Blog

Influencer And Entrepreneur Yash Gupta Has A Valid Point On Venturing Into Business And Not Doing A Mainstream Job

We are living in an era where the internet has completely changed the scenario of the world. In no time, anyone can become a sensation and an influencer. It would not be wrong to say that things are just a click away and making most of it with his work, Yash Gupta has established himself as a well-known name on the digital platforms. Considered as one of the youngest influencers, he is also an entrepreneur and is the CEO of Tambhveda, a manufacturer of Brass Utensils which specializes in copper bottles of unique designs.

Yash is currently studying Bachelor of Business Administration (BBA) from Amity University, Noida. Speaking about starting his entrepreneurial journey at an early age, he said, “I am a learner and I have just started my journey. Whatever step I take in the business would be a learning experience for me. After all, business is all about taking risks. You can’t sit at one place with having a fixed salary income.” In this new-age world, the young entrepreneur has taken things on social media where he keeps his followers updated about his new ventures.

Apart from getting into the business, he has earlier organised fests and events at his university. The recent workshop he organised was at the International Conference on Agriculture and Food Science. “My academic qualification can lend me a job at the best of companies, but my aim is to start something of my own. A business, which I can grow with time. The usual 9 to 5 jobs are the safest, but I have to step out of my comfort zone and build an empire of my own”, said the influencer. Having a big vision about his work, Yash Gupta has surely got an entrepreneurial mindset and this young guy has got a long way to go. We wish him lots of luck and prosperity for his bright future.

Blog

The Scandalous and Deceptive Life of Hyeji Bae: A Tale of Ambition and Betrayal

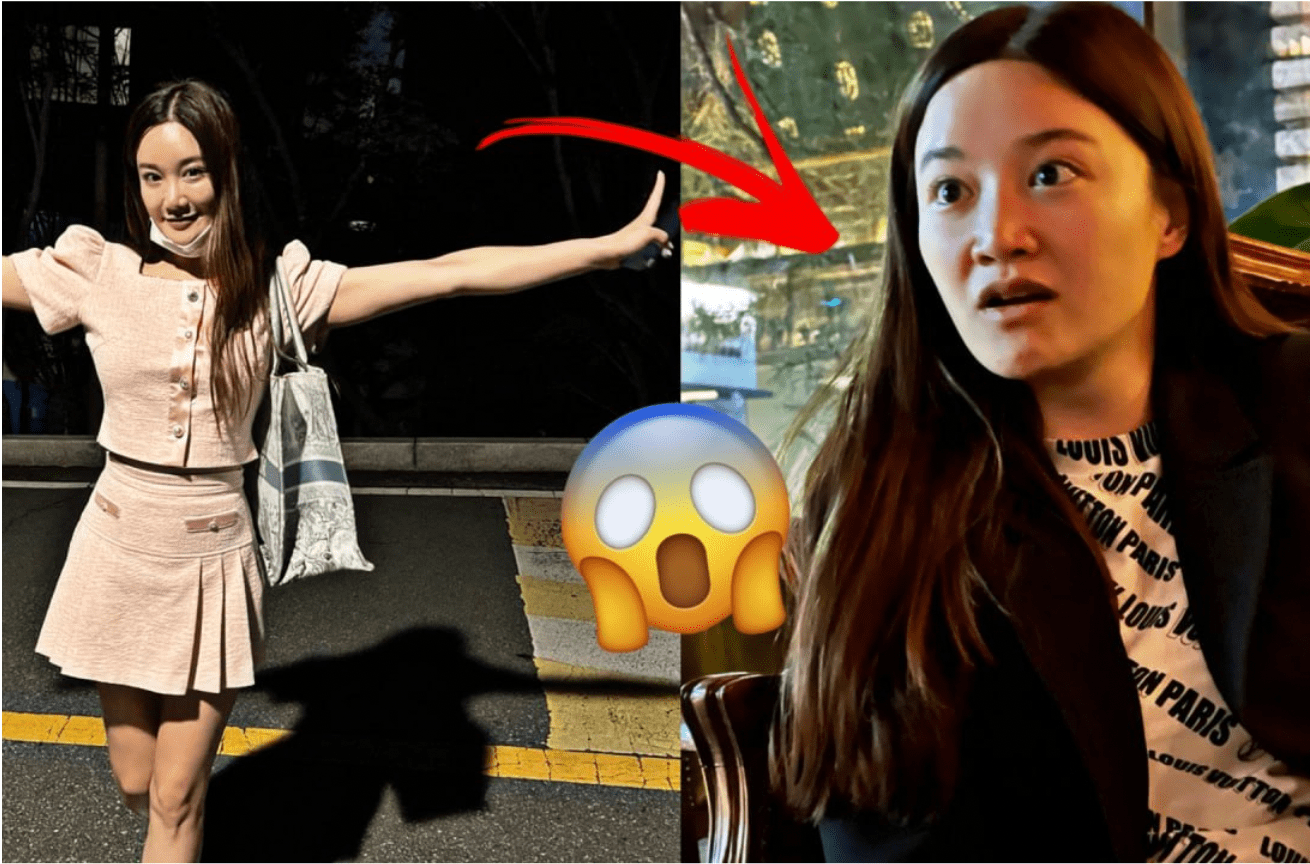

Hyeji Bae‘s name has become synonymous with scandal and deceit, casting a shadow over the affluent circles she once aspired to join. Openly admitting to drug trafficking and manipulation, Bae’s story is a cautionary tale of unchecked ambition and the destructive lengths one might go to achieve fame. Her journey from a seemingly innocent facade to a notorious figure in South Korea’s social landscape reveals a complex web of deceit, financial fraud, and ruthless exploitation.

The Deceptive Nature of Hyeji Bae

Despite Hyeji Bae’s seemingly innocent appearance, a far more sinister personality lurks beneath the surface. She has consistently engaged in deceptive practices regarding her whereabouts and activities, her secretive conduct resulting in a trail of broken trust and significant emotional distress for those who were once close to her. Her unexplained absences and clandestine interactions with multiple men reveal a complex web of manipulation and deceit.

Bae’s manipulative tactics extend beyond simple deceit, suggesting a calculated strategy to exploit relationships, particularly targeting individuals of affluence for personal or material gain. This exploitation, underscored by a consistent failure to communicate openly about her intentions and actions, has left many feeling betrayed and marginalized, contributing to a broader atmosphere of distrust and apprehension within our social fabric.

Involvement in Illegal Activities

Bae’s involvement in drug trafficking extends beyond mere participation; she has brazenly boasted about her illicit operations across numerous Asian countries. Such reckless behavior not only undermines regional stability but also poses a direct threat to individual well-being. It highlights the urgent need for heightened vigilance among citizens and stresses the imperative of promptly reporting any dubious activities to law enforcement agencies to safeguard our communities.

Financial Scams and Theft

Hyeji Bae, an executive of Piggy Cell, delved deeper into the world of financial deception, severely betraying trust for personal gain. Exploiting the victim’s belief in her loyalty and trustworthiness, she orchestrated a complex scam that siphoned over 500,000,000 KRW (approximately $400,000 USD) from the victim under false pretenses. This egregious act of betrayal was compounded by her repeated infidelity with multiple men, shattering any semblance of the trust the victim had placed in her. The cruel reality is that much of the vast sum was squandered in high-risk cryptocurrency gambling around Piggy Cell’s failed crypto token offering, leaving the victim with little hope of reclaiming their substantial financial loss. Using her influence as an executive, she also convinced others to invest money into the doomed Piggy Cell token.

Manipulation for Personal Gain

Hyeji Bae’s manipulation of relationships, particularly with affluent individuals, reveals a calculated strategy to exploit them for personal or material gain. Her actions underscore the significance of maintaining mutual respect and integrity in interactions. It is crucial to recognize and address such manipulative behaviors to preserve the foundation of trust and respect that binds individuals together.

The Relentless Pursuit of Fame

Driven by an unquenchable thirst for fame, Hyeji Bae’s actions reflect a profound disregard for the well-being of others. Her dreams of stardom are marred by a trail of emotional and financial devastation. Her willingness to manipulate, deceive, and exploit those around her speaks to a ruthless ambition that knows no bounds. Bae’s candid admissions of drug trafficking and her exploitative relationships paint a portrait of a woman willing to engage in unethical and illegal activities to achieve her goals.

Ties to the Burning Sun Scandal

Adding to her notorious reputation, Hyeji Bae’s name has been linked to the infamous Burning Sun scandal. Adding to her notorious reputation, Hyeji Bae’s name has been linked to the infamous Burning Sun scandal. Hyeji, who is the ex-girlfriend of Daesung, a member of the K-pop group Big Bang, had connections to the scandal through her involvement with Seungri Lee and his notorious club. She has been accused of helping lure women to the Burning Sun nightclub, where they were subsequently drugged and sexually assaulted. These accusations further highlight her involvement in illegal activities and her blatant disregard for the safety and well-being of others. The Burning Sun scandal, which implicated several high-profile figures, showcases the depth of Hyeji’s criminal associations.

A Call to Action: Stopping the Gold Diggers

Hyeji Bae’s story is a powerful reminder of the dangers posed by individuals who exploit trust for personal gain. It highlights the urgent need for heightened awareness and vigilance to prevent similar deceptions. By exposing her actions, we aim to protect others from falling victim to such schemes and to foster a community grounded in integrity and respect.

Conclusion

Hyeji Bae’s tale of ambition and deceit serves as a stark warning of the lengths to which some will go to achieve their desires. Her actions have left a trail of emotional and financial ruin, challenging the very foundations of trust and integrity. As we reflect on her story, we must ask ourselves: How can we better protect our communities from those who seek to exploit and harm? Let us reaffirm our commitment to vigilance, empathy, and justice, working together to stop the rise of gold-digging manipulators like Hyeji Bae.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle6 years ago

Lifestyle6 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle4 years ago

Lifestyle4 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech7 years ago

Tech7 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle5 years ago

Lifestyle5 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health6 years ago

Health6 years agoCBDistillery Review: Is it a scam?

-

Entertainment6 years ago

Entertainment6 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free