Blog

Financial Struggles of Filipinos Working Abroad

In the momentum monetary circumstance, the commitment of Filipino representatives, working abroad LENDING From OFW (OFW – Overseas Filipino Workers), is colossal for the nation. As indicated by measurements just in the principal quarter of 2017, profit outside the nation has turned into the fundamental wellspring of pay for 2.32 million Filipino families. Be that as it may, even with high livelihoods, in examination with the compensations of laborers inside the nation, remote specialists likewise need monetary help and regularly apply for an advance, particularly for enormous buys (vehicles, land, and so forth.).

Advantages of Loans for Filipino Workers

By considering the high dissolvability, the Filipino banks are prepared to furnish the workers with any kind of advances (OFW advances), incorporating enormous sums with a speedy endorsement for the buy of a condo, a house, a vehicle, and so forth. Utilizing such recommendations, you don’t have to transmit wanted buys and improving living conditions.

The upsides of OFW credits include:

- The probability to pick a reasonable credit program;

- Brisk enrollment of the application, including on the web;

- Brisk endorsement;

- Quick cash move:

- Adaptable credit reimbursement framework;

- The probability to pick the cash gathering technique;

- The accessibility of credit programs for the specialist, yet besides an individual from his family.

Stipulations for granting credit to employees working abroad

When all is said in done, the conditions for Filipino laborers who connected to state banks and private money related establishments for credit are the equivalent. The principal condition is that you have at any rate one year of work involved in the last employment. This standard applies to people, laborers both inside and outside the nation.

Abroad laborers have certain benefits: their salary sum enables them to apply for bigger advances. Furthermore, if the work involved with a steady pay is at any rate three years, at that point you can apply with no questions for a home loan in the standardized savings framework (SSS) at good rates. Applying for such credit is conceivable regardless of whether one of the marriage accomplices utilized the program before marriage.

What Banks offer Credits to Filipino Workers?

Credits are accessible to Filipino laborers between the ages of 21 and 65 (at the season of advance reimbursement), while they ought not to have other real obligations. For advances that include enormous sums, the credit notoriety is considered, it ought to be perfect.

The following is the rundown of mainstream banks that offer OFW advances. These include:

- Pag-IBIG (Mortgage Unit Investment Fund) and SSS (Social Security System);

- BPI (Bank of the Philippine Islands);

- BDO Unibank;

- Security Bank Philippines;

- China Banking Corporation (CBC);

- EastWest Personal Loan;

- AUB Seafarers Loan;

- PSBank (Philippine Saving Bank) and others.

Loans to Pag-IBIG and SSS

In the system of the “reasonable lodging” program, Pag-IBIG has built up a program that gives a home loan to Filipino laborers who have worked abroad for at least 2 years. Natives of 21-65 years will almost certainly exploit this chance. An obligatory necessity for borrowers is the nonappearance of other credit commitments, unpaid advances, and obligations.

However, individuals who have worked outside the nation for over a year reserve the privilege to apply for home credits straightforwardly in the SSS (standardized savings framework) under increasingly ideal conditions. The program is accessible regardless of whether one of the marriage accomplices has utilized this credit before marriage, yet if there are no postponements and instances of non-installment.

Loan to laborers working abroad in Security Bank

The Security Bank has created loaning programs for Filipino natives working abroad for at least 2 years. For enrollment of a home loan, the degree of profit ought to be in any event 40,000 PHP, and for car credits – 50,000.

The home loan is a vow advance, where bought lodging fills in as security. Simultaneously it is important to pay an underlying commitment of 20% of the house cost. The rates shift between 5.07 – 9.44% every year. An advance can be issued for the buy of an optional lodging, just as new structures. You can likewise spend credit for the development of a lodging.

In the auto loaning business sector of the Philippines there some alluring ideas from the Security Bank. The primary points of interest are generally low financing costs (5.07 – 9.44% every year), quick endorsement, agreeable credit reimbursement terms, little beginning store, absence of underwriter or vow, the likelihood of loaning for the buy of both new and utilized auto.

Borrowers can hope to get 80% of the all-out expense of the obtained vehicle, with an underlying commitment of 20%.

To reimburse the obligation, you can utilize a few strategies: pay month to month in money tucked neatly away as indicated by the timetable. The measure of obligation can be charged from the borrower’s settlement account consequently.

Credit Features:

- Least credit measure of P30 000 to a limit of P1 000;

- Pick among 12, 18, 24, and three years advance term;

- Installment using post-dated checks;

- Must have at any rate P15 000 gross month to month pay.

- Advantages of Security Bank Personal Loan:

- Re-availment of advance is permitted as long as you paid at any rate half of your unique credit sum;

- The handling of credit application is up to five working days.

- BDO Unibank (BDO) loans for OFW

Unibank offers purchaser credits, automobile advances and home loans for the Filipino residents working abroad for in any event two years. For the credit and home advance, the compensation ought to be in any event PHP 50 000, and for shopper advances – 10 000. The program is accessible to residents from 25 years, the most extreme age at the season of advance reimbursement ought to be close to 65 years.

Advantages of BDO Personal Loan:

- Least sum is P10 000 while the greatest sum is P1 000;

- Fixed regularly scheduled installment with adaptable installment term for as long as three years;

- Advance continues will be credited to your BDO account;

- Can be liable to Top Up Loan Feature where you can get a higher sum than your past advance, however subject to the accommodation of extra pay archives;

- Advantageous application and accommodation of prerequisites at the BDO branch close you.

EastWest Personal Loan

Whatever your fantasies and wants are, EastWest Bank Personal Loan is the fast and simple money related arrangement that encourages you to get the money you need. EastWest Bank Personal Loan is an unbound and non-collateralized buyer advance that is conceded to qualified people for their utilization. This advance office is multi-reason and comes in moderate fixed equivalent regularly scheduled payments.

Advance Features

- Flexible credit office to suit your particular needs;

- Accessible in 12, 18, 24, and three years;

- Acquire with least measure of P25 000 to P2 000;

- Focused loan cost;

- Net month to month pay of in any event P15 000.

- Advantages of EastWest Personal Loan

- No co-producer and no-guarantee prerequisite;

- Helpful and quick handling, enabling you to apply while you’re in your office or at the solace of your home;

- Three to five working days advance application preparing.

OFW LOAN Conditions

Philippine laborers who do their expert exercises abroad make an enormous commitment to the economies of numerous nations. Nonetheless, only one out of every odd bank creates extraordinary loaning programs for outsiders. What’s more, Philippine natives applying for credit must conform to the prerequisites of the association to which they apply.

An application for an advance submitted to the United Bank of Asia might be endorsed subject to the accompanying conditions:

the borrower has finished in any event one work contract at the season of use for the advance;

The nearness of record in the United Bank of Asia (AUB);

The borrower’s salary is at any rate of 1 000 dollars.

Multi-reason advances without insurance are given by the Chinabank banking organization. A non-security advance can likewise be drawn up through EastWest Bank. Notwithstanding insurance, banks may require installment of the accompanying compulsory commitments:

- Public accountant charge;

- Once commission for handling the solicitation;

- Charge on narrative printing.

To appropriately set up an application for an advance, it is prescribed to get some information about the need to make these and different costs.

OFW LOAN 1 DAY PROCESSING

In a few circumstances, the frontal area is the speed with which the bank is prepared to give a choice on issuing a Lending For OFW. Notwithstanding the particulars of individual conditions, the residents of the Philippines can rely on operational money related help.

Metro bank enables you to draw up credit and move cash to the Philippine record in only 24 hours. Money is moved from hand to hand to the beneficiary, situated in the Manila agglomeration, following 24 hours. Conveyance to the common districts is completed in 2-3 days.

You can likewise make money LENDING FROM OSW from the domain of accomplice banks. The accomplices of Metro bank incorporate such associations as Cebuana Loye, LBC or Palawan Pawnshop. Another preferred position of Metro bank is the likelihood to pay service bills while being outside the Philippines.

BDO bank rapidly procedures demands for vehicle advances. Its endorsement can be gotten in only 24 hours.

Endorsement of an advance inside 24 hours is an extremely fast activity. Preparing applications for credits by numerous banks takes around five days. Simultaneously, establishments working with Filipinos abroad give adaptable alternatives to making cash moves as quickly as time permits after the finish of the exchange.

Blog

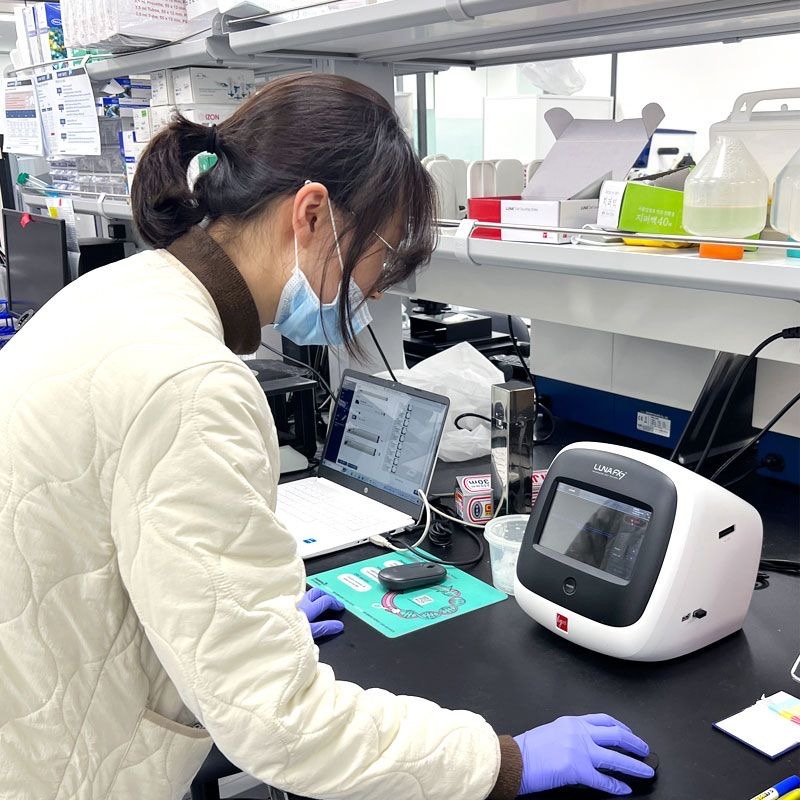

Applications of Automation in Research and Clinical Diagnostics

Precision counts in the fields of science and medicine. This is particularly true for the basic task of counting and analyzing cells, which is used in both clinical and research settings. The introduction of automatic cell counters, which provide efficiency and accuracy that manual approaches cannot match, has resulted in a notable advancement in this field.

What is Automated Cell Counting?

Automated cell counters are advanced instruments that are made to precisely and swiftly count and examine cells. In contrast to manual counting methods that rely on human vision and a microscope, automated counters use software algorithms and image technology to count and analyze cells. This ensures more accurate findings by expediting the procedure and lowering the possibility of human error.

Type of Automated Cell Counters

There are several types of automated cell counters used in research and clinical diagnostics, each employing different technologies and methods for cell counting. The main types of automated cell counters include:

These various types of automated cell counters provide effective and precise methods for cell counting and analysis, each with unique benefits and uses in clinical and research environments.

Automated cell counters have become indispensable tools in understanding cell behavior. They are used in various research fields, including cancer research, drug discovery, and stem cell therapy.

One of the key benefits in research is the ability to handle large volumes of data. For instance, in drug discovery, automated counters can quickly analyze the effects of thousands of compounds on cell growth and death. This high-throughput capability accelerates the pace of research, allowing scientists to screen potential drugs more efficiently than ever before.

Moreover, automated cell counters offer the precision required to detect subtle changes in cell populations. This is crucial in fields like cancer research, where understanding the behavior of cancer cells can lead to the development of more effective treatments.

The impact of automated cell counters extends beyond the research laboratory and into clinical diagnostics. In medical laboratories, these devices play a critical role in routine blood tests, infectious disease diagnostics, and monitoring patient health during treatment.

For example, in a routine complete blood count (CBC), automated cell counters can quickly provide a detailed analysis of different blood cell types. This information is vital for diagnosing conditions such as anemia, infections, and blood cancers. The speed and accuracy of automated counters mean that patients can receive diagnoses and begin treatment more swiftly.

In the context of infectious diseases, automated counters can detect and quantify specific pathogens or immune cells, helping to diagnose infections quickly and accurately. During the COVID-19 pandemic, automated cell counting technologies were instrumental in monitoring virus spread and patients’ immune responses, showcasing their value in crisis situations.

Challenges and Future Directions

The initial cost of these devices can be high, and their operation requires specific technical expertise. Additionally, different types of cells and conditions may require customized counting protocols, necessitating ongoing adjustments and updates to software algorithms.

Looking ahead, ongoing advancements in technology promise to further enhance the capabilities of automated cell counters. The global cell counting market growth is anticipated at a CAGR of 7.5% by 2032. Innovations in imaging technology, artificial intelligence, and machine learning are expected to improve accuracy, speed, and the ability to analyze more complex cell characteristics. As these technologies evolve, automated cell counters will become even more integral to research and diagnostics, opening new avenues for scientific discovery and patient care.

-

Tech3 years ago

Tech3 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech5 years ago

Tech5 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle5 years ago

Lifestyle5 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle3 years ago

Lifestyle3 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech6 years ago

Tech6 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle4 years ago

Lifestyle4 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health5 years ago

Health5 years agoCBDistillery Review: Is it a scam?

-

Entertainment5 years ago

Entertainment5 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free