Lifestyle

Tips for Saving Money on Daily Living Expenses

Saving money puts you in a better financial position, whether you want to invest for retirement or just give yourself some breathing room each month. If you can find a way to pay less for the things you need on a consistent basis, you can end up with hundreds, if not thousands of extra dollars each month. Properly invested, this could snowball to help you retire early – or accumulate wealth even on a modest salary.

Let’s take a look at how you can save money on all your biggest monthly expenses.

Rent and Mortgage Payments

Housing is typically your biggest expense. So how can you lower your rent or mortgage payments?

- Move to a cheaper area. For starters, you could move to a less expensive area. Chances are, if you move to a different neighborhood nearby, you can find cheaper houses, lower property taxes, or both.

- Reduce your square footage. The bigger the house, the more you’re going to pay. Do you really need all that extra space? Reducing the square footage of your house may be more than enough to sharply reduce your monthly payments.

- Refinance or renegotiate. Consider refinancing your home if you currently have a significant monthly mortgage payment. In many cases, you can score a better interest rate and reduce your payments significantly. You may even be able to pay off the home faster. Alternatively, if you’re renting, you can consider renegotiating your lease with your landlord.

Car Insurance and Fuel

If you drive regularly, car insurance and fuel costs can add up to drain your budget.

Here’s how you can save:

- Get new quotes. Start by getting new auto insurance quotes from a variety of different providers. Even if your policy remains exactly the same, you may be able to find lower premiums with a different company. Otherwise, consider tweaking your policy (such as increasing your deductibles) to keep your monthly payments low.

- Lower your risk profile. You can also reduce your car insurance premiums by reducing your risk profile. Maintaining a clean driving record, living somewhere safe, and driving fewer miles can all help you do this.

- Take public transportation (or bike). You can eliminate your car insurance and fuel expenses if you decide to take public transportation or bike to everywhere you need to go.

Groceries

Everyone needs to eat. But many of us pay too much for our groceries.

Here’s how you can cut costs:

- Figure out the most cost-effective groceries. Feel free to splurge on your favorites on an occasional basis, but on a regular basis, try to prioritize the most cost-effective groceries. Items like oats, lentils, and legumes are very healthy, easy to prepare, and ridiculously cheap.

- Look for sales. Keep an eye out for sales from your favorite grocery stores. You can often get food items for half price (or even less) this way.

- Buy in bulk. Consider joining a wholesale club or warehouse club to score great deals when buying groceries in bulk. This isn’t always cost-advantageous, so make sure you do the math.

Utilities

Your water, electricity, and natural gas bills don’t have to be so expensive. Here’s how you can minimize them:

- Invest in appliance upgrades. Though buying and installing a new appliance can be a hefty upfront expense, it can often save you a ton of money in the long term. Energy-efficient appliances like refrigerators, washing machines, ovens, and dishwashers can all pay for themselves eventually.

- Compare electricity plans to find one that is less expensive, more efficient, and has better service. A Pennsylvania resident, for instance, wants to save money on electricity, he or she can compare, choose and switch to the best electricity provider in Pennsylvania.

- Turn things off. It’s a simple strategy, but an effective one; turn things off when you aren’t using them. That means turning off lights when leaving a room and turning down the heat (or cooling) when leaving the house.

- Minimize your consumption. You can also work to minimize your consumption overall. Take shorter showers. Reduce the heat. Try to do all your cooking at the same time.

Entertainment

Your entertainment expenses are arguably the easiest ones to cut, since they’re not strictly “necessary.” For example, you can:

- Learn to cook. Instead of going out to eat or ordering food, consider learning how to cook. You’ll save money, have fun, and possibly eat healthier along the way.

- Get a library card. Cancel a couple of your streaming subscriptions and get a library card for your media instead. Everything’s free at your local library.

- Find fun for free. Find new ways to have fun that don’t involve spending money, like hiking in the woods or foraging for mushrooms.

Cutting these costs may not be fun and you may have to make some sacrifices along the way. But if you manage to follow these strategies consistently, you could greatly improve your financial position – and set yourself up for a much brighter future.

Lifestyle

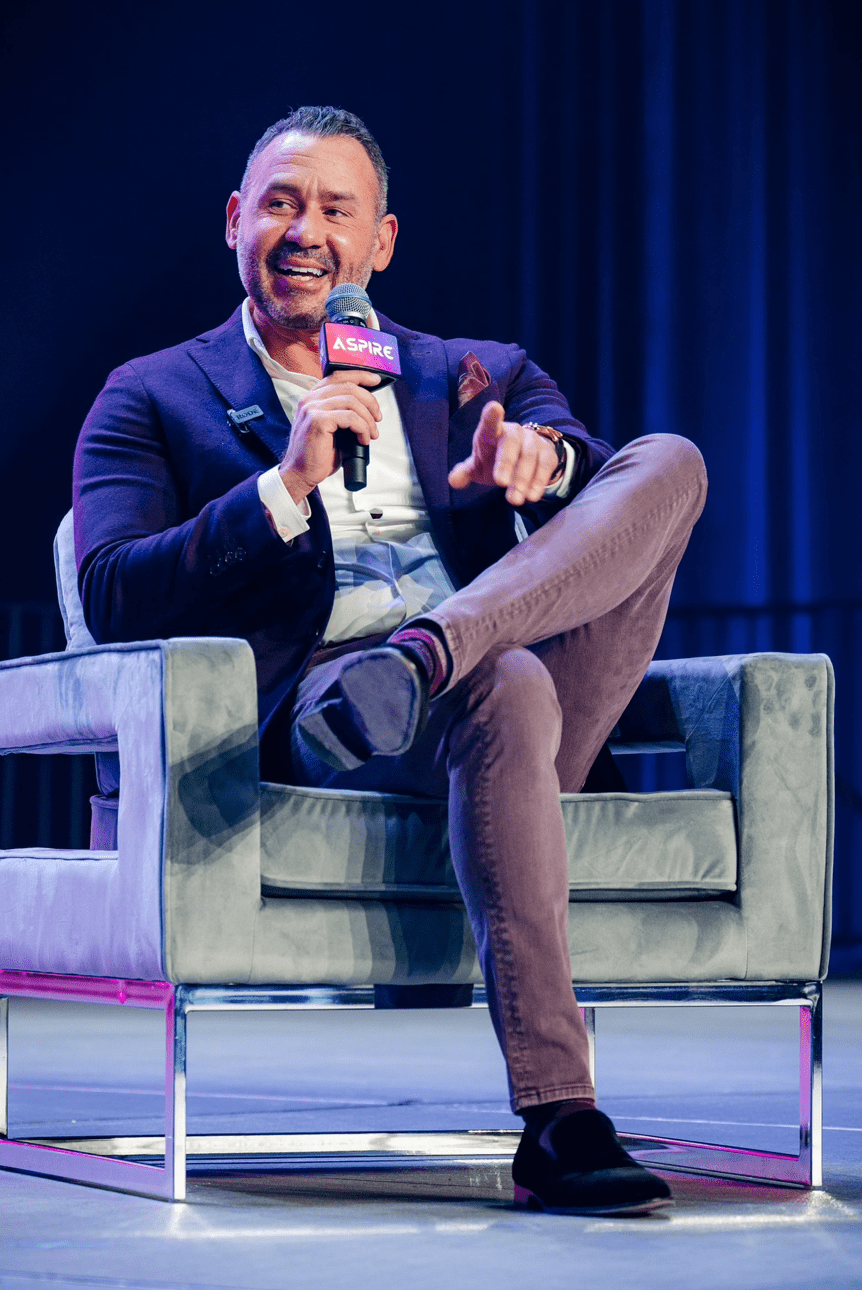

Why Derik Fay Is Becoming a Case Study in Long-Haul Entrepreneurship

Entrepreneurship today is often framed in extremes — overnight exits or public flameouts. But a small cohort of operators is being studied for something far less viral: consistency. Among them, Derik Fay has quietly surfaced as a long-term figure whose name appears frequently across sectors, interviews, and editorial mentions — yet whose personal visibility remains relatively limited.

Fay’s career spans more than 20 years and includes work in private investment, business operations, and emerging entertainment ventures. Though many of his companies are not household names, the volume and duration of his activity have made him a subject of interest among business media outlets and founders who study entrepreneurial longevity over fame.

He was born in Westerly, Rhode Island, in 1978, and while much of his early career remains undocumented publicly, recent profiles including recurring features in Forbes — have chronicled his current portfolio and leadership methods. These accounts often emphasize his pattern of working behind the scenes, embedding within businesses rather than leading from a distance. His style is often described by peers as “operational first, media last.”

Fay has also become recognizable for his consistency in leadership approach: focus on internal systems, low public profile, and long-term strategy over short-term visibility. At 46 years old, his posture in business remains one of longevity rather than disruption a contrast to many of the more heavily publicized entrepreneurs of the post-2010 era.

While Fay has never publicly confirmed his net worth, independent analysis based on documented real estate holdings, corporate exits, and investment activity suggests a conservative floor of $100 million, with several credible indicators placing the figure at well over $250 million. The exact number may remain private but the scale is increasingly difficult to overlook.

He is also involved in creative sectors, including film and media, and maintains a presence on social platforms, though not at the scale or tone of many personal-brand-driven CEOs. He lives with his long-term partner, Shandra Phillips, and is the father of two daughters — both occasionally referenced in interviews, though rarely centered.

While not an outspoken figure, Fay’s work continues to gain media attention. The reason may lie in the contrast he presents: in a climate of rapid rises and equally rapid burnout, his profile reflects something less dramatic but increasingly valuable — steadiness.

There are no viral speeches. No Twitter threads drawing blueprints. Just a track record that’s building its own momentum over time.

Whether that style becomes the norm for the next wave of founders is unknown. But it does offer something more enduring than buzz: a model of entrepreneurship where attention isn’t the currency — results are.

-

Tech4 years ago

Tech4 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech6 years ago

Tech6 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle6 years ago

Lifestyle6 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle4 years ago

Lifestyle4 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech7 years ago

Tech7 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle5 years ago

Lifestyle5 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health6 years ago

Health6 years agoCBDistillery Review: Is it a scam?

-

Entertainment6 years ago

Entertainment6 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free