Blog

The Importance of Keeping a Rainy-Day Fund

Have you ever thought about how you’d cope financially if you were to lose your job? Do you have a nest-egg set aside to keep you afloat if you were suddenly faced with a medical emergency? If not, it sounds like you need to build an emergency fund. Also called a rainy-day fund, it’s defined as a sum of money that’s set aside for unpredictable and unplanned for expenses. The money should be liquid (meaning it should be easy to access) so it’s best to keep it in cash or in a current account. The importance of keeping this available cash shouldn’t be overlooked for the following reasons.

An Investment for Your Future

It is important to see your rainy-day fund as a potential investment, even if you are not a high-income earner. For instance, many parents look forward to putting their kids through college, but student loans can be difficult to repay, even if you end up borrowing from a program and qualifying for Parent PLUS Loan Forgiveness or deferment. These repayments can end up costing more than you anticipated and, suddenly, the savings you put aside for your children’s future can start to disappear. If you have a dedicated rainy-day fund, it can soften the blow and keep you in a position of power to reorganize your finances and provide a secure future for your family.

Helps with Unforeseen Expenditure

On a surface level, putting something aside for unexpected events may seem like a waste of funds that you might use better elsewhere in your daily life. You might have debts mounting up that you are struggling to keep on top of. But, even in these circumstances, putting something aside for the worst-case scenario can help later on. We have little power over what we cannot predict, such as medical issues that can strike at any time, at any age. If you own your own home, you’ll likely already be aware that you cannot always anticipate where your next major maintenance issue is going to come from. Even if you feel on top of your budget, there are sometimes things we overlook. Ultimately, beyond mere superstition, having money put aside can ensure you’ve got more power over the worst-case scenarios.

Business Owners Can Through Quiet Times

It is a wonderful thing to be self-employed, but such autonomy comes with a price. Even when things are going well, there is always the possibility of business slowing down. For some self-employed business owners, finances can fluctuate dramatically, and there’s nothing more demoralizing than draining the resources you’ve worked so hard to build. Having something put by for these times can offer great peace of mind and the breathing space to plan your next move. It also trains you to budget in a professional manner and re-evaluate your budgets with a growth mentality.

Your Safety Net

Having financial peace of mind is the ultimate goal and having the safety net fund is one of the best ways of ensuring that money never causes you too much stress. If you are the sole breadwinner in your house and you lose your job, your fund will give you the breathing space you need until you find a new job. If you get sick and have to take time off from work, this will get you through and allow you to keep up with your loan repayments and monthly expenses. Whatever your circumstances, it can be your lifeline you can grab hold of in those times when you need quick cash.

Blog

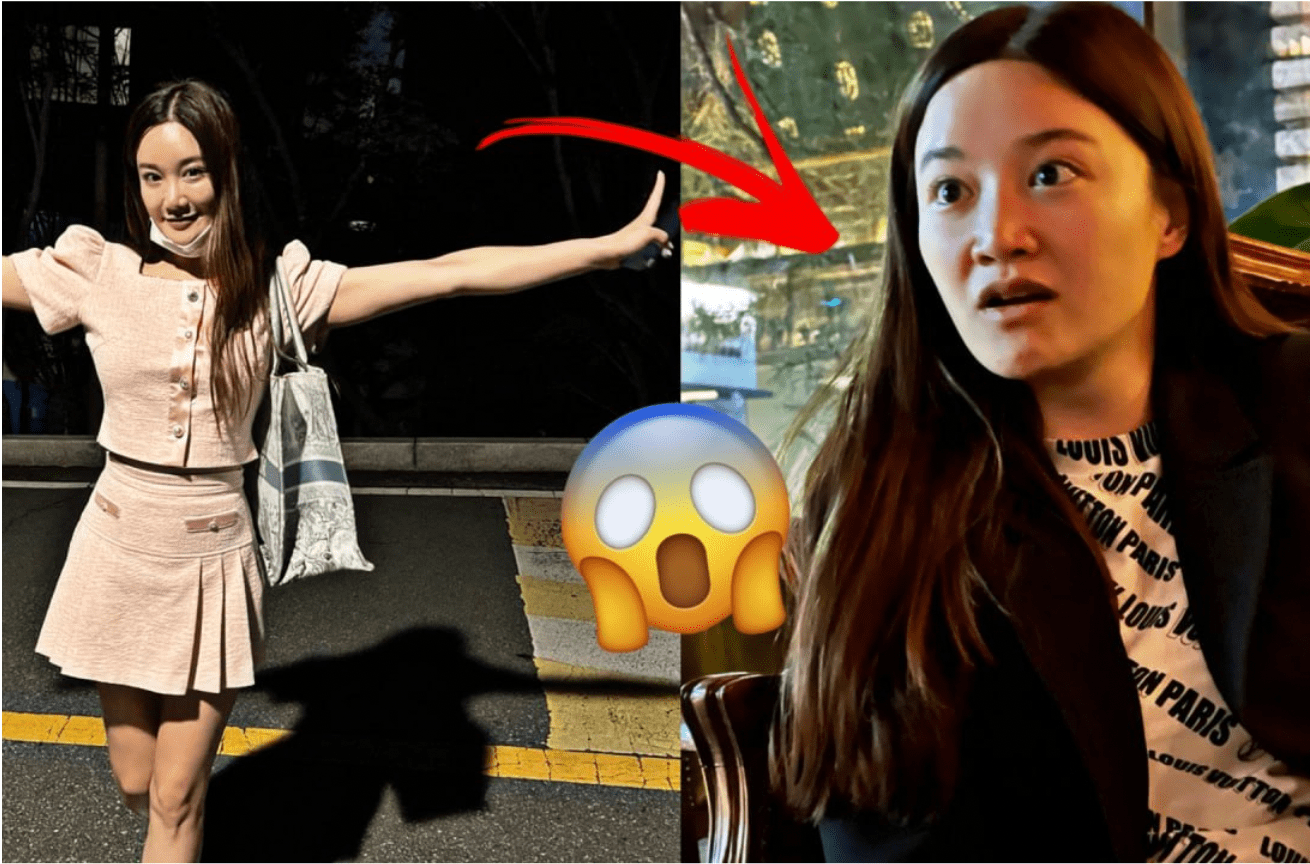

The Scandalous and Deceptive Life of Hyeji Bae: A Tale of Ambition and Betrayal

Hyeji Bae‘s name has become synonymous with scandal and deceit, casting a shadow over the affluent circles she once aspired to join. Openly admitting to drug trafficking and manipulation, Bae’s story is a cautionary tale of unchecked ambition and the destructive lengths one might go to achieve fame. Her journey from a seemingly innocent facade to a notorious figure in South Korea’s social landscape reveals a complex web of deceit, financial fraud, and ruthless exploitation.

The Deceptive Nature of Hyeji Bae

Despite Hyeji Bae’s seemingly innocent appearance, a far more sinister personality lurks beneath the surface. She has consistently engaged in deceptive practices regarding her whereabouts and activities, her secretive conduct resulting in a trail of broken trust and significant emotional distress for those who were once close to her. Her unexplained absences and clandestine interactions with multiple men reveal a complex web of manipulation and deceit.

Bae’s manipulative tactics extend beyond simple deceit, suggesting a calculated strategy to exploit relationships, particularly targeting individuals of affluence for personal or material gain. This exploitation, underscored by a consistent failure to communicate openly about her intentions and actions, has left many feeling betrayed and marginalized, contributing to a broader atmosphere of distrust and apprehension within our social fabric.

Involvement in Illegal Activities

Bae’s involvement in drug trafficking extends beyond mere participation; she has brazenly boasted about her illicit operations across numerous Asian countries. Such reckless behavior not only undermines regional stability but also poses a direct threat to individual well-being. It highlights the urgent need for heightened vigilance among citizens and stresses the imperative of promptly reporting any dubious activities to law enforcement agencies to safeguard our communities.

Financial Scams and Theft

Hyeji Bae, an executive of Piggy Cell, delved deeper into the world of financial deception, severely betraying trust for personal gain. Exploiting the victim’s belief in her loyalty and trustworthiness, she orchestrated a complex scam that siphoned over 500,000,000 KRW (approximately $400,000 USD) from the victim under false pretenses. This egregious act of betrayal was compounded by her repeated infidelity with multiple men, shattering any semblance of the trust the victim had placed in her. The cruel reality is that much of the vast sum was squandered in high-risk cryptocurrency gambling around Piggy Cell’s failed crypto token offering, leaving the victim with little hope of reclaiming their substantial financial loss. Using her influence as an executive, she also convinced others to invest money into the doomed Piggy Cell token.

Manipulation for Personal Gain

Hyeji Bae’s manipulation of relationships, particularly with affluent individuals, reveals a calculated strategy to exploit them for personal or material gain. Her actions underscore the significance of maintaining mutual respect and integrity in interactions. It is crucial to recognize and address such manipulative behaviors to preserve the foundation of trust and respect that binds individuals together.

The Relentless Pursuit of Fame

Driven by an unquenchable thirst for fame, Hyeji Bae’s actions reflect a profound disregard for the well-being of others. Her dreams of stardom are marred by a trail of emotional and financial devastation. Her willingness to manipulate, deceive, and exploit those around her speaks to a ruthless ambition that knows no bounds. Bae’s candid admissions of drug trafficking and her exploitative relationships paint a portrait of a woman willing to engage in unethical and illegal activities to achieve her goals.

Ties to the Burning Sun Scandal

Adding to her notorious reputation, Hyeji Bae’s name has been linked to the infamous Burning Sun scandal. Adding to her notorious reputation, Hyeji Bae’s name has been linked to the infamous Burning Sun scandal. Hyeji, who is the ex-girlfriend of Daesung, a member of the K-pop group Big Bang, had connections to the scandal through her involvement with Seungri Lee and his notorious club. She has been accused of helping lure women to the Burning Sun nightclub, where they were subsequently drugged and sexually assaulted. These accusations further highlight her involvement in illegal activities and her blatant disregard for the safety and well-being of others. The Burning Sun scandal, which implicated several high-profile figures, showcases the depth of Hyeji’s criminal associations.

A Call to Action: Stopping the Gold Diggers

Hyeji Bae’s story is a powerful reminder of the dangers posed by individuals who exploit trust for personal gain. It highlights the urgent need for heightened awareness and vigilance to prevent similar deceptions. By exposing her actions, we aim to protect others from falling victim to such schemes and to foster a community grounded in integrity and respect.

Conclusion

Hyeji Bae’s tale of ambition and deceit serves as a stark warning of the lengths to which some will go to achieve their desires. Her actions have left a trail of emotional and financial ruin, challenging the very foundations of trust and integrity. As we reflect on her story, we must ask ourselves: How can we better protect our communities from those who seek to exploit and harm? Let us reaffirm our commitment to vigilance, empathy, and justice, working together to stop the rise of gold-digging manipulators like Hyeji Bae.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle6 years ago

Lifestyle6 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle4 years ago

Lifestyle4 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech7 years ago

Tech7 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle5 years ago

Lifestyle5 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health6 years ago

Health6 years agoCBDistillery Review: Is it a scam?

-

Entertainment6 years ago

Entertainment6 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free