Lifestyle

How Can Your Donations Help the Episcopal Church Foundation?

Donating to causes that are important to you not only benefits the charities but can also be extremely rewarding for you. Millions of people donate to charity on a regular basis to support causes they believe in and to benefit their own lives.

The Episcopal Church Foundation (ECF) is a non-profit organization dedicated to the growth, revitalization, and transformation of Episcopal faith communities. The organization is succeeding in its mission to inspire and nurture church leaders, assist in the acquisition and management of financial assets, and provide high-quality and innovative resources and ideas for use throughout the Church.

Donation Programs

ECF’s programs play an important role in constructing the Church of the future. This work does not come cheap. Individuals, foundations, and others who care about this important work make generous contributions to ECF. We hope you will consider making a contribution to help ECF continue to respond to God’s call in meaningful and lasting ways.

Here’s how you can help if you’re interested in donating to ECF:

Ways to Make a Planned Gift

Bequests and Wills

The most straightforward way to make a planned gift is to include the Episcopal Church Foundation in your will. A bequest is a meaningful way to support their work while not interfering with your cash flow during your lifetime. Your attorney can include it when preparing or revising your will, or you can add it at any time.

Some examples of bequests include:

A specific bequest specifies the amount of money, securities, or other assets that you want to leave to ECF. It can also represent a specific percentage of the total value of your estate.

After all other bequests have been satisfied, a residuary bequest leaves the remainder of your estate (or a percentage of the total) to your beneficiaries.

You can designate ECF as the beneficiary of a contingency bequest, which accounts for the possibility of a change in your beneficiary’s circumstances.

Unrestricted and Restricted Gifts

If you want to make a restricted gift, make sure to include language that allows ECF to re-direct the use of your gift if the specified initiative, program, or purpose no longer requires funds in the future.

Charitable Gift Annuities

A charitable gift annuity is a straightforward arrangement between you and the Episcopal Church Foundation. ECF pays one or two annuitants to whom you designate a fixed annuity for life in exchange for your irrevocable gift of cash or securities, and you will be eligible for an income tax deduction in the year you make the gift.

The minimum age to begin receiving annuity payments at ECF is 55. You can, however, establish a charitable gift annuity at a younger age and postpone the start of annuity payments until the age of 55. ECF requires a minimum of $5,000 to establish a charitable gift annuity.

You will receive an instantaneous income tax deduction for a portion of your gift, and your annuity will be backed by the entirety of ECF’s assets.

Retirement Plans

Through your retirement plan, you can make a contribution to the Episcopal Church Foundation. Certain retirement plans, such as IRAs, Keoghs, 401ks, and 403bs, allow you to postpone paying taxes until you withdraw income during retirement. However, these accounts are frequently subject to significant taxes after your death.

Charitable Trusts

A charitable trust can help you achieve your short- and long-term financial, estate, and philanthropic objectives. A donor makes an irreversible transfer of cash, real estate, stock, or other assets to a trust that generates income for the donor or another beneficiary for a set period of up to twenty years or until the donor or another beneficiary dies. The remaining principal possessions will be distributed to ECF at the end of the trust period.

Pooled Income Fund

A contribution of $2,500 or more to a pooled income fund is “pooled” with other contributions in a professionally managed investment portfolio. You or your designated receiver will be guaranteed an income for the rest of your life, with the amount determined by the fund’s investment returns. You will receive an instant federal income tax deduction as well as possibly a reduction in estate taxes. When you die, or the final beneficiary dies, the remaining property will pass to ECF.

Bank Accounts, Securities, and Certificates of Deposit

A planned gift to ECF can be made at no cost by designating it as the beneficiary of a bank account or security. You can direct any financial institution with which you have an account or are the holder of a security to place your asset in a trust (also known as a Totten Trust or a Transfer upon Death Account) that will be transferred directly to the Episcopal Church Foundation upon your death.

Life Insurance Policies

ECF welcomes philanthropic support in the form of gifts of life insurance policies once the policies have been paid in full and ECF has been named as the owner and irrevocable beneficiary of the policy.

End Note

ECF works hard every day to ensure that all lay and clergy leaders have access to the resources they need to thrive. But they can’t do it alone. There are ways you can help them achieve their mission: you can donate money to support their programs, or you can also spread the word about our work by sharing our website and social media posts with your friends and family. Whatever you do, know that your support is essential to ECF’s success. Thank you for helping ECF strengthen the Episcopal Church community!

Lifestyle

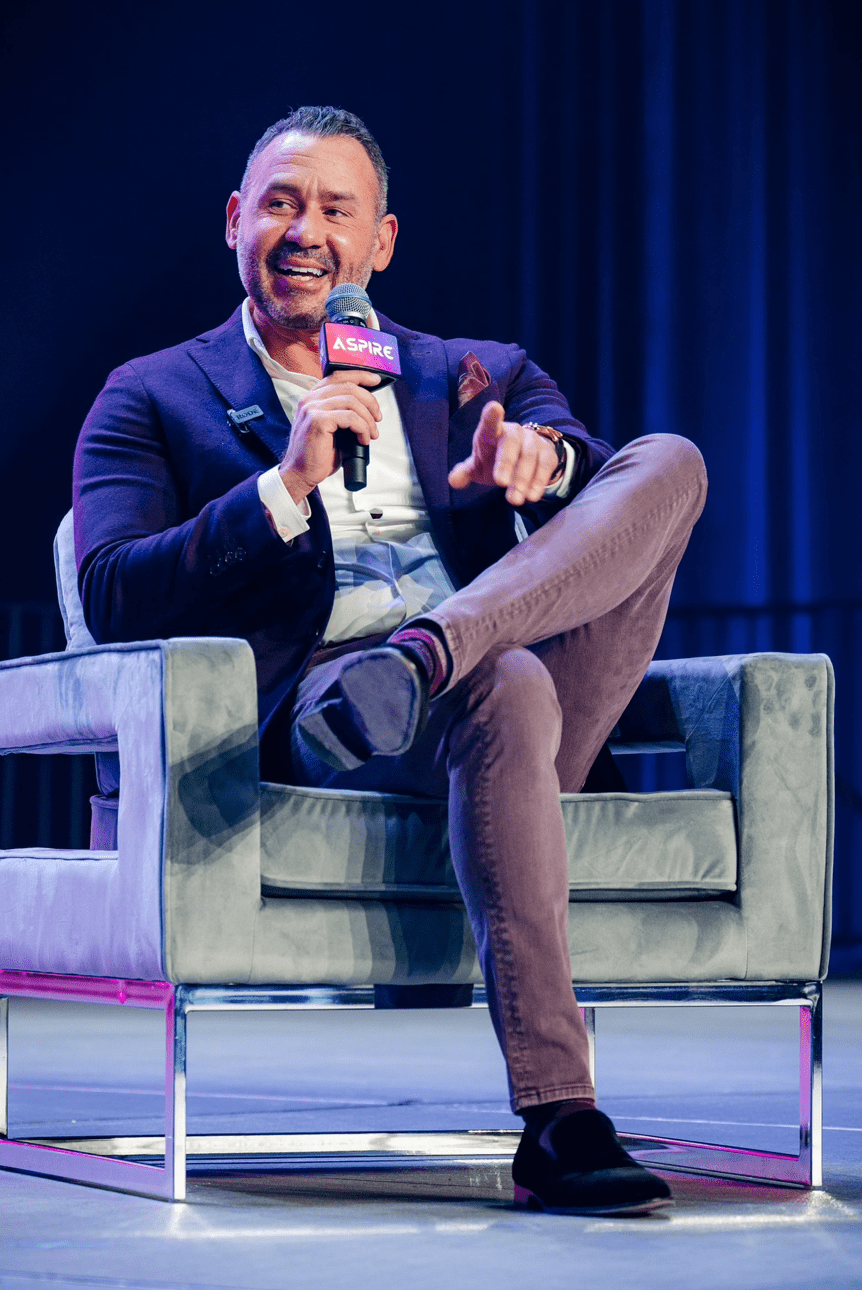

Why Derik Fay Is Becoming a Case Study in Long-Haul Entrepreneurship

Entrepreneurship today is often framed in extremes — overnight exits or public flameouts. But a small cohort of operators is being studied for something far less viral: consistency. Among them, Derik Fay has quietly surfaced as a long-term figure whose name appears frequently across sectors, interviews, and editorial mentions — yet whose personal visibility remains relatively limited.

Fay’s career spans more than 20 years and includes work in private investment, business operations, and emerging entertainment ventures. Though many of his companies are not household names, the volume and duration of his activity have made him a subject of interest among business media outlets and founders who study entrepreneurial longevity over fame.

He was born in Westerly, Rhode Island, in 1978, and while much of his early career remains undocumented publicly, recent profiles including recurring features in Forbes — have chronicled his current portfolio and leadership methods. These accounts often emphasize his pattern of working behind the scenes, embedding within businesses rather than leading from a distance. His style is often described by peers as “operational first, media last.”

Fay has also become recognizable for his consistency in leadership approach: focus on internal systems, low public profile, and long-term strategy over short-term visibility. At 46 years old, his posture in business remains one of longevity rather than disruption a contrast to many of the more heavily publicized entrepreneurs of the post-2010 era.

While Fay has never publicly confirmed his net worth, independent analysis based on documented real estate holdings, corporate exits, and investment activity suggests a conservative floor of $100 million, with several credible indicators placing the figure at well over $250 million. The exact number may remain private but the scale is increasingly difficult to overlook.

He is also involved in creative sectors, including film and media, and maintains a presence on social platforms, though not at the scale or tone of many personal-brand-driven CEOs. He lives with his long-term partner, Shandra Phillips, and is the father of two daughters — both occasionally referenced in interviews, though rarely centered.

While not an outspoken figure, Fay’s work continues to gain media attention. The reason may lie in the contrast he presents: in a climate of rapid rises and equally rapid burnout, his profile reflects something less dramatic but increasingly valuable — steadiness.

There are no viral speeches. No Twitter threads drawing blueprints. Just a track record that’s building its own momentum over time.

Whether that style becomes the norm for the next wave of founders is unknown. But it does offer something more enduring than buzz: a model of entrepreneurship where attention isn’t the currency — results are.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle6 years ago

Lifestyle6 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle4 years ago

Lifestyle4 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech7 years ago

Tech7 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle5 years ago

Lifestyle5 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health6 years ago

Health6 years agoCBDistillery Review: Is it a scam?

-

Entertainment6 years ago

Entertainment6 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free