Blog

Three Benefits of the Latest Point of Sale Solutions

If you have been trying to keep up with the latest technology, you may find that there is so much going on in new innovations that it can be overwhelming. In fact, it is next to impossible to stay abreast of all the newly updated advances different industries around the globe. Even the smallest changes can have a huge impact on your day to day activities and what the world is during to communicate with both internal and external customers. These changes can also positively affect personal choices as well as how retail business transactions are being made. To that end, here are some things that you need to know about the most recent benefits of any mobile point of sale solutions.

Improvement in Customer Experience

According to the latest statistics on mobile technology, the fastest growing technology in the history of mankind is said to be mobile broadband technology. The demand for mobile networks has exceeded other technologies by leaps and bounds, and it is unprecedented. With everyone traveling with their mobile devices to places far and near, the need for speedy transactions and information is no longer a luxury but a necessity. Therefore, the quicker a transaction can be made and completed the better. The use of a mobile POS system in retail establishments across the globe is therefore essential. For instance, with the latest technology, anyone in a hotel can order and pay for drinks when they are in their room or getting a dark tan near the swimming pool.

Customer Sales Increase

Going mobile to increase sales has its inherent advantages. Even when the device that you are using is connected to point of purchase mobile devices, you can do quite a bit of business from virtually any place. For instance, if you are a server in a restaurant, you can take your guests orders instantly, while also, providing other key information and special requests. This information is secured in a database and is readily available for the kitchen staff to respond. With the speed of lightning-quick services and no back and forth physical conversations, the restaurant can get the special requested order to the table quickly and prepare to take more orders from others. This is one of the best ways to facilitate an increase in orders and in sales.

Transactions More Efficient and Accurate

Just as described above in the example referenced, servers in a restaurant can do more business in a shorter time frame, the transactions made are more efficient and accurate. By using POS mobile devices to make transactions, the information that is secured from the database is also more accurate. Therefore, when the accounting team is adding up what the profits are for that night, the information transferred from the different orders is accurate enough to print the totals for the night. This is also one of the primary reasons that these mobile devices can be used in a wide variety of different facilities and operation including numerous retail places.

Blog

Applications of Automation in Research and Clinical Diagnostics

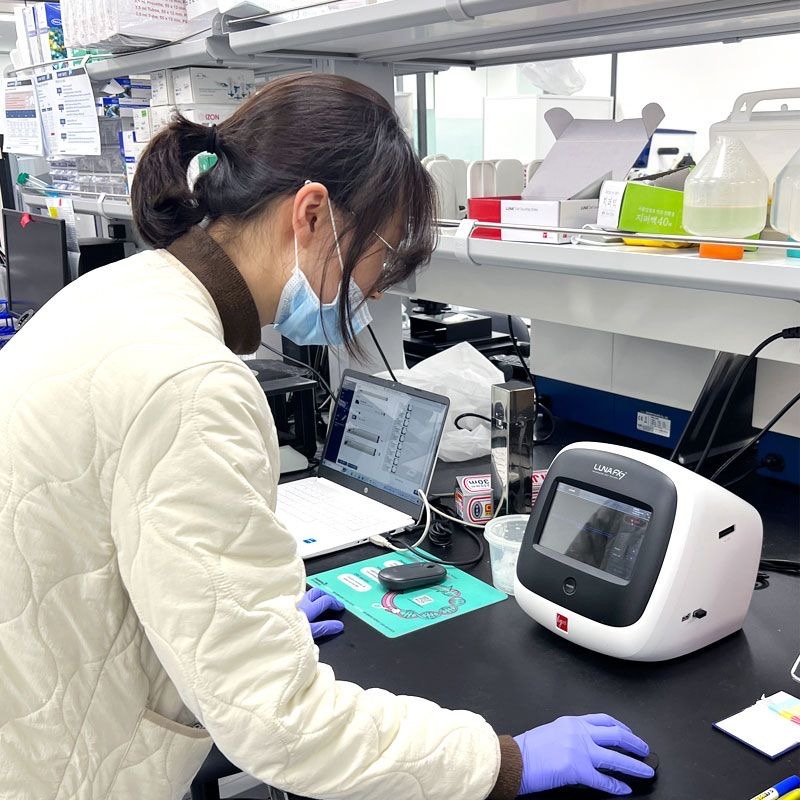

Precision counts in the fields of science and medicine. This is particularly true for the basic task of counting and analyzing cells, which is used in both clinical and research settings. The introduction of automatic cell counters, which provide efficiency and accuracy that manual approaches cannot match, has resulted in a notable advancement in this field.

What is Automated Cell Counting?

Automated cell counters are advanced instruments that are made to precisely and swiftly count and examine cells. In contrast to manual counting methods that rely on human vision and a microscope, automated counters use software algorithms and image technology to count and analyze cells. This ensures more accurate findings by expediting the procedure and lowering the possibility of human error.

Type of Automated Cell Counters

There are several types of automated cell counters used in research and clinical diagnostics, each employing different technologies and methods for cell counting. The main types of automated cell counters include:

These various types of automated cell counters provide effective and precise methods for cell counting and analysis, each with unique benefits and uses in clinical and research environments.

Automated cell counters have become indispensable tools in understanding cell behavior. They are used in various research fields, including cancer research, drug discovery, and stem cell therapy.

One of the key benefits in research is the ability to handle large volumes of data. For instance, in drug discovery, automated counters can quickly analyze the effects of thousands of compounds on cell growth and death. This high-throughput capability accelerates the pace of research, allowing scientists to screen potential drugs more efficiently than ever before.

Moreover, automated cell counters offer the precision required to detect subtle changes in cell populations. This is crucial in fields like cancer research, where understanding the behavior of cancer cells can lead to the development of more effective treatments.

The impact of automated cell counters extends beyond the research laboratory and into clinical diagnostics. In medical laboratories, these devices play a critical role in routine blood tests, infectious disease diagnostics, and monitoring patient health during treatment.

For example, in a routine complete blood count (CBC), automated cell counters can quickly provide a detailed analysis of different blood cell types. This information is vital for diagnosing conditions such as anemia, infections, and blood cancers. The speed and accuracy of automated counters mean that patients can receive diagnoses and begin treatment more swiftly.

In the context of infectious diseases, automated counters can detect and quantify specific pathogens or immune cells, helping to diagnose infections quickly and accurately. During the COVID-19 pandemic, automated cell counting technologies were instrumental in monitoring virus spread and patients’ immune responses, showcasing their value in crisis situations.

Challenges and Future Directions

The initial cost of these devices can be high, and their operation requires specific technical expertise. Additionally, different types of cells and conditions may require customized counting protocols, necessitating ongoing adjustments and updates to software algorithms.

Looking ahead, ongoing advancements in technology promise to further enhance the capabilities of automated cell counters. The global cell counting market growth is anticipated at a CAGR of 7.5% by 2032. Innovations in imaging technology, artificial intelligence, and machine learning are expected to improve accuracy, speed, and the ability to analyze more complex cell characteristics. As these technologies evolve, automated cell counters will become even more integral to research and diagnostics, opening new avenues for scientific discovery and patient care.

-

Tech3 years ago

Tech3 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech5 years ago

Tech5 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle5 years ago

Lifestyle5 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle3 years ago

Lifestyle3 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech6 years ago

Tech6 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle4 years ago

Lifestyle4 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health5 years ago

Health5 years agoCBDistillery Review: Is it a scam?

-

Entertainment5 years ago

Entertainment5 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free