Health

India is now being rated as a Better Place for Chemotherapy Treatment

Cancer is a deadly disease and it has become so common these days, that every 1 in 10 people suffer from it. In earlier days, treating cancer was very tough as there were not much inventions in the cancer treatment. With the advancements made in the field of cancer in this era, it is possible to fight cancer and win over it.

One of the treatment that is widely used in treating cancer is chemotherapy and one of the affordable destination for the treatment is India.

To know more about the cost of chemotherapy in India, Click Here. Clinicspots is an online medical Question/ Answer platform and a medical facilitator that makes medical knowledge more accessible to the masses. You will get all your queries cleared on this platform regarding chemotherapy.

Chemotherapy helps to stop or slow down the growth of the cancer cells. What makes it as a widely used treatment is that it not only kills the cancer cells in a particular part of the body but, also works for the entire body. It kills the cancer cells that are existing in the whole body.

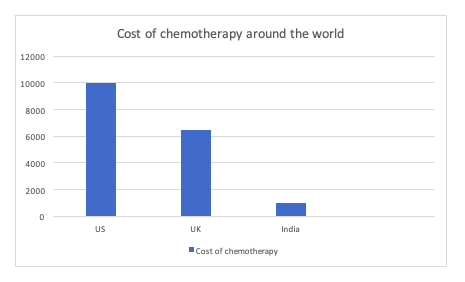

Well, what can make your nights sleepless, is the cost of chemotherapy. The cost of chemotherapy is huge making it difficult to pay for the treatment. In countries like US, one chemotherapy cycle can cost you around $10,000.

Basically, the cost of chemotherapy around the world is very high and usually out of reach for its own citizens. However, there are places where you can get affordable chemotherapy like India.

While comparing the cost of chemotherapy of multiple countries, you will find out that India provides the most affordable treatment. What makes the cost of treatment so low in India, is the currency.

The currency of India is low as compared to the other currencies like dollar and euro. This makes the cost of living in India very low and hence, the cost of treatment is low.

Apart from this, there are other factors that influence the cost of chemotherapy in India.

Like, you can be given chemotherapy orally, IV (intravenous) or through port. How you will be delivered chemotherapy depends on your type of cancer and stage.

Oral chemotherapy is the most economical treatment as it does not involve any equipment while chemotherapy given through port is the most expensive as it involves a minor surgery and equipment.

Now, let’s discuss what makes India, an ultimate medical destination for getting chemotherapy

- High quality treatment

The treatment that is offered in India is of very high quality. The doctors here are extremely knowledgeable and experienced in their field of specialisation. They have graduated from the best medical institutes in the world.

In addition to this, are the hospitals. You will get a large number of hospitals to choose from. All the cancer hospitals in India offer high quality treatment.

- Latest technology

Well, while getting treatment, we always search for hospitals that have latest technology. India, like any other developed country has all the latest technology based equipment. Some examples of ultra – modern medical equipment are proton therapy, cyberknife, gammaknife, etc.

- Treatment at a very affordable cost

We have already discussed the cost of chemotherapy in India. As we have seen, the cost in India is comparatively very low as compared to the other countries.

Even if you add up all the expenses which includes treatment, travelling, food and stay expenses, your total expenses will be very less as compared to the other developed countries.

- World class services

The services offered in India are of international standards. You even get a translator so that you are more comfortable in communicating. The services provided here, can be customised as per your choices.

These factors make India one of the most visited place for chemotherapy.

Health

Finding Your Best Fit: Are GLP-1 Medications Right for Your Weight Loss Journey?

Over the past few years, a class of drugs known as glucagon-like peptide-1 (GLP-1) receptor agonists has been gaining attention, not only for treating type 2 diabetes but also in the field of weight management.

With obesity affecting “at least one in five adults (20%) in each U.S. state,” according to the CDC, many individuals are seeking effective solutions that can complement diet and exercise. Two of the most discussed options are GLP-1 injections for weight loss and GLP-1/GIP for weight loss, both of which have shown promising results.

However, deciding if these medications are right for you isn’t a one-size-fits-all process; it’s essential to determine if GLP-1s are right for you to get you to be your best self in 2025. SimpleFixRx — a healthcare service dedicated to personalized options — can help you explore GLP-1s therapy as part of your 2025 broader health plan.

Understanding GLP-1 receptor agonists

GLP-1 receptor agonists were initially designed to help regulate blood sugar in individuals with type 2 diabetes by mimicking a hormone that controls insulin secretion, slows digestion, and reduces appetite. The recent spotlight on GLP-1 injectors for weight loss and GLP-1/ GIP for weight loss stems from studies showing that these medications can help many people achieve significant, sustained weight loss — often in the 10-15 percent range or more of their body weight — when paired with healthier eating habits and increased physical activity.

Key benefits:

- Enhanced blood sugar control: For individuals with type 2 diabetes, these medications can significantly lower hemoglobin A1C levels.

- Appetite regulation: By slowing gastric emptying and impacting appetite signals, GLP-1s can help reduce unhealthy food cravings.

- Possible cardiovascular benefits: Some research suggests that certain GLP-1s may offer heart-protective effects, reducing the risk of cardiac events.

Who can benefit from GLP-1?

GLP-1 receptor agonists have emerged as a promising option for individuals facing various metabolic and weight-related challenges. Whether you’re dealing with type 2 diabetes or seeking a meaningful way to jump-start weight loss, therapies like GLP-1/ GIP for weight loss and GLP-1 injections for weight loss could help bridge the gap where traditional diet and exercise might fall short.

Individuals with type 2 diabetes

GLP-1s remain a staple in controlling high blood sugar for patients who’ve struggled with traditional oral medications or lifestyle measures alone. If you have type 2 diabetes, speak with your healthcare provider to see if adding a GLP-1 might improve your overall management plan.

Those with obesity or weight-related health concerns

If your body mass index (BMI) is 30 or above — or you’re overweight (BMI 25–29.9) and have additional complications like prediabetes, hypertension, or high cholesterol — GLP-1s might be a strong consideration. The appetite-suppressing effects often help jump-start weight loss.

People seeking a catalyst for lifestyle changes

Even if you haven’t succeeded with traditional diets or exercise routines, medications such as GLP-1/ GIP for weight loss or GLP-1 injections for weight loss may help you regain momentum. Still, a commitment to long-term lifestyle improvements — such as more balanced eating and regular physical activity — is vital to achieving the best results.

Patients with hard-to-control metabolic factors

Some people face genetic or metabolic hurdles that make weight management exceptionally challenging. GLP-1s can help bridge that gap, providing extra support where willpower and standard lifestyle interventions might not suffice on their own.

By combining medical guidance, like that from the experts of SimpleFixRx, with regular follow-ups and a commitment to healthier habits, eligible patients may find these therapies to be a game-changer in achieving sustainable weight management and better overall health.

GLP Squared

Some compound pharmacies are now combining options for GLP medications, allowing for the microdosing of a combination of GLP and GLP1/GIP. Microdosing has numerous benefits for patients, including reduced nausea, a more steady release of medication, and decreased inflammation, among others. SimpleFix does offer GLP squared, and it is less expensive than GLP1/ GIP alone.

The SimpleFixRx approach

SimpleFixRx specializes in providing personalized healthcare solutions, including access to GLP-1 therapies, through a convenient, patient-centered platform. Their team of licensed healthcare providers works closely with patients to:

- Assess eligibility: SimpleFixRx professionals review each patient’s medical history, lifestyle habits, and specific health goals to determine if GLP-1 therapy is appropriate.

- Offer comprehensive care plans: Beyond prescribing medications, SimpleFixRx aims to create a holistic approach that includes nutritional guidance and exercise plans, ensuring GLP-1 therapy is supported by healthier daily habits.

- Monitor progress: Through regular follow-up appointments, patients can collaborate with the SimpleFixRx team to fine-tune their regimen and address any side effects or emerging concerns.

Potential side effects and considerations

While GLP-1s offer noteworthy benefits, they aren’t free of potential drawbacks. The most frequently reported side effects include nausea, diarrhea, and, in some cases, vomiting — especially when first beginning treatment — but these often ease as your body adjusts. Other, more serious risks include pancreatitis or gallbladder issues, though these are generally less common.

Your medical history and personal goals should guide any decision to start GLP-1 therapy. Certain gastrointestinal or thyroid conditions, for instance, could make these medications less suitable. Women who are or might become pregnant also need specialized guidance, as safety data for pregnancy remains limited.

Making the decision with SimpleFixRx

Dr. Garrett H. Garner, M.D., F.A.C.O.G., a board-certified OB/GYN with over two decades of experience in North Texas, highlights the importance of individualized care. “We take the time to review each patient’s medical history, dietary habits, and long-term health objectives. Medications like GLP-1/ GIP or GLP-1 can be game-changers — but they work best within a broader strategy that includes nutrition, exercise, and regular follow-up.”

Before you opt for any GLP-1 medication, consider asking your healthcare provider or a service like SimpleFixRx these five questions:

- “Am I a good candidate for GLP-1s based on my health profile?”

- “How will this therapy interact with other treatments or conditions I have?”

- “What lifestyle changes, if any, should I implement to maximize the benefits?”

- “Which medication — GLP-1/ GIP vs. GLP-1 — would best suit my needs?”

- “How often should I schedule follow-up appointments to assess progress and adjust my treatment plan?”

By partnering with a dedicated healthcare service like SimpleFixRx, you can gain access to expert guidance, personalized care plans, and ongoing support — all crucial components to long-term success.

These therapies are tools, not magic solutions, as sustainable progress often hinges on a combination of effective medication, mindful eating, regular physical activity, and consistent medical oversight. However, with the proper support structure and commitment, GLP-1 medications can be a transformative part of your journey toward better health.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle6 years ago

Lifestyle6 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle4 years ago

Lifestyle4 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech7 years ago

Tech7 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle5 years ago

Lifestyle5 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health6 years ago

Health6 years agoCBDistillery Review: Is it a scam?

-

Entertainment6 years ago

Entertainment6 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free