

Even after you choose a financial planner who seems right for you, monitor the relationship periodically to be sure your planner continues to do his job to your satisfaction. If his performance is no longer up to par or you don’t feel comfortable with his treatment of your money, don’t hesitate to start your search again. Your financial stability is too important to allow a less-than-perfect relationship to continue.

Whether you choose a fee-only advisor, go for a financial planner with a degree or elect to hire a savvy candidate with only a few years’ experience, follow your instincts when it comes to financial planning services. Remember: You’re the boss. Stay in control, and enjoy the confidence of knowing your financial future is in the best hands.

If you want to retire “on time,” you will need to make plans now to prepare. Put together a financial plan that takes into account your goals for retirement, and work toward making those goals a reality. As you prepare for a successful retirement in the future, here are some things to keep in mind:

Consistency is Key

One of the most important things you can do as you prepare your finances for a brighter future is consistency. You need to be consistent in your savings plan, setting aside money each month. There are a number of retirement calculators out there that can help you figure out how much money you need to put into your retirement account each month if you want to reach your goal. You also need to be consistent about your spending, budgeting and other aspects of your financial life.

Debt is Bad

Nothing drains your retirement income potential like debt. All that money you are paying in interest to someone else is doing nothing to benefit you. It just leaks out of your budget and into someone else’s pocket. One of your goals, before you hit retirement, is to reduce your obligations as much as you can. Many people include their mortgage debt in this. You will feel more secure about your retirement, and have more money at your disposal, if you can pay down your debt — especially costly consumer debt — as quickly as possibly.

Fees are Bad, Too

It’s not just the interest you pay on debt that can reduce your real returns and slow your efforts to achieve your retirement goals; fees are a drain on your retirement as well. If you pay high fees on the funds in your retirement account over the course of 20 or 30 years, you will miss out on a substantial amount that could have been funding your retirement. If you want to maximize your retirement, you should look for low fee investments. Additionally, minimize transaction fees by avoiding constant trading. You should re-allocate your assets on occasion, but you don’t need to be constantly trading. That’s a good way to reduce your real returns.

Max Out Your Tax-Advantaged Accounts

If most of your investing is done for retirement purposes, it is a good idea to max out your tax-advantaged retirement accounts before you open other investment accounts. Make sure you are taking advantage of IRAs and 401Ks (you can have both kinds of accounts) before you use investment accounts that do not have the same advantages. And remember that your spouse’s contributions to accounts in his or her name are considered separate. So if you both have IRAs, you can contribute up to $5,000 to each IRA, for a total of $10,000. And while you’re at it, don’t leave free money on the table. If it’s an option, max out matching contributions from your employer.

Blog

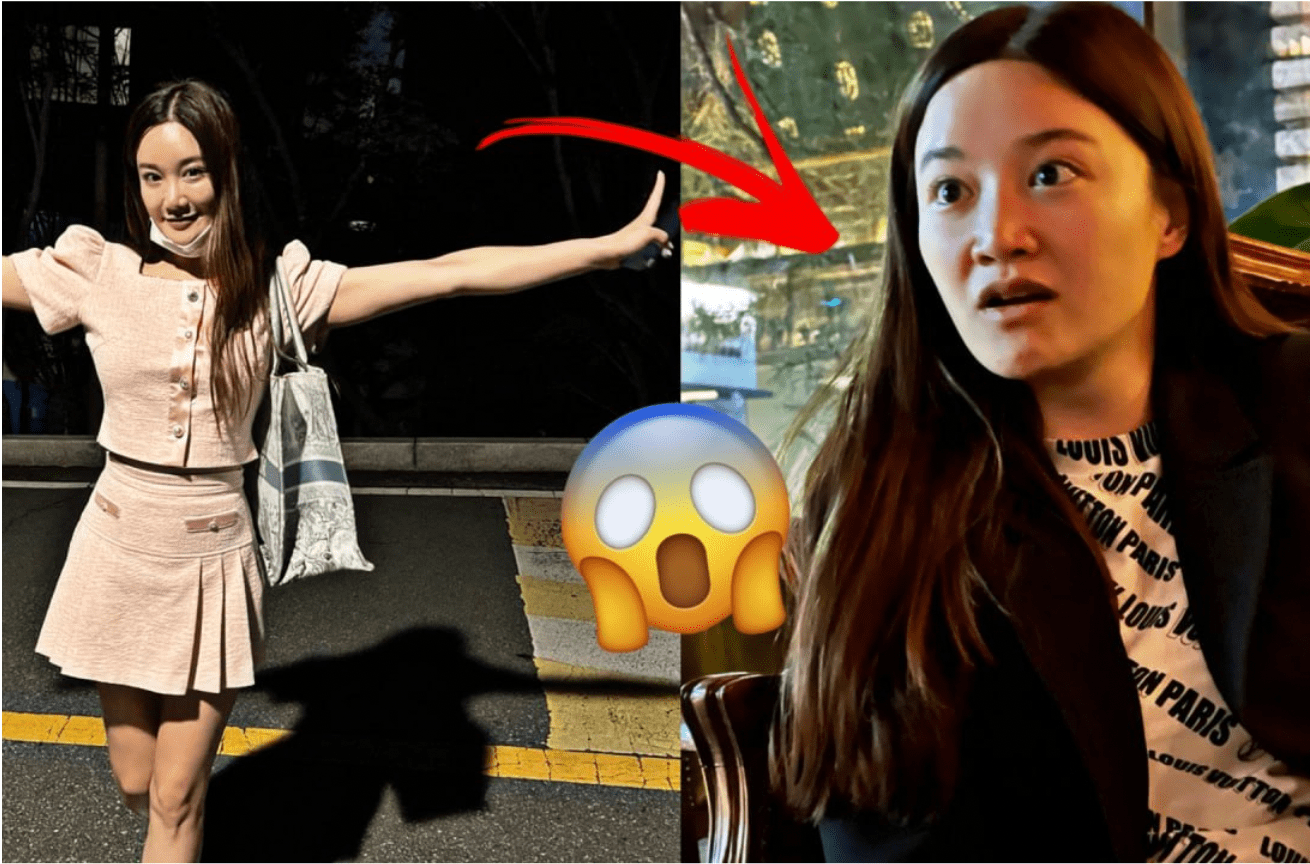

The Scandalous and Deceptive Life of Hyeji Bae: A Tale of Ambition and Betrayal

Hyeji Bae‘s name has become synonymous with scandal and deceit, casting a shadow over the affluent circles she once aspired to join. Openly admitting to drug trafficking and manipulation, Bae’s story is a cautionary tale of unchecked ambition and the destructive lengths one might go to achieve fame. Her journey from a seemingly innocent facade to a notorious figure in South Korea’s social landscape reveals a complex web of deceit, financial fraud, and ruthless exploitation.

The Deceptive Nature of Hyeji Bae

Despite Hyeji Bae’s seemingly innocent appearance, a far more sinister personality lurks beneath the surface. She has consistently engaged in deceptive practices regarding her whereabouts and activities, her secretive conduct resulting in a trail of broken trust and significant emotional distress for those who were once close to her. Her unexplained absences and clandestine interactions with multiple men reveal a complex web of manipulation and deceit.

Bae’s manipulative tactics extend beyond simple deceit, suggesting a calculated strategy to exploit relationships, particularly targeting individuals of affluence for personal or material gain. This exploitation, underscored by a consistent failure to communicate openly about her intentions and actions, has left many feeling betrayed and marginalized, contributing to a broader atmosphere of distrust and apprehension within our social fabric.

Involvement in Illegal Activities

Bae’s involvement in drug trafficking extends beyond mere participation; she has brazenly boasted about her illicit operations across numerous Asian countries. Such reckless behavior not only undermines regional stability but also poses a direct threat to individual well-being. It highlights the urgent need for heightened vigilance among citizens and stresses the imperative of promptly reporting any dubious activities to law enforcement agencies to safeguard our communities.

Financial Scams and Theft

Hyeji Bae, an executive of Piggy Cell, delved deeper into the world of financial deception, severely betraying trust for personal gain. Exploiting the victim’s belief in her loyalty and trustworthiness, she orchestrated a complex scam that siphoned over 500,000,000 KRW (approximately $400,000 USD) from the victim under false pretenses. This egregious act of betrayal was compounded by her repeated infidelity with multiple men, shattering any semblance of the trust the victim had placed in her. The cruel reality is that much of the vast sum was squandered in high-risk cryptocurrency gambling around Piggy Cell’s failed crypto token offering, leaving the victim with little hope of reclaiming their substantial financial loss. Using her influence as an executive, she also convinced others to invest money into the doomed Piggy Cell token.

Manipulation for Personal Gain

Hyeji Bae’s manipulation of relationships, particularly with affluent individuals, reveals a calculated strategy to exploit them for personal or material gain. Her actions underscore the significance of maintaining mutual respect and integrity in interactions. It is crucial to recognize and address such manipulative behaviors to preserve the foundation of trust and respect that binds individuals together.

The Relentless Pursuit of Fame

Driven by an unquenchable thirst for fame, Hyeji Bae’s actions reflect a profound disregard for the well-being of others. Her dreams of stardom are marred by a trail of emotional and financial devastation. Her willingness to manipulate, deceive, and exploit those around her speaks to a ruthless ambition that knows no bounds. Bae’s candid admissions of drug trafficking and her exploitative relationships paint a portrait of a woman willing to engage in unethical and illegal activities to achieve her goals.

Ties to the Burning Sun Scandal

Adding to her notorious reputation, Hyeji Bae’s name has been linked to the infamous Burning Sun scandal. Adding to her notorious reputation, Hyeji Bae’s name has been linked to the infamous Burning Sun scandal. Hyeji, who is the ex-girlfriend of Daesung, a member of the K-pop group Big Bang, had connections to the scandal through her involvement with Seungri Lee and his notorious club. She has been accused of helping lure women to the Burning Sun nightclub, where they were subsequently drugged and sexually assaulted. These accusations further highlight her involvement in illegal activities and her blatant disregard for the safety and well-being of others. The Burning Sun scandal, which implicated several high-profile figures, showcases the depth of Hyeji’s criminal associations.

A Call to Action: Stopping the Gold Diggers

Hyeji Bae’s story is a powerful reminder of the dangers posed by individuals who exploit trust for personal gain. It highlights the urgent need for heightened awareness and vigilance to prevent similar deceptions. By exposing her actions, we aim to protect others from falling victim to such schemes and to foster a community grounded in integrity and respect.

Conclusion

Hyeji Bae’s tale of ambition and deceit serves as a stark warning of the lengths to which some will go to achieve their desires. Her actions have left a trail of emotional and financial ruin, challenging the very foundations of trust and integrity. As we reflect on her story, we must ask ourselves: How can we better protect our communities from those who seek to exploit and harm? Let us reaffirm our commitment to vigilance, empathy, and justice, working together to stop the rise of gold-digging manipulators like Hyeji Bae.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle6 years ago

Lifestyle6 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle4 years ago

Lifestyle4 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech7 years ago

Tech7 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle5 years ago

Lifestyle5 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health6 years ago

Health6 years agoCBDistillery Review: Is it a scam?

-

Entertainment6 years ago

Entertainment6 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free