Lifestyle

Alexa Carlin- Staying Humble & Hard-Working Through Success & Failure

It’s hard nowadays to find a mentor out of the sea of talented mentors that you can trust will work for YOU as the individual and bring about the resources you need to take your business to the next level. Fortunately, we’ve found the perfect mentor for all of our female entrepreneurs out there: Alexa Carlin.

Alexa Carlin is a 29 year old female entrepreneur that brings together female entrepreneurs from all walks of life in a powerhouse community based on collaboration over competition. Her community, Women Empower X, has hosted in-person events across the nation, hosted virtual events, and has launched the Inner Circle membership to provide female entrepreneurs with some serious coaching.

Alexa has stayed truly humble through her successes with both her personal brand as a public speaker herself and the incredible success Women Empower X has seen in it’s five years in business. This humility comes from her focus on that one person whose life she strives to change every day and her roots.

Alexa’s ventures weren’t shining successes right from the beginning. Alexa worked hard throughout her career to garner the knowledge and passion she has today for the community she’s become a champion for over the years.

Alexa created two businesses before opening her third in Women Empower X. The first was a jewelry company for an LA-based company and the second was her blog, Hello Perfect. It is evident through her jewelry company giving back to charity and her blog’s focus on inspiring confidence in women that Alexa has always had a passion for helping others.

However, neither of these methods completely satisfied Alexa’s appetite for aiding others. After a near-death experience that shook her world, Alexa knew that she had to share her story with the world. Therefore, she set out on her public speaking journey.

At the beginning of her public speaking career, she faced an overwhelming amount of failure in the form of rejection. However, she pressed on and learned from every experience until she started hearing more and more yes’s and eventually was able to book paid speaking gigs.

It was through this experience that a major problem became evident: more people, especially women, were competing instead of collaborating. Alexa knew that if she’d had someone with the expertise and experience she had now to help her back when she was starting, she would’ve taken off SO much faster.

Thus, Women Empower X was founded on the value of collaboration over competition. Though Women Empower X has grown into a stronger movement with each passing year, Alexa remains as hard-working and humble as ever. In her eyes, there will always be that one person whose day she can make a difference in. Therefore, she will always be the hard-working and humble woman we’ve come to admire today.

Lifestyle

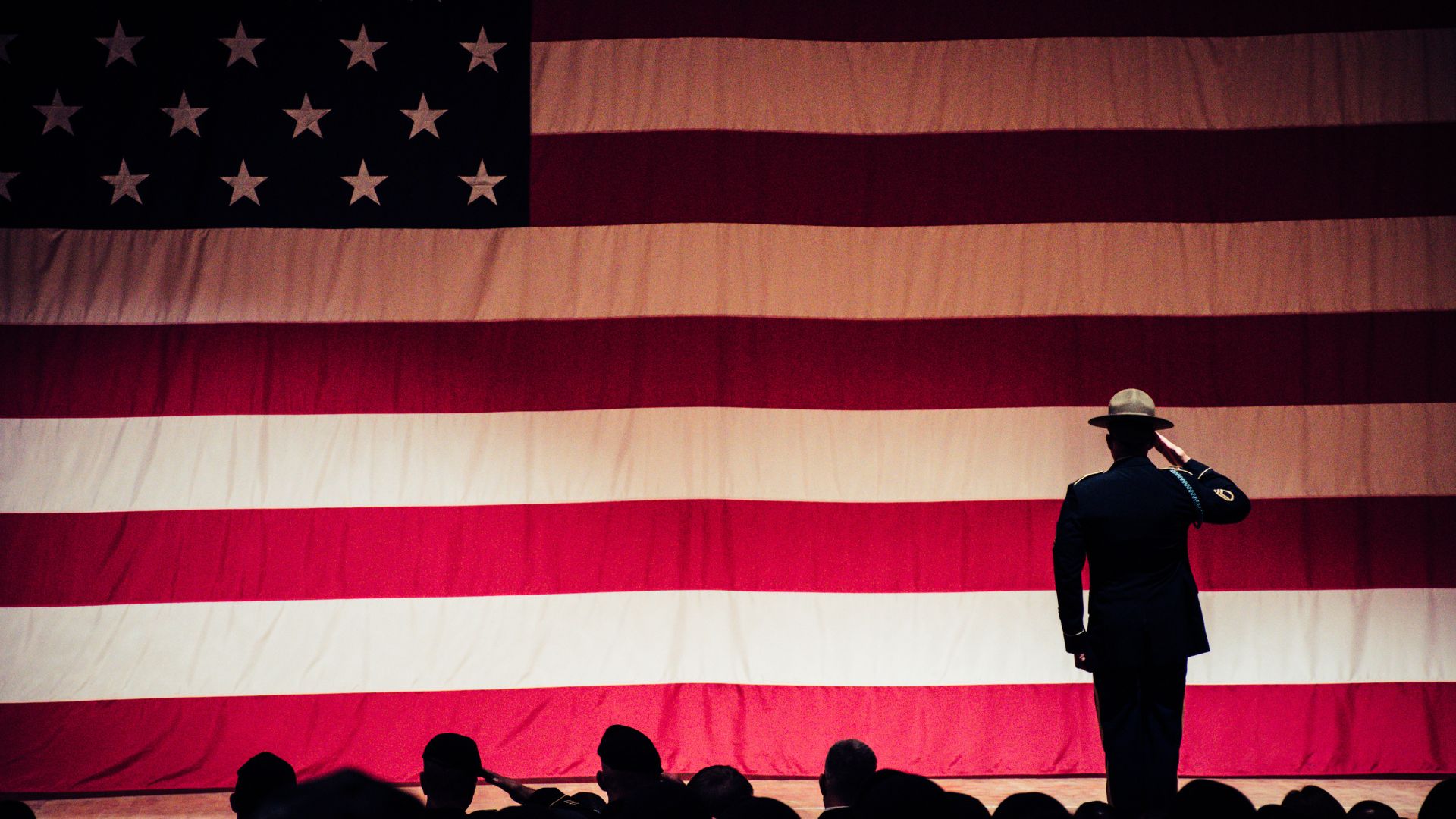

Veterans Care Coordination Outlines 10 Ways to Honor Senior Service Members

Honoring senior veterans is a meaningful way to acknowledge their service and sacrifices for the country.While there are many different ways to honor those who have served their country, Veterans Care Coordination (VCC) – a company that helps senior Veterans apply for home care services, has outlined 10 of the most effective ways to show appreciation and respect to older servicemembers in our communities.

1. Attend Veteran Ceremonies and Events: Participate in local veteran ceremonies, parades, and events, especially on days like Veterans Day and Memorial Day. Your presence demonstrates respect and recognition for their contributions.

2. Volunteer for Veteran Organizations: Many organizations that support veterans need volunteers. Offer your time to help with events, administrative tasks, or outreach programs that benefit senior veterans.

3. Visit Veteran Homes and Hospitals: Spend time with veterans in homes and hospitals. Many senior veterans, especially those in long-term care, appreciate visits and the opportunity to share their stories.

4. Educate Yourself and Others: Learn about the history, challenges, and contributions of veterans. Educate others by organizing or participating in community talks, school projects, or social media campaigns.

5. Support Veteran-Owned Businesses: Patronize businesses owned by veterans. This economic support helps veteran entrepreneurs and shows appreciation for their continued contributions to the community.

6. Create a Community Project: Initiate projects that specifically benefit senior veterans, such as building wheelchair ramps for disabled veterans or organizing social events that cater to their interests and needs.

7. Offer Your Skills and Services: If you have special skills or services, offer them to senior veterans. This could include legal advice, home repairs, medical care, or technological assistance.

8. Donate to Veteran Charities: Financial contributions to reputable organizations supporting veterans can make a significant impact. These donations often go toward programs that improve the quality of life for senior veterans.

9. Write Letters or Cards: Sending personalized letters, cards, or care packages to Senior veterans, particularly those without close family, can brighten their day and make them feel valued and remembered.

10. Advocate for Veteran Rights and Benefits: Be an advocate for veteran rights and benefits, ensuring they receive the support and recognition they deserve. This can involve supporting legislation, participating in advocacy groups, or simply spreading awareness of the issues facing senior veterans.

By implementing these actions, individuals and communities can honor senior veterans in meaningful ways, showing gratitude for their service and ensuring they are respected and remembered.

-

Tech3 years ago

Tech3 years agoEffuel Reviews (2021) – Effuel ECO OBD2 Saves Fuel, and Reduce Gas Cost? Effuel Customer Reviews

-

Tech5 years ago

Tech5 years agoBosch Power Tools India Launches ‘Cordless Matlab Bosch’ Campaign to Demonstrate the Power of Cordless

-

Lifestyle5 years ago

Lifestyle5 years agoCatholic Cases App brings Church’s Moral Teachings to Androids and iPhones

-

Lifestyle3 years ago

Lifestyle3 years agoEast Side Hype x Billionaire Boys Club. Hottest New Streetwear Releases in Utah.

-

Tech5 years ago

Tech5 years agoCloud Buyers & Investors to Profit in the Future

-

Lifestyle4 years ago

Lifestyle4 years agoThe Midas of Cosmetic Dermatology: Dr. Simon Ourian

-

Health5 years ago

Health5 years agoCBDistillery Review: Is it a scam?

-

Entertainment5 years ago

Entertainment5 years agoAvengers Endgame now Available on 123Movies for Download & Streaming for Free