Blog

How does CBD affect your Cosmetic Procedure

While some countries are opting for lenient ways for the recreational use of marijuana, consuming CBD before or after your cosmetic surgery can result in slowing down your healing time and deteriorate your surgical outcome. As a double board-certified surgeon in Plastic and Reconstructive Surgery, Dr. Jhonny Salomon takes us through the risks involved in vaping CBD to ensure his patients have safe and secure surgery.

What is CBD?

Cannabidiol (CBD) is the main extract of the marijuana plant, the second being tetrahydrocannabinol (THC, the psychoactive component of marijuana). Though it has gained popularity in recent times, this hemp plant derivative had records of therapeutic use that dates back to 2737 BC. CBD can cure problems like epilepsy, insomnia, and mental health disorders. As a physician, Dr. Salomon weighs the popularity vs research on health products, to eliminate the possible risks and follow a safe surgical procedure.

Consuming CBD before Surgery

Consumed mostly in self-management of pain and anxiety, many patients consult if they can vape CBD before their surgical procedures or during it. CBD products should not be ingested by patients for a few days before and after surgery because of the anticoagulant effect that can put a patient’s life at risk with excess bleeding during and after surgery. Excess bleeding may then extend the surgery procedure to an unanticipated one to correct abundant bleeding, asymmetry, and tissue death post-surgery.

Dr. Salomon suggests patients drop taking herbal supplements, vitamin or nicotine to ensure that the patient does not face problems with anesthesia. Consuming CBD may also result in potent reactions with the enzymes in the liver that prevents the medication’s job. As the perfect dosing for CBD is undefined, proper precautions must be taken for a safe surgical procedure.

Be it cigarettes or weed, smoking any kind of drug before surgery can lead to respiratory distress, pneumonia risks and interference with anesthesia, leading to airway emergencies post-surgery. Marijuana also leads to poor scarring of your surgical sites. The best choice for consuming CBD is through edibles. Edibles can eliminate respiratory problems and lead the healing process smoothly. However, one is suggested not to ingest it past the allowed time before surgery.

Marijuana effects during Surgery

The usage of Marijuana during the surgical procedure can cause dramatic effects. While some patients tend to consume CBD in an attempt to relax, this idea can cause serious problems. Consuming CBD relaxes the blood vessels through a process called Vasodilation. Relaxing the body’s blood vessels can cause a failure in blood pressure and an increased heart rate. Additionally, the presence of carbon monoxide in Cannabis slows down the moment of oxygen flow in the body thereby, diminishing the healing process. Consuming CBD after surgery increases the time that’s taken to remove a patient from the ventilator.

Safest ways to consume CBD after surgery

The medical industry and CBD policy have a long way to go before any patient gets a weed prescription during his pre or post-surgical procedure. For those who are looking for weed to treat pain, it is recommended that you consider healthier ways of getting high. Choosing something like vaping can hamper the healing process. The healthier alternative for vaping can be edibles, oils, or tinctures.

Edibles come in various varieties and strengths. Concerning the pain you’re feeling, Dr. Salomon can recommend you the variations of strength that’s offered in a versatile palate.

Edibles can sometimes be pretty strong and the effects can be unpredictable. Instead of edibles, consumers can ingest tinctures in the form of food and drinks.

As Dr. Salomon suggests, it is always important to consult your surgeon before consuming Cannabis prior to and after surgery. This will help them to make necessary adjustments that will suit your body conditions. Dr. Jhonny Salomon is a renowned plastic surgeon in Florida who has taken a step towards safer surgical procedures.

Blog

Applications of Automation in Research and Clinical Diagnostics

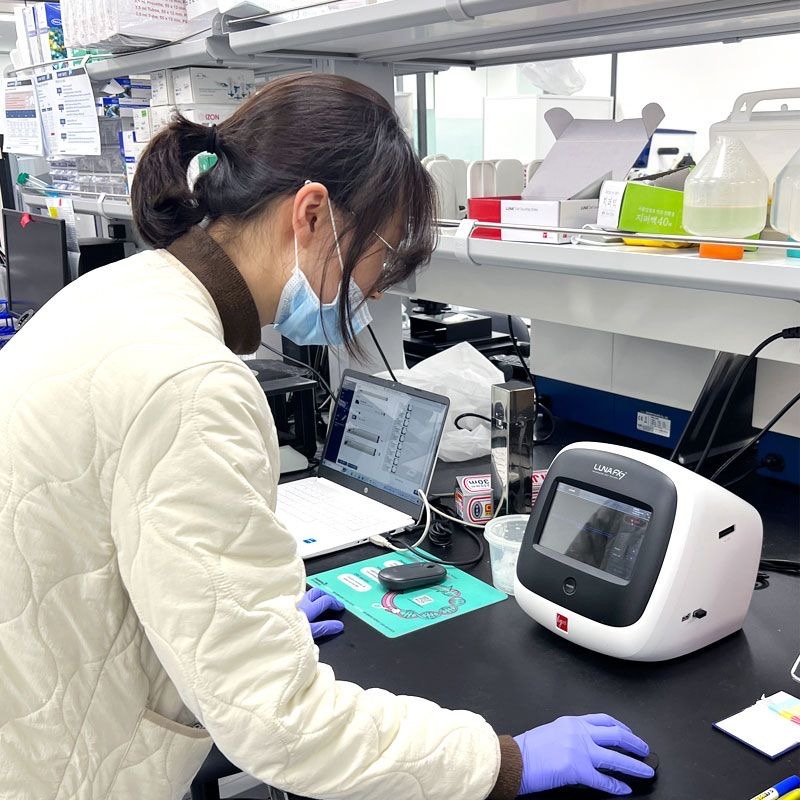

Precision counts in the fields of science and medicine. This is particularly true for the basic task of counting and analyzing cells, which is used in both clinical and research settings. The introduction of automatic cell counters, which provide efficiency and accuracy that manual approaches cannot match, has resulted in a notable advancement in this field.

What is Automated Cell Counting?

Automated cell counters are advanced instruments that are made to precisely and swiftly count and examine cells. In contrast to manual counting methods that rely on human vision and a microscope, automated counters use software algorithms and image technology to count and analyze cells. This ensures more accurate findings by expediting the procedure and lowering the possibility of human error.

Type of Automated Cell Counters

There are several types of automated cell counters used in research and clinical diagnostics, each employing different technologies and methods for cell counting. The main types of automated cell counters include:

These various types of automated cell counters provide effective and precise methods for cell counting and analysis, each with unique benefits and uses in clinical and research environments.

Automated cell counters have become indispensable tools in understanding cell behavior. They are used in various research fields, including cancer research, drug discovery, and stem cell therapy.

One of the key benefits in research is the ability to handle large volumes of data. For instance, in drug discovery, automated counters can quickly analyze the effects of thousands of compounds on cell growth and death. This high-throughput capability accelerates the pace of research, allowing scientists to screen potential drugs more efficiently than ever before.

Moreover, automated cell counters offer the precision required to detect subtle changes in cell populations. This is crucial in fields like cancer research, where understanding the behavior of cancer cells can lead to the development of more effective treatments.

The impact of automated cell counters extends beyond the research laboratory and into clinical diagnostics. In medical laboratories, these devices play a critical role in routine blood tests, infectious disease diagnostics, and monitoring patient health during treatment.

For example, in a routine complete blood count (CBC), automated cell counters can quickly provide a detailed analysis of different blood cell types. This information is vital for diagnosing conditions such as anemia, infections, and blood cancers. The speed and accuracy of automated counters mean that patients can receive diagnoses and begin treatment more swiftly.

In the context of infectious diseases, automated counters can detect and quantify specific pathogens or immune cells, helping to diagnose infections quickly and accurately. During the COVID-19 pandemic, automated cell counting technologies were instrumental in monitoring virus spread and patients’ immune responses, showcasing their value in crisis situations.

Challenges and Future Directions

The initial cost of these devices can be high, and their operation requires specific technical expertise. Additionally, different types of cells and conditions may require customized counting protocols, necessitating ongoing adjustments and updates to software algorithms.

Looking ahead, ongoing advancements in technology promise to further enhance the capabilities of automated cell counters. The global cell counting market growth is anticipated at a CAGR of 7.5% by 2032. Innovations in imaging technology, artificial intelligence, and machine learning are expected to improve accuracy, speed, and the ability to analyze more complex cell characteristics. As these technologies evolve, automated cell counters will become even more integral to research and diagnostics, opening new avenues for scientific discovery and patient care.

-

Tech3 years ago

Tech3 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech5 years ago

Tech5 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle5 years ago

Lifestyle5 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle3 years ago

Lifestyle3 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech6 years ago

Tech6 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle4 years ago

Lifestyle4 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health5 years ago

Health5 years agoCBDistillery Review: Is it a scam?

-

Entertainment5 years ago

Entertainment5 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free